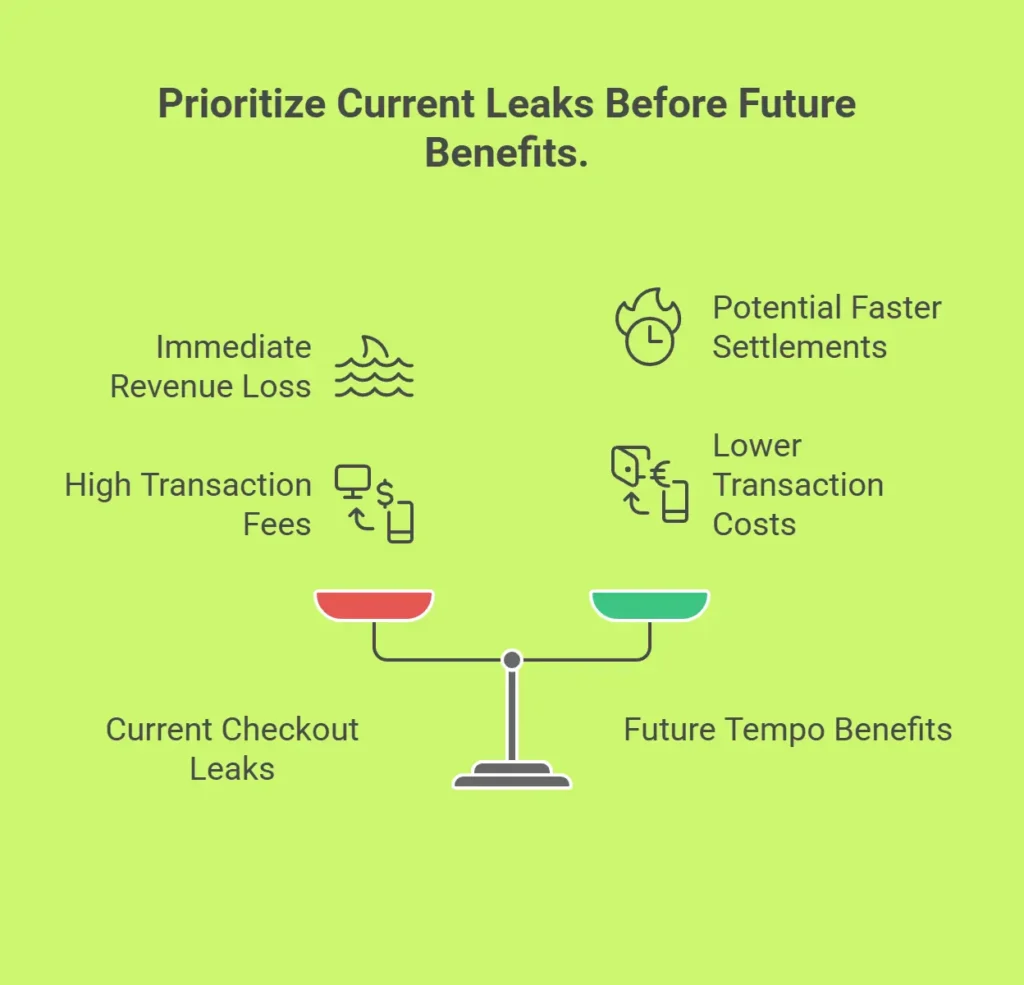

Stripe’s new Tempo project points to the future of faster, cheaper settlements. But for eCommerce, SaaS, and marketplace operators, the bigger revenue leaks are happening right now, inside your checkout.

What Happened: Stripe’s Tempo Announcement

In early September 2025, Stripe and Paradigm announced Tempo, a payments-focused Layer-1 blockchain. Here are the essentials:

- What it is: Tempo is an independent blockchain designed to enable high-throughput, low-cost stablecoin transactions for payment use cases. It features an enshrined automated market maker (AMM) to ensure neutrality across stablecoins.

- Context: Observers note similarities to Meta’s Libra/Diem project. However, Libra’s co-creator, Christian Catalini, has cautioned that Tempo’s corporate-led model risks creating “walled gardens” and may trigger the same kind of regulatory pushback that ultimately stalled Libra.

