On July 23, the fintech world got a jolt.

Fiserv’s stock dropped 23% intraday—its biggest single-day plunge since 2000—before closing the session down nearly 14%. The cause? Weaker-than-expected merchant growth, a revised revenue forecast, and mounting pressure on its flagship product, Clover.

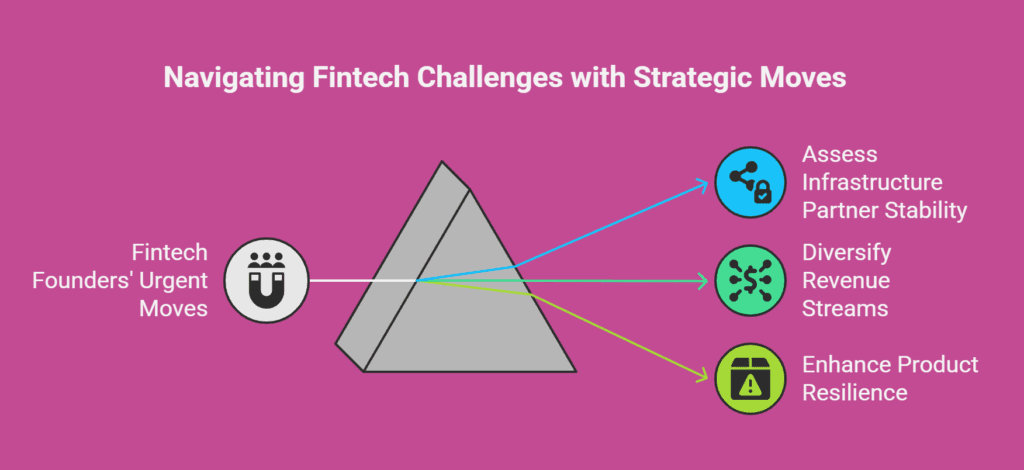

For fintech founders, CTOs, and payment product teams, this isn’t just a market fluctuation—it’s a flashing red light. When major infrastructure partners wobble, you absorb the impact.

What Happened—and Why It Matters

Let’s break down the highlights:

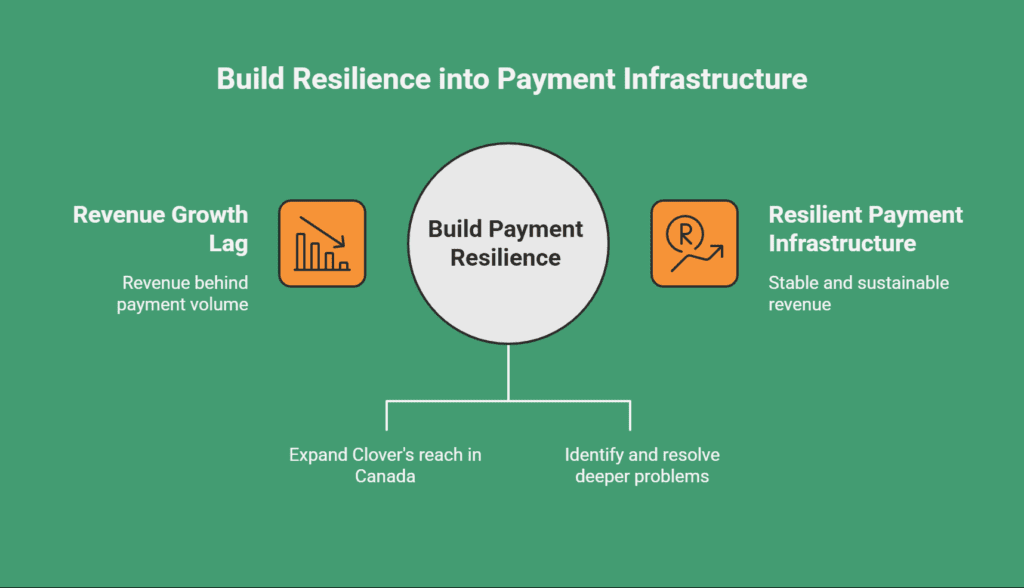

- Fiserv trimmed its 2025 revenue guidance to ~10% due to slower-than-expected growth initiatives

- Clover’s revenue lagged 19 points behind payment volume growth—raising serious competitiveness concerns

- The upside? 30,000+ TD Bank merchant locations in Canada will soon migrate to Clover, expanding its reach

Still, the gap between volume and revenue growth suggests deeper structural issues. As a product leader, it’s your signal to build resilience into your payment infrastructure—now.

