The fintech world is evolving fast. And one of the clearest signs of that evolution? The powerful strategic partnership between Fiserv and TD.This collaboration signals the rise of a new standard: real-time, cloud-native, embedded financial infrastructure. For fintech founders, CTOs, and product leaders, this isn’t just news—it’s a signal to adapt now or risk falling behind.

The Shift: Fiserv x TD Are Rewiring the Future of Payments

With this partnership, Fiserv (a global fintech and payments leader) and TD Bank (one of North America’s largest banks) are building an ecosystem that supports:

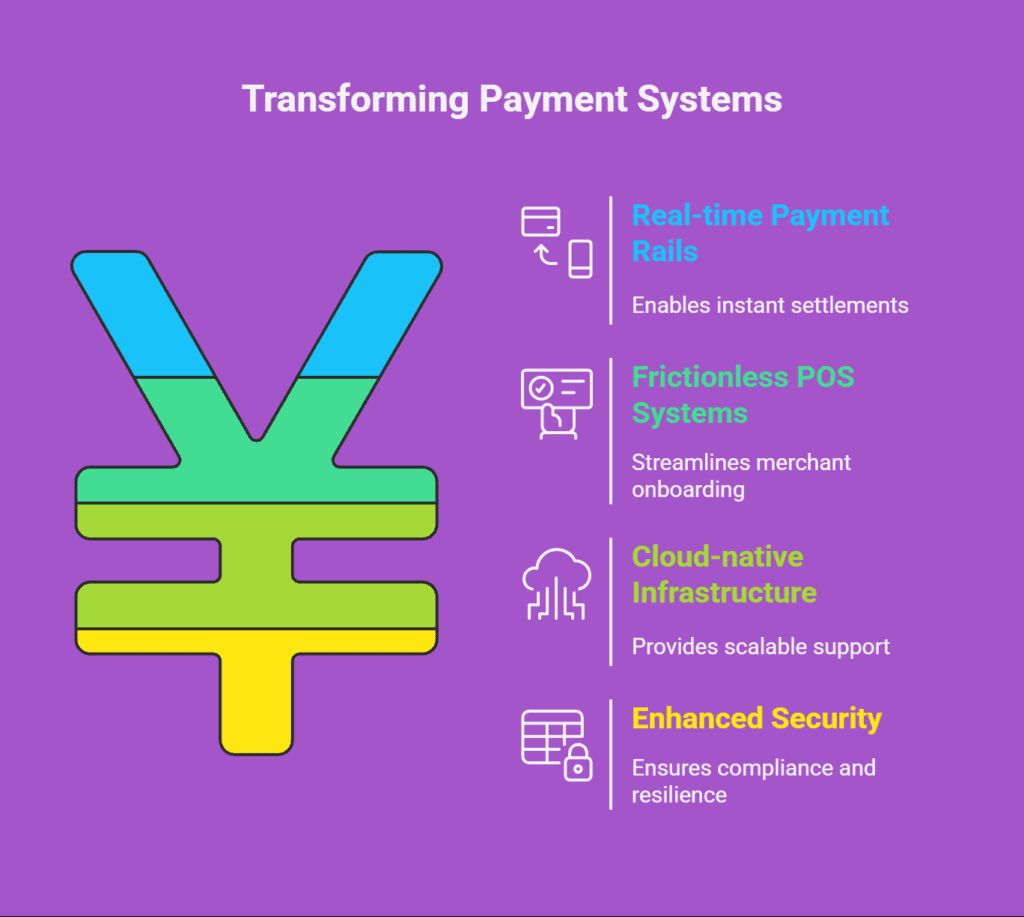

- Real-time payment rails for instant settlements

- Frictionless POS systems and merchant onboarding

- Cloud-native, scalable infrastructure for growing platforms

- Enhanced security, compliance, and operational resilience

This move is more than an upgrade. It’s a fundamental redesign of how payments flow—optimized for speed, transparency, and scalability in a digital-first world.