- Stablecoin support: Tempo is built to support major stablecoins (e.g., USDC, USDB). This is separate from Stripe’s earlier integration of USDC on Base and other networks for payouts in 2024.

- Target audience (for now): B2B and cross-border payments, where settlement speed and high fees remain persistent pain points.

- Performance: Tempo is targeting 100,000+ transactions per second (TPS) with sub-second finality. That figure is an ambitious long-term goal. Today, even high-speed chains like Solana average closer to ~1,000 TPS.

- Status: Currently in a private testnet with design partners (including Visa and Shopify). It is not broadly available for merchants yet.

Why This Matters for Operators

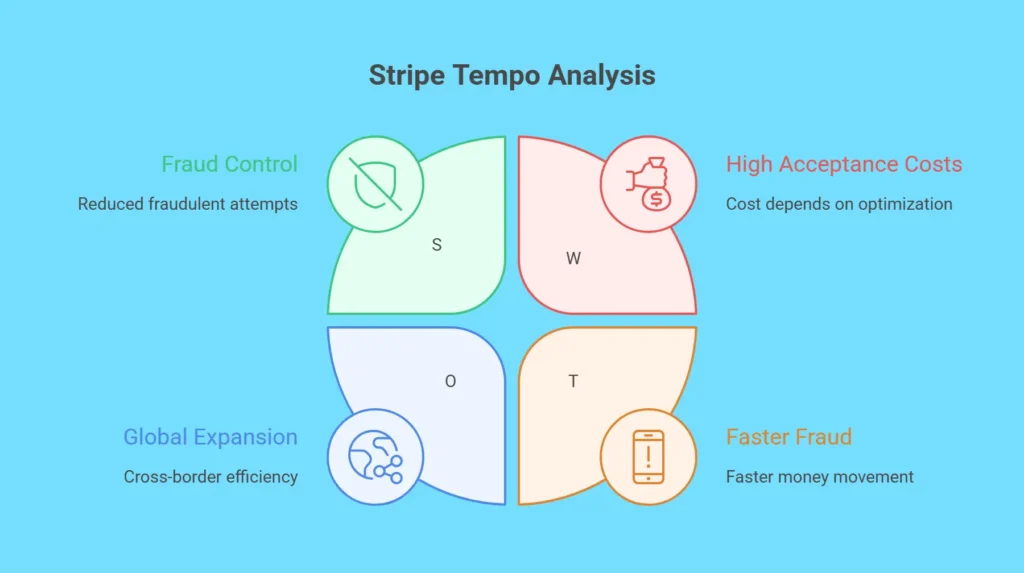

Revenue and Conversion

False declines are a major, measurable leak today. Industry research suggests merchants reject around 6% of eCommerce orders as suspected fraud, and Stripe data indicates that up to 10% of legitimate transactions are falsely declined globally. Stripe and EY also estimate that businesses lose up to 5% of total earnings from broader revenue leakage. This lost revenue is significant and far more immediate than blockchain savings.

Cost and Settlement Speed

Tempo may eventually reduce settlement costs.

But today, your cost of acceptance depends on whether you optimize for cards, wallets, or ACH.

Risk, Fraud, and Chargebacks

Faster money movement also means faster fraud if controls aren’t tuned.

Stripe Radar and rules-based controls have materially reduced card testing and other fraudulent attempts, but the exact results depend on configuration.

Global Expansion and Local Methods

Tempo’s promise is future cross-border efficiency.

But right now, enabling local wallets (like iDEAL in the EU, Pix in Brazil, UPI in India) delivers immediate conversion gains.