📌 For the full industry breakdown, check out our LinkedIn deep-dive here

Why Product & Payments Teams Should Act Now

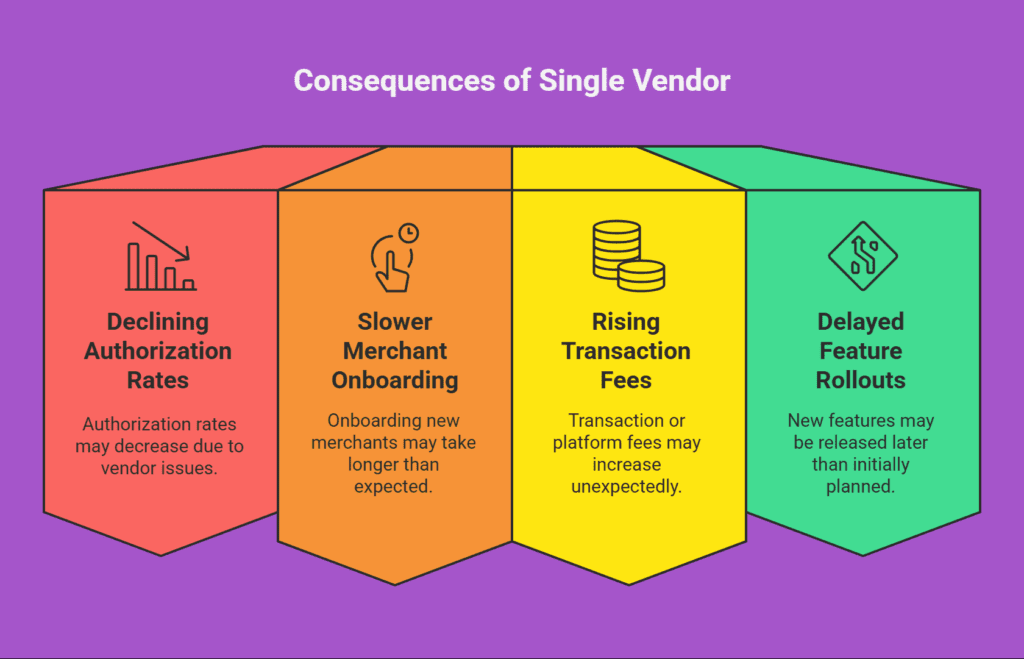

If your system relies on a single PSP or POS vendor, you’re exposed to every performance dip, support delay, or pricing shift they make.

When Clover stumbles or Fiserv slows, you could feel it in:

- Declining authorization rates

- Slower merchant onboarding

- Rising transaction or platform fees

- Delayed feature rollouts

Redundancy, observability, and optionality are the new non-negotiables.

Revenue-Resilience Moves to Make This Week

Here are three immediate, high-leverage actions to bulletproof your payments stack—no overhauls, just smart readiness.

