Tallinn‑based Creem has raised €1.8M (pre‑seed) to build a “Stripe for AI Financial OS.” The vision: a developer‑first finance layer that automates payments, tax, compliance, and multi‑party revenue splits across fiat and stablecoin rails—built for globally distributed, AI‑native teams.

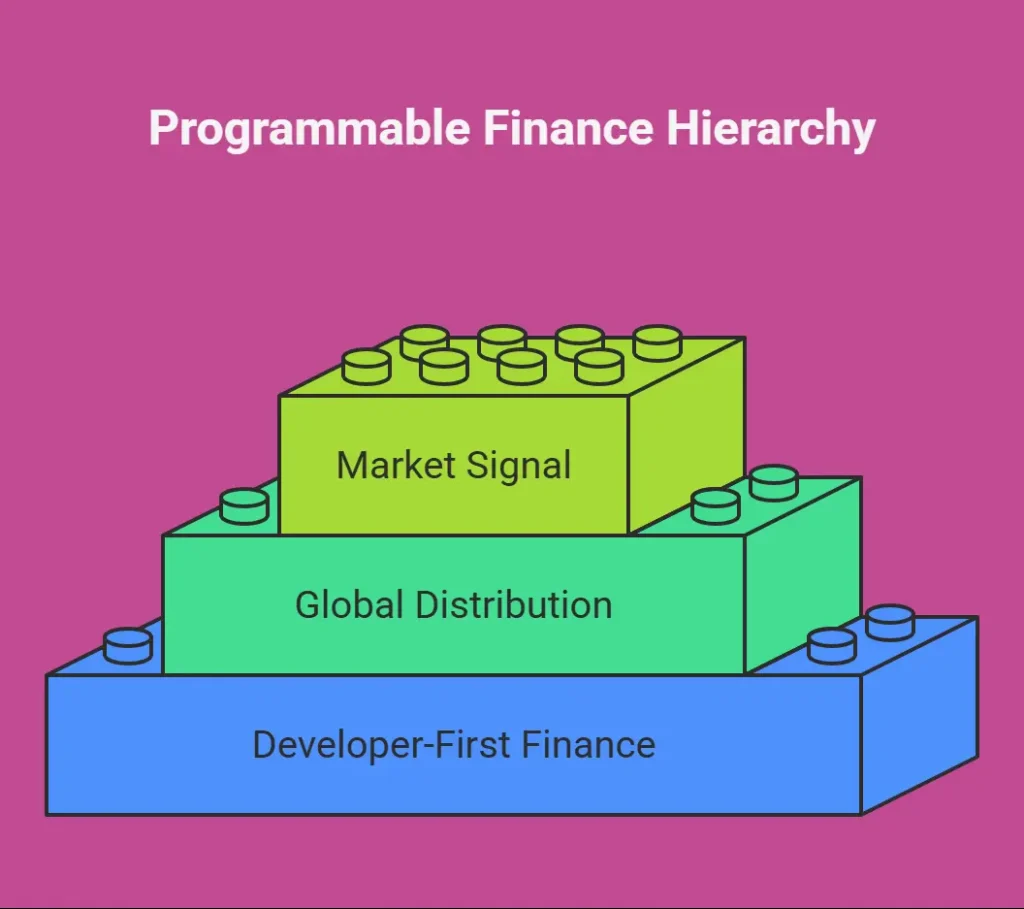

Whether or not you’re “AI‑native,” the market signal is clear: programmable finance is becoming table stakes for SaaS, marketplaces, and e‑commerce platforms.Translation: “Money movement now needs to be modeled and automated. It must also support multiple rails, not be bolted on.

What’s in the News (and Why It Matters)

Funding & momentum: Creem announced €1.8M pre-seed led by Practica Capital with Antler and angels. Moreover, it reports early ARR traction and plans to expand APIs, compliance tooling, and geography coverage.

Product posture: A financial OS that handles usage/metered revenue, multi‑party splits, tax/KYC/AML, and payouts—spanning cards, bank debits, wallets, and stablecoins.

The bigger shift: Stripe’s own ecosystem has been moving here for years (Connect, Billing, Tax, Treasury, USDC on Base; Radar/AI for risk and routing). Creem’s raise shows the shift toward programmable, compliant, multi-rail payment ops.