Why This Matters for Fintech Builders

For product owners, engineers, and SaaS teams, this evolution brings urgency—and opportunity.

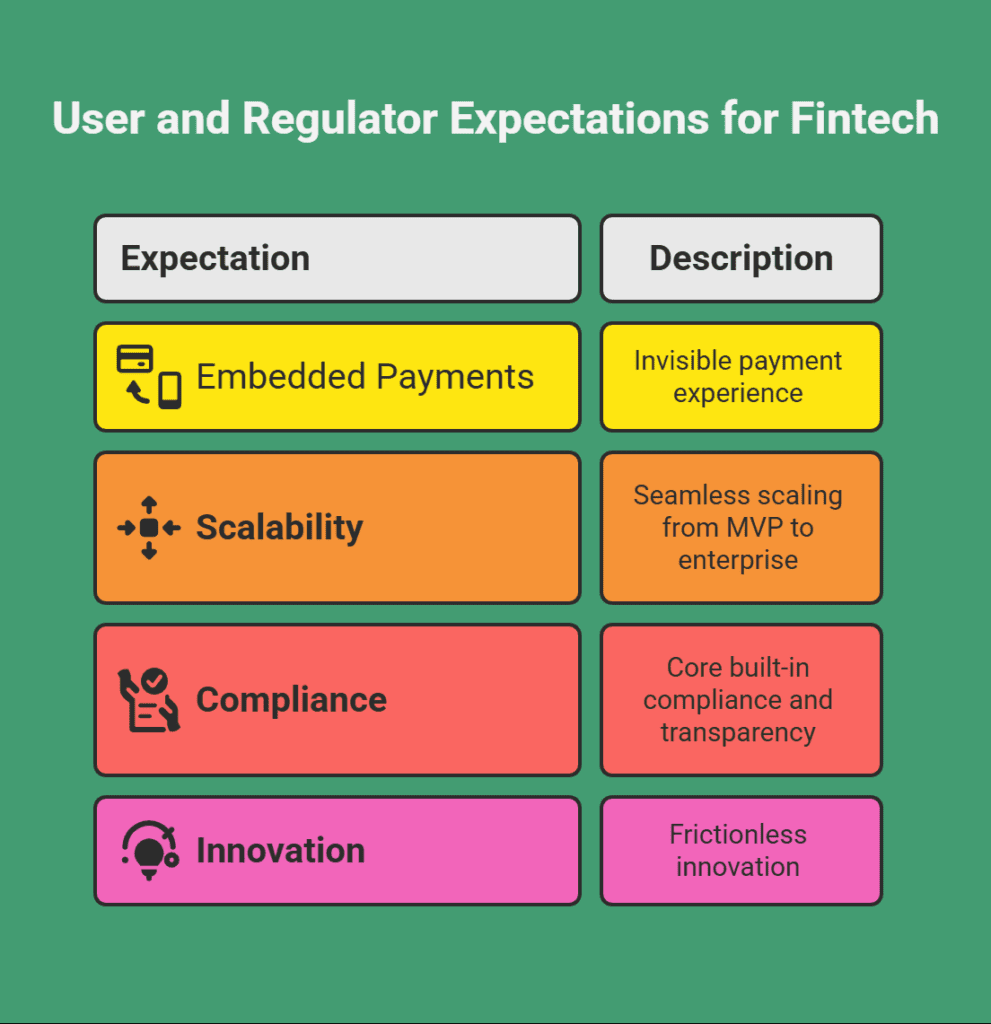

Here’s what today’s users (and regulators) expect:

- Embedded payments that feel invisible

- Infrastructure that scales seamlessly from MVP to enterprise

- Compliance and transparency built into the core

- Innovation without friction from outdated financial systems

Platforms still using legacy rails will soon hit walls—while those embracing modern architecture will scale faster, onboard users smoother, and operate more efficiently.

📌 Want a real-world breakdown of this shift? Check out our original article on LinkedIn to see how this change is already shaping fintech roadmaps.

🧠 How SubcoDevs Helps You Build the Future of Finance

At SubcoDevs, we don’t just build apps—we engineer scalable fintech infrastructure that’s ready for what’s next.