What To Do This Quarter (With Stripe)

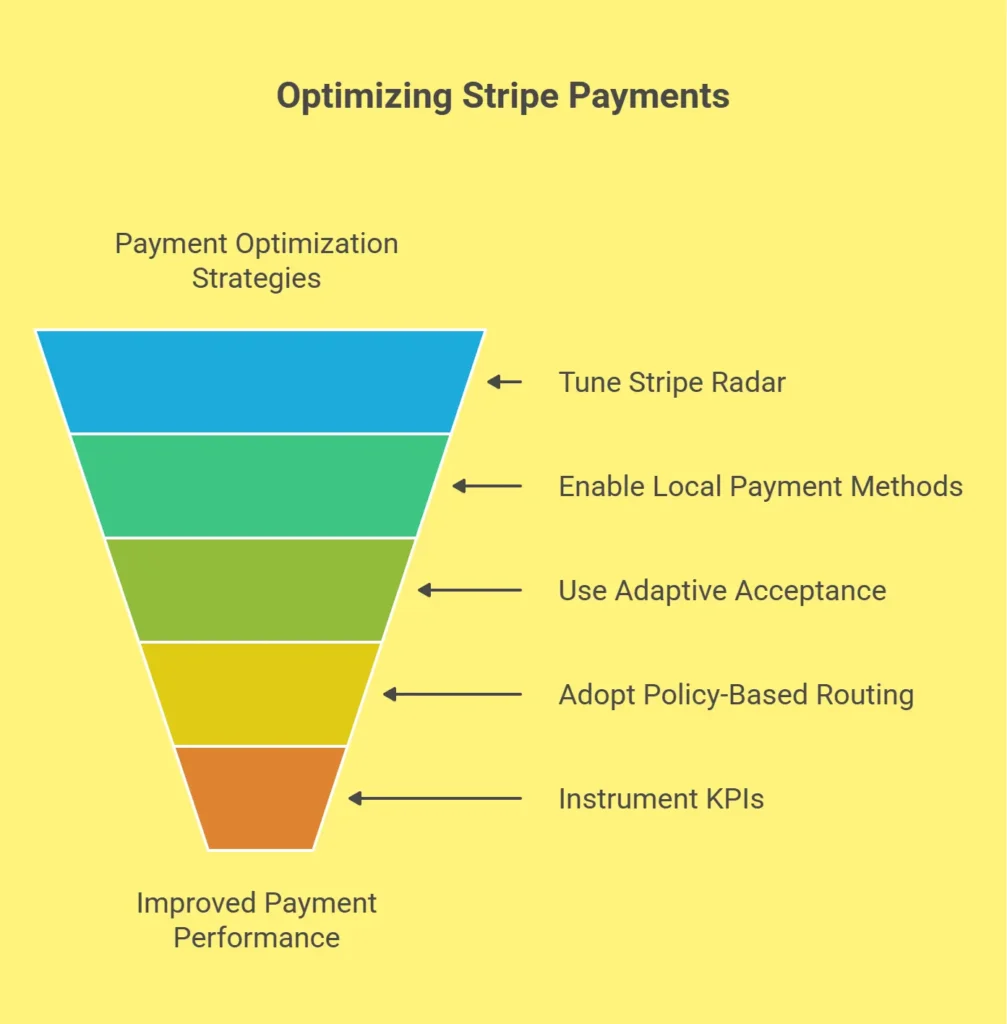

Before dreaming about blockchain, fix today’s leaks. Here’s where to start:

Turn on and tune Stripe Radar

- Add rules like: challenge high-value orders from risky BINs, but auto-approve repeat trusted customers.

Enable Pay by Bank and local wallets

- In the US, reduce reliance on cards.

- In Europe, Latin America, and APAC, local payment methods can drive double-digit conversion lifts.

Use Adaptive Acceptance + Smart Retries

- Stripe’s data shows a 2–6% increase in authorization rates when soft declines are retried intelligently.

Adopt policy-based routing

- Route payments based on auth rate and cost (e.g., cards vs. ACH vs. wallets).

Instrument KPIs

- Authorization rate, recovery %, chargeback ratio, cost per transaction.