What “AI Financial OS” Looks Like in Practice

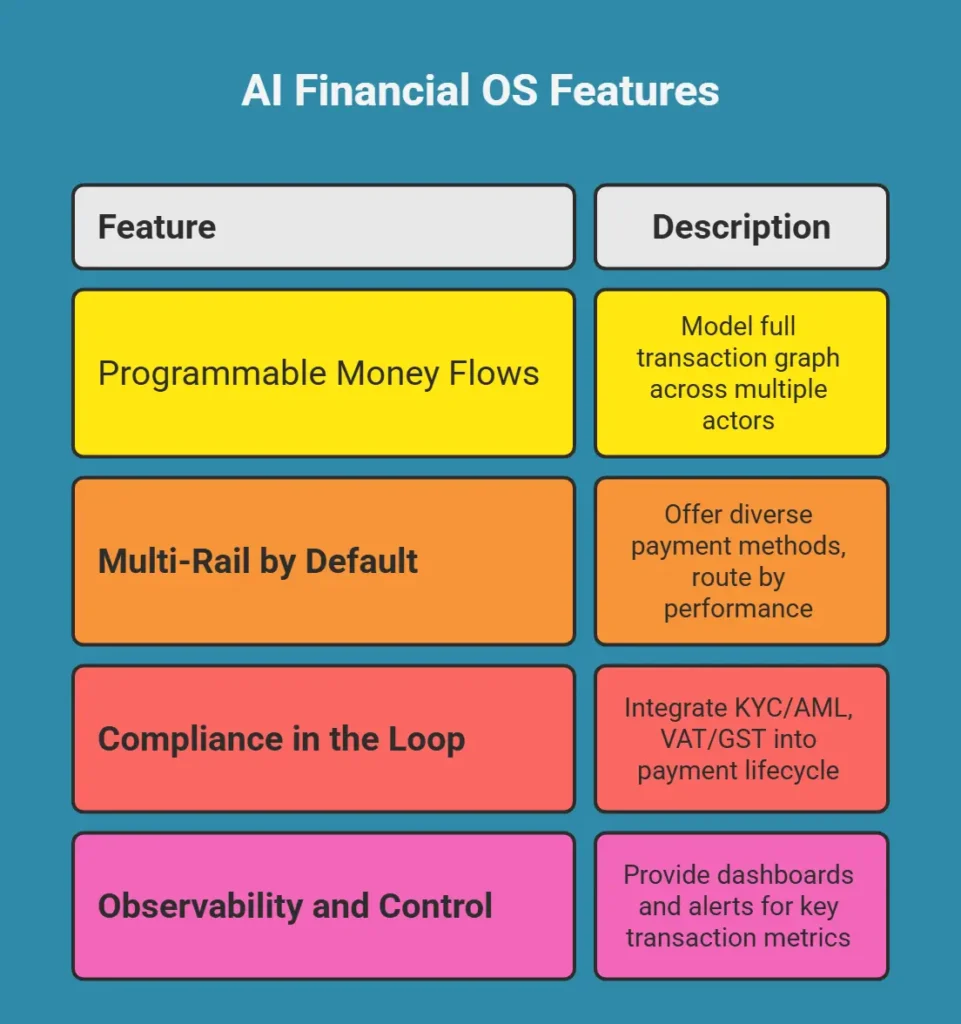

- Programmable money flows

Model the full graph: charge → split → tax → hold → payout → reconcile across multiple actors (buyers, sellers, partners, affiliates, creators). - Multi‑rail by default

Offer cards, A2A/Pay by Bank, local wallets, and stablecoins. Route transactions by cost, speed, and success, not by habit. - Compliance in the loop

Treat KYC/AML, VAT/GST, and reporting as first‑class steps in the payment lifecycle, not afterthoughts. - Observability and control

Ship dashboards and alerts for approval lift, recovery, disputes/fraud, and cost per transaction—by market, rail, and device.

