The global digital cross-border payments market is surging—projected to grow from $272.2B in 2023 to $707.6B by 2033, according to a recent Newstrail report. That’s nearly 3× growth in a decade. For online businesses, SaaS platforms, and global marketplaces, this isn’t just a statistic—it’s a wake-up call.

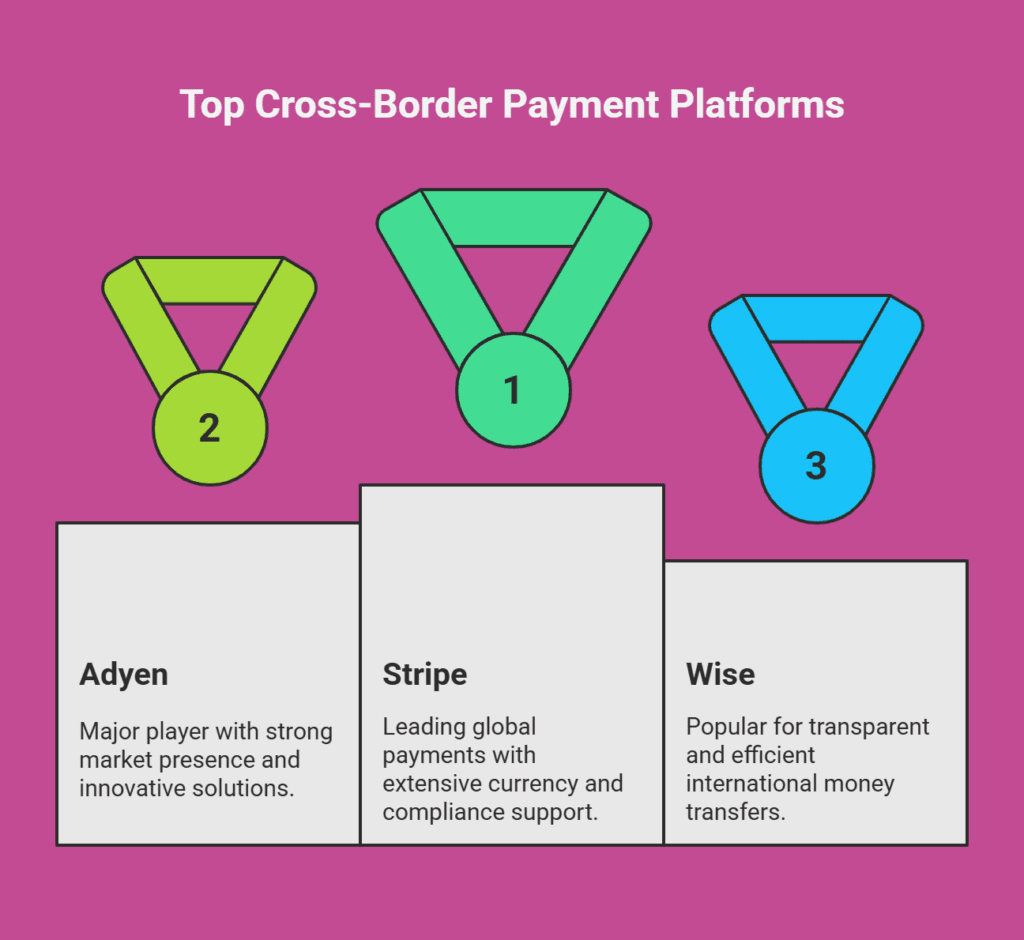

Stripe, Adyen, Wise: Who’s Winning the Race?

While many fintech players are competing for share, Stripe is fast becoming the backbone of modern global payments. With support for 135+ currencies, local acquiring in dozens of countries, and built-in compliance tools, Stripe offers more than plug-and-play APIs—it offers a global commerce foundation.

At SubcoDevs, we see Stripe not as a vendor—but as an enabler of scale.

Why the Cross-Border Surge?

