The payment industry is booming in 2025, reshaping how businesses and consumers interact. According to Zacks, the Financial Transaction Services sector grew 20.8% YoY, outperforming the S&P 500 (16.6%) and the Business Services sector (9.3%).

This surge isn’t only about stock market performance—it’s a roadmap for the future of digital payments and a wake-up call for tech leaders, CTOs, and product managers.

Why Payment Industry Growth Matters in 2025

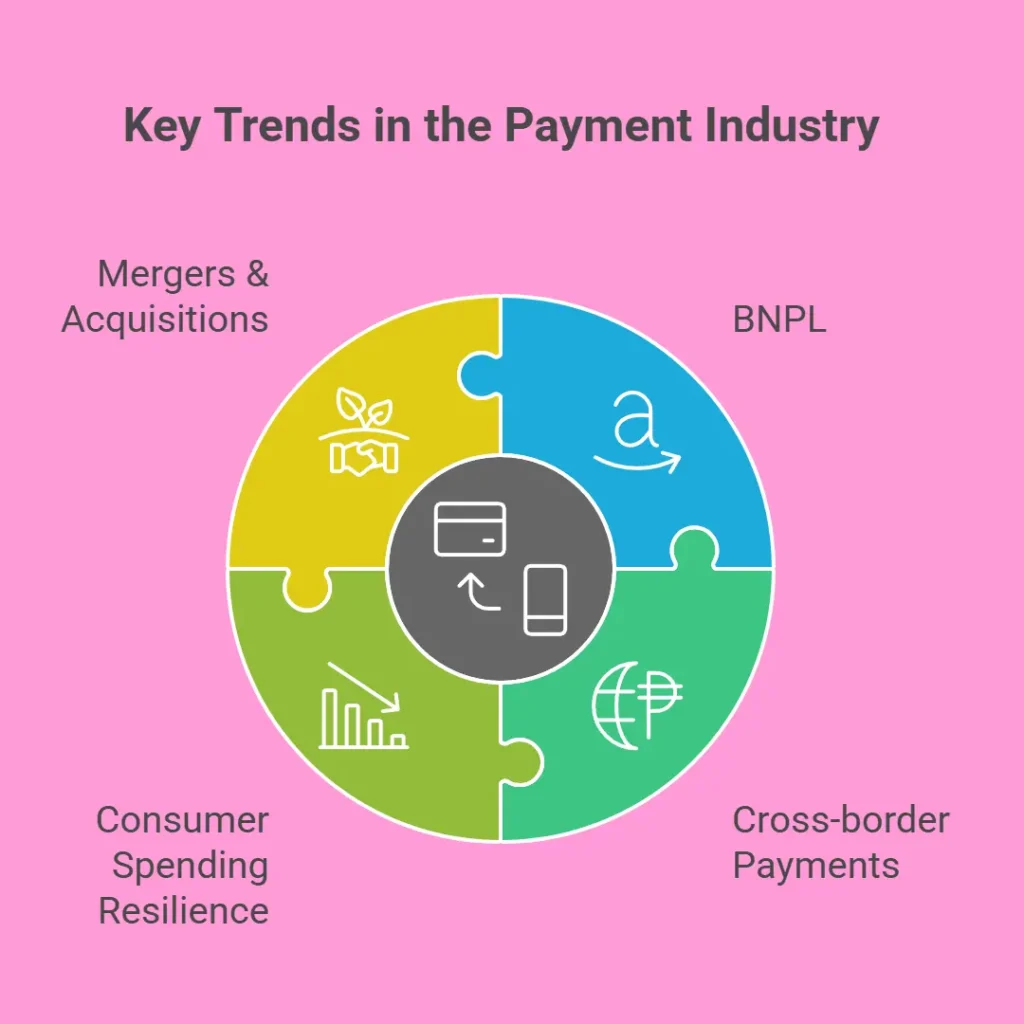

Digital payments are now at the core of business growth. The latest trends include:

- BNPL (Buy Now, Pay Later) → a must-have option for e-commerce.

- Cross-border payments → Visa reported a 12% YoY increase in Q3 2025.

- Consumer spending resilience → still up 2.3% YoY despite market challenges.