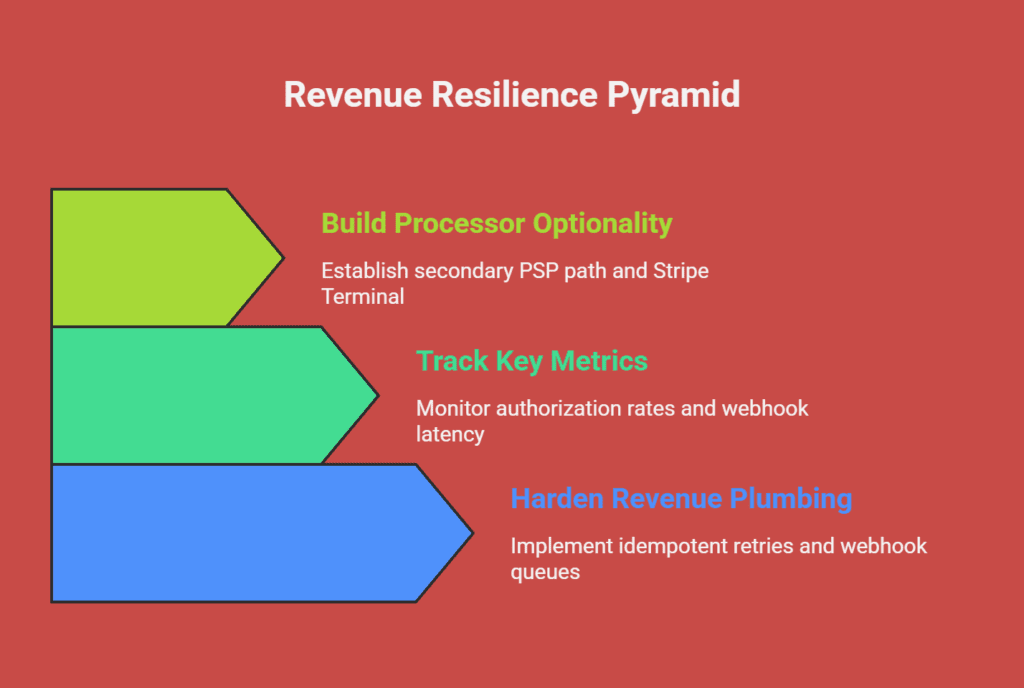

1. Harden Your Revenue Plumbing

- Implement idempotent retries to prevent double charges

- Use webhook DLQs + replay queues to recover missed events

- Add a backfill job to catch dropped entitlements or subscription renewals

💡 Pro tip: Stripe Billing + Radar + robust webhook handlers = fast, measurable uplift.

2. Track What Really Matters

You can’t fix what you can’t see. Monitor:

- Authorization rate by BIN and issuer

- Chargebacks segmented by SKU

- Webhook latency and failure rates

- Variance from baseline SLOs (>X%)

With alerts in place, you’ll spot problems before users or finance teams do.

3. Build in Processor Optionality

Even if you don’t plan to switch now, build the hooks:

- Stand up a secondary PSP path (e.g., Stripe cohort, alt geo)

- Explore Stripe Terminal for POS redundancy

- Segment traffic or flows for pilot testing in low-risk lanes

Modern systems should have failovers—not just for infrastructure, but for payment logic too.

How SubcoDevs Builds Payment Ecosystems That Scale

At SubcoDevs, we don’t just build fintech features—we architect end-to-end payment infrastructure that withstands disruption.

We’ve helped SaaS platforms, marketplaces, and mobile apps:

- Integrate Stripe Checkout, Connect, Billing, Radar, and Elements

- Unify web + mobile entitlements with RevenueCat and IAP syncing

- Add observability and crash-free flows to catch silent failures

- Migrate from legacy PSPs like Clover or Adyen without downtime

Whether you’re looking to pilot Stripe, harden webhooks, or redesign your entire flow—we’ve done it.

Free “Payment Resilience Check” for Your Platform

Not sure where your single points of failure are?

Our team offers a free 30-minute session to:

- Map SPOFs in your current payment setup

- Prioritize fixes based on revenue impact

- Suggest low-risk pilot options to de-risk Clover, Fiserv, or other dependencies

👉 Book your free strategy call with SubcoDevs

💬 Or read the original insights on LinkedIn here to dive deeper into our fintech playbook.

Final Thought: Build Resilience Before You Need It

The Clover slowdown isn’t just about Fiserv—it’s about the fragility of over-reliance on any single platform.

As we help clients across verticals modernize their financial stack, one thing is clear:

The strongest platforms don’t just process payments.

They protect revenue. At scale.

Let’s build yours.