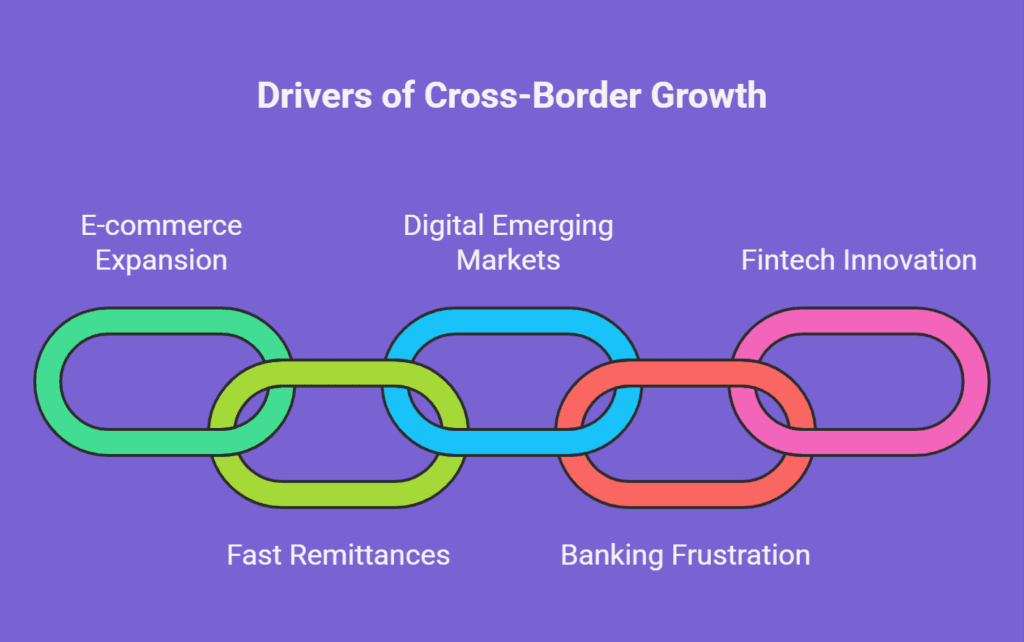

Growth is being driven by:

- The global expansion of e-commerce

- Demand for fast, low-cost B2B and consumer remittances

- Emerging markets going digital

- Frustration with traditional banking delays and fees

Fintech companies like Stripe, Wise, and Adyen are building real-time, low-cost, transparent alternatives to legacy rails. For forward-looking founders, this is a chance to outpace the competition.

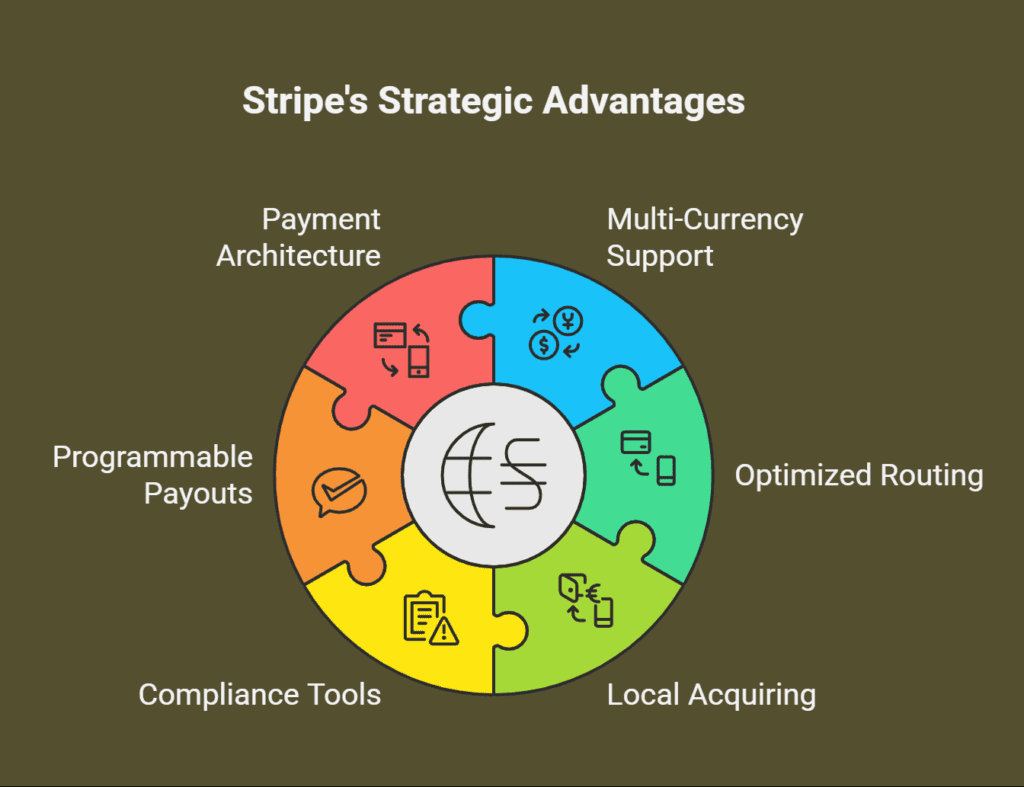

Stripe’s Edge in Cross-Border Strategy

Stripe offers:

- Multi-currency support with intelligent FX handling

- Optimized routing to increase authorization rates

- Local acquiring for higher conversion and lower fees

- Compliance-first tools (AML, KYC, tax handling)

- Programmable payouts and treasury via Stripe Connect and Treasury

Whether you run a global SaaS, an international marketplace, or a high-growth D2C brand, Stripe is now critical infrastructure.

But Here’s the Catch: Integration Alone Is Not Enough

Anyone can plug in an API. Few teams design payment architecture that minimizes fees, prevents fraud, ensures regulatory compliance—and most importantly, maximizes revenue.

How SubcoDevs Helps (Beyond the Basics)

We help founders, CTOs, and ops leaders with:

- Multi-region account setups

- Custom Stripe Connect architectures

- Global tax and compliance automation

- Stablecoin settlements and smart routing logic

The Future Is Global. Are You Ready?

If you’re still relying on outdated payment flows or cobbling together tools that don’t scale internationally, you’re already falling behind. Let’s fix that.

👉 Book a free strategy session with our Stripe experts at SubcoDevs and learn how to make your payments cross-border ready—and future-proof.

References: Newstrail Report on Digital Cross-Border Payments Market