Our team works with founders and product leaders to:

- Design real-time payment flows using APIs from Fiserv, Stripe, and others

- Embed payout systems, wallets, and cross-border transaction engines

- Automate reconciliation and compliance for worry-free scaling

- Launch multi-currency, multi-region payment platforms from the ground up

Whether you’re integrating your first financial feature or replacing a legacy system, we help you go to market faster, smarter, and fully compliant.

Why This Shift Is a Competitive Advantage

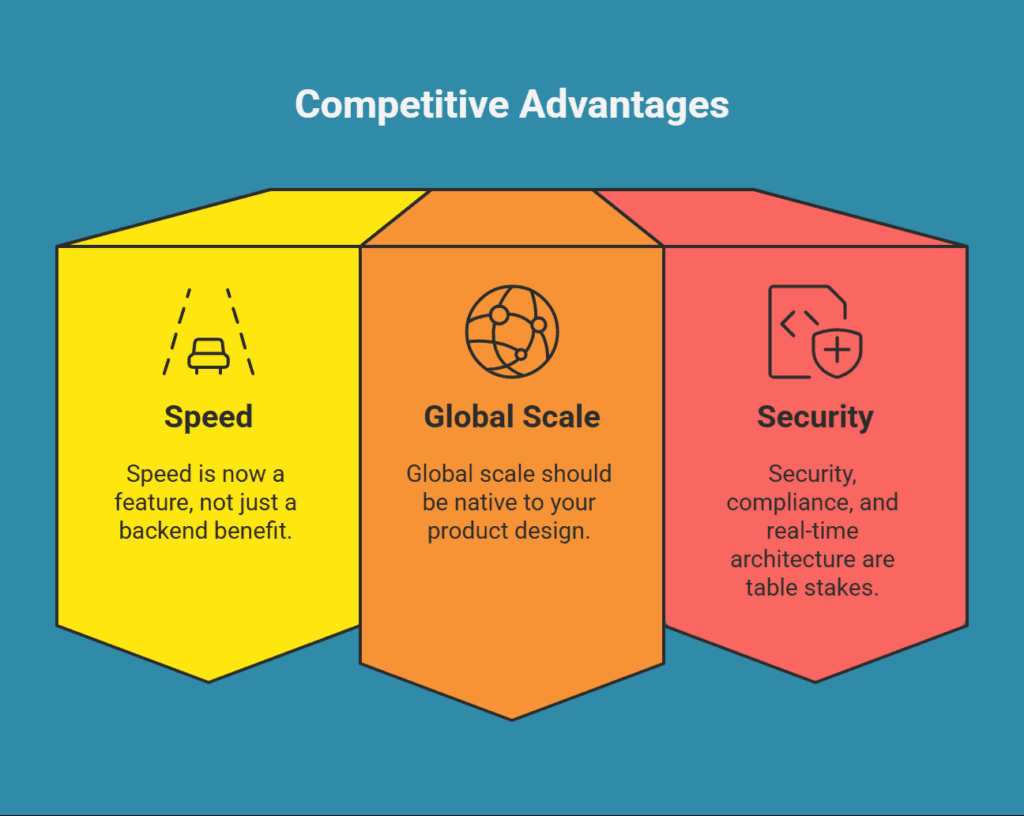

The Fiserv x TD move isn’t just a headline—it’s a signal for builders everywhere.

Here’s the big takeaway:

- Speed is now a feature, not just a backend benefit

- Global scale should be native to your product design

- Security, compliance, and real-time architecture are table stakes

If your platform handles money, now is the time to build infrastructure that lasts.

📞 Let’s Future-Proof Your Fintech Stack

Forward-thinking companies are already embedding smarter financial systems—and seeing results in performance, retention, and revenue.

👉 Book your free strategy consultation with SubcoDevs and explore how we can help you launch or upgrade your fintech product with cloud-native, embedded payment infrastructure.

We don’t just talk fintech.

We build it.