- Mergers & Acquisitions → pushing companies to merge ecosystems and tech stacks.

👉 In short: If your payment stack isn’t evolving, you’re leaving money on the table.

Key Engineering Implications for Digital Payments

The payment landscape is expanding rapidly. To stay competitive, engineering teams must modernize payment architectures.

1. BNPL & Flexible Payments

Shoppers now expect instalment payments, grace periods, and deferred settlements. Integration should be smooth, without slowing checkout conversion rates.

2. Cross-Border Expansion

Scaling globally requires multi-currency pricing, FX risk management, and local rails like UPI, Pix, and SEPA. Miss this, and you miss international growth.

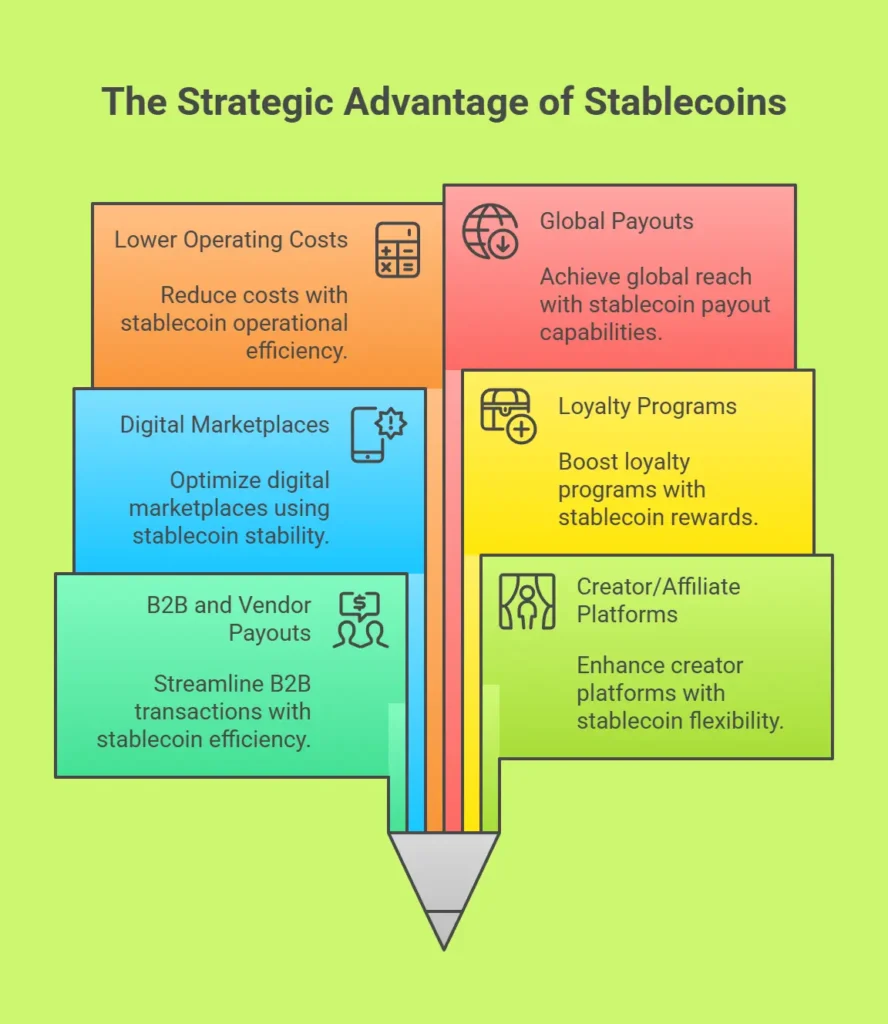

3. Crypto & Biometric Authentication

From stablecoin settlements to face ID verification, payment innovation demands fraud-resistant integrations and reliable infrastructure.

4. Post-M&A Integration

Consolidation creates technical challenges. Teams must merge APIs, unify ledgers, and streamline data to avoid outages or compliance failures.

Risks Hidden Behind the Growth

Opportunities are rising, but risks are too:

- Regulatory scrutiny over crypto and antitrust.

- Tech debt building up from rushed integrations.