The Stripe-First Playbook (What to Build Now)

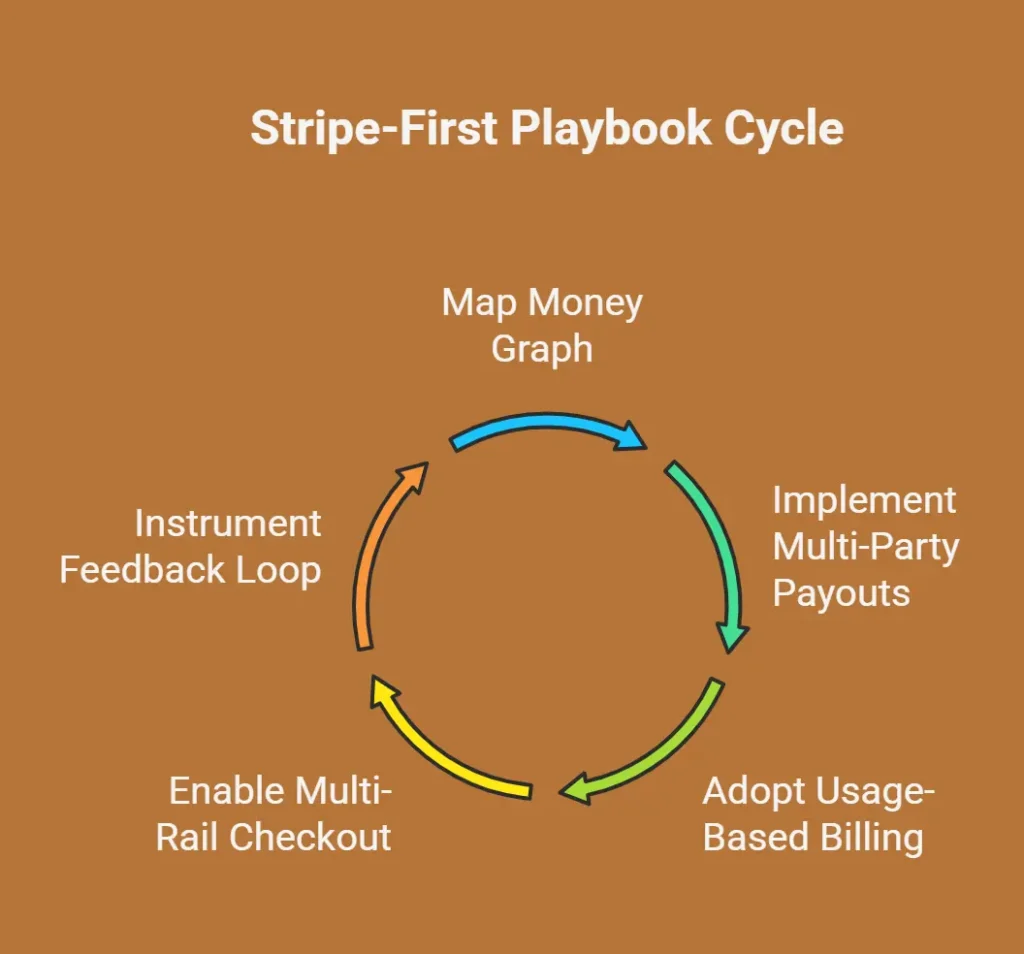

1) Map your money graph

Document every actor and flow. If the diagram is messy, your finance ops will be messier. Define split rules, fee logic, and tax touchpoints before you write code.

2) Ship multi‑party payouts with Stripe Connect

Implement platform fees, partner rev‑shares, and automated reconciliation. Add on‑behalf‑of tax collection where needed.

3) Adopt usage‑based billing with Stripe Billing

Leverage metered/usage APIs, trials, and proration. Pair with Adaptive Acceptance and Smart Retries to cut false declines and recover failed charges.

4) Enable multi‑rail checkout

Offer cards + Pay by Bank (A2A) + local wallets; consider USDC on Base for relevant markets. Use policy‑based routing to optimize cost and success.

5) Instrument the feedback loop

Track auth rates, fraud blocks, recovery %, cost/txn, and settlement speed. Let data drive routing and roadmap decisions.

Why SubcoDevs

We’re a Stripe‑first engineering partner. Our team designs and ships programmable finance: multi‑party payouts, usage‑based billing, multi‑rail checkout, and on‑chain options—with compliance and reconciliation that won’t break your back office.

- Multi‑rail checkout & routing (cards, A2A, wallets, USDC on Base)

- Connect architectures for marketplaces and platforms

- Billing (metered), revenue recovery, and dunning

- Tax, KYC/AML workflows, and finance ops tracking

👉 Book a 20-minute Stripe audit—we’ll highlight your top three ROI moves for checkout, routing, and payouts.