Case Study: The $1.2M Leak Fixed in 45 Days

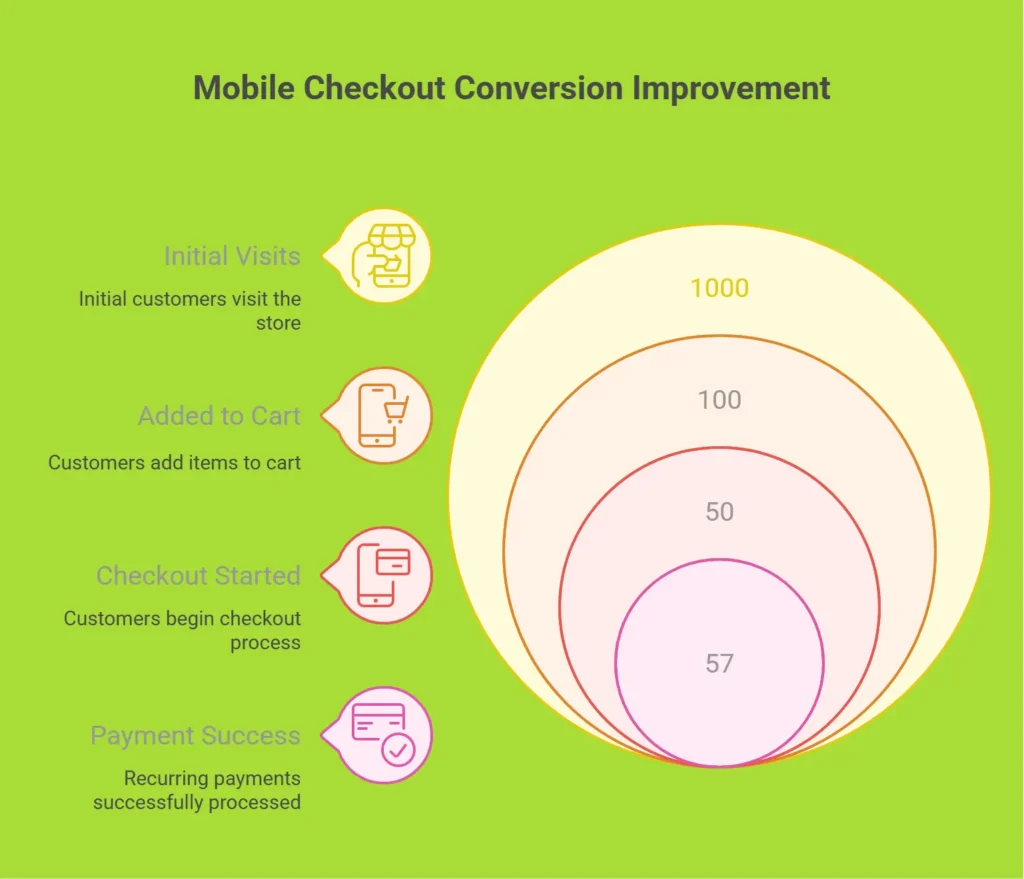

Here’s a real-world example from one of our recent engagements (anonymized for confidentiality):

Symptoms

- High mobile checkout abandonment.

- 18% recurring revenue loss from soft declines.

- Frequent card testing attacks spiking fraud costs.

Fixes

- Activated Adaptive Acceptance + issuer-aware retries.

- Tuned Radar with custom rules.

- Enabled Apple Pay, Google Pay, and Pay by Bank.

- Deployed cost-based routing to prioritize high-success rails.

Results (in 60 days)

- +4.3% overall authorization lift.

- +7% mobile conversion.

- 57% recovery on recurring payments.

- 95% reduction in card testing fraud.

- Net result: $1.2M annualized revenue impact.

Engineering time: Less than 30 hours.

The Bottom Line

Stripe’s Tempo is a glimpse into the payments future, multi-rail, blockchain-based, faster, cheaper. But the bigger opportunity isn’t tomorrow. It’s fixing today’s revenue leaks.

Every soft decline, every unnecessary false decline, every unoptimized routing choice is money left on the table.

At SubcoDevs, we help eCommerce brands, SaaS platforms, and marketplaces stop revenue leaks and prepare their payment stack for the future, whether that’s blockchain rails or AI-driven optimization.

👉 Book a 20-minute Stripe audit with SubcoDevs and uncover hidden leaks before Q4 hits.