- Cybersecurity threats increasing as digital payments expand.

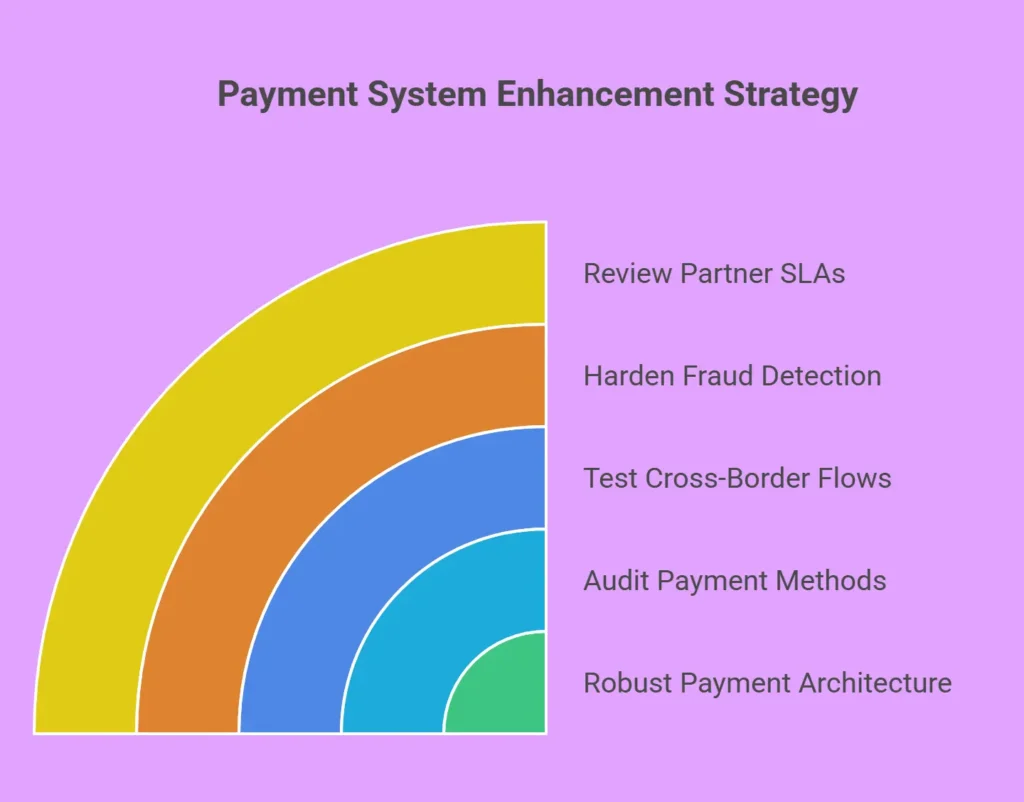

Therefore, a robust, secure, and scalable payment architecture is no longer optional—it’s essential.

Action Plan for Tech Leaders in 2025

To future-proof your digital payment systems:

- Audit payment methods → Add BNPL, crypto, and local payment options.

- Test cross-border flows → Prepare for FX shifts and delays.

- Harden fraud detection → Strengthen BNPL and crypto monitoring.

Review partner SLAs → Ensure uptime guarantees on critical flows.

👉 For a deeper industry breakdown, read our LinkedIn article here.

How SubcoDevs Helps Optimize Payment Stacks

At SubcoDevs, we help businesses scale with custom-built payment solutions. Our goal is to make your systems conversion-friendly, fraud-resistant, and future-ready.

Our expertise includes:

- Stripe Billing/Connect for BNPL and international payouts.

- Crypto on-ramps and blockchain payment integrations.

- Webhook and ledger reliability to prevent revenue leaks.

Whether you’re a fintech startup or an enterprise, we help you build digital payment systems designed for growth.

Final Thoughts

The 20.8% growth in the payment industry is more than a statistic—it’s proof that businesses must adapt their payment architecture now.

With BNPL, cross-border payments, crypto, and fraud prevention shaping the future, companies that invest in modern payment stack optimization will lead the market.At SubcoDevs, we partner with you to create secure, scalable, and innovative payment systems—so your business isn’t just keeping up, it’s leading.