As Fiserv (NYSE: FI) faces investor-led lawsuits over its Payeezy-to-Clover migration, fintech product teams are left with a critical question:

What happens to your revenue if your payment provider fails?

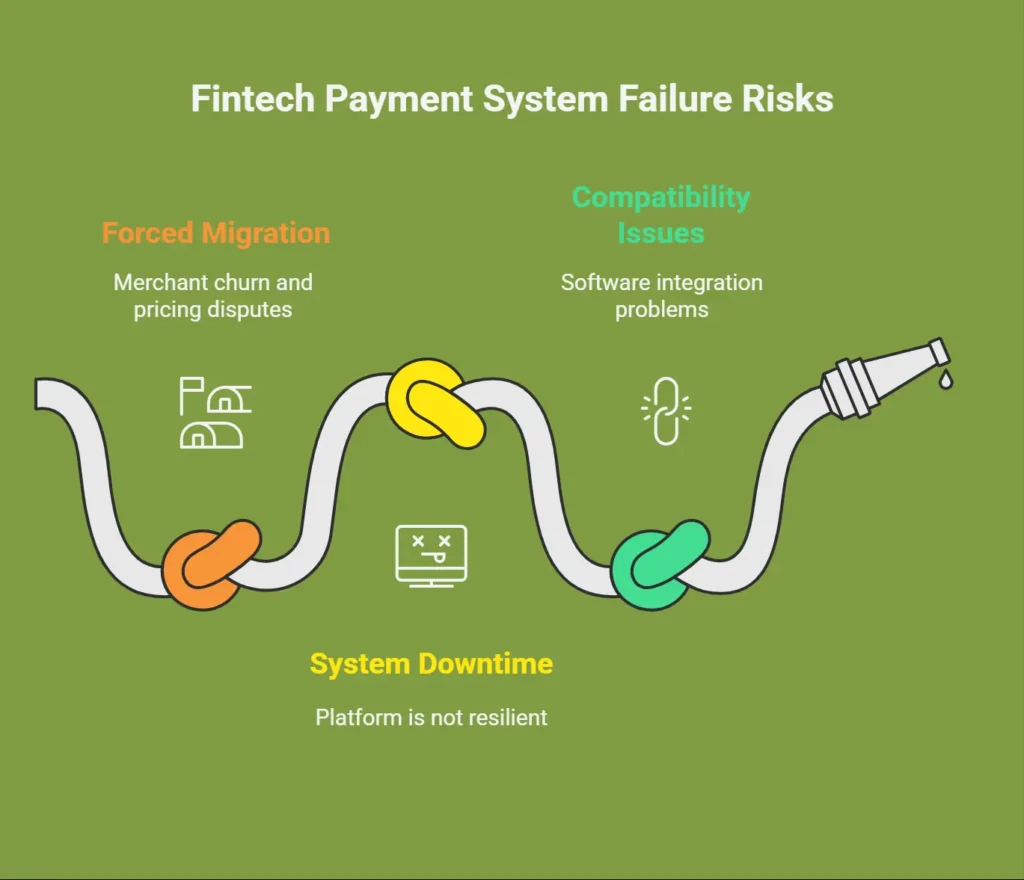

Between July 24, 2024, and July 22, 2025, lawsuits allege that Fiserv misled investors by temporarily inflating Clover’s growth metrics during a forced migration. The fallout? Merchant churn, pricing disputes, system downtime, and compatibility issues.

While Fiserv denies wrongdoing and no class has been certified, the market has responded sharply:

- Stock dropped 18.5% on April 24

- Dropped 16.2% on May 15

- Dropped 13.9% on July 23

These events aren’t just legal news—they’re a real-world reminder that your platform is only as resilient as your payment architecture.

Why This Matters to CTOs and Product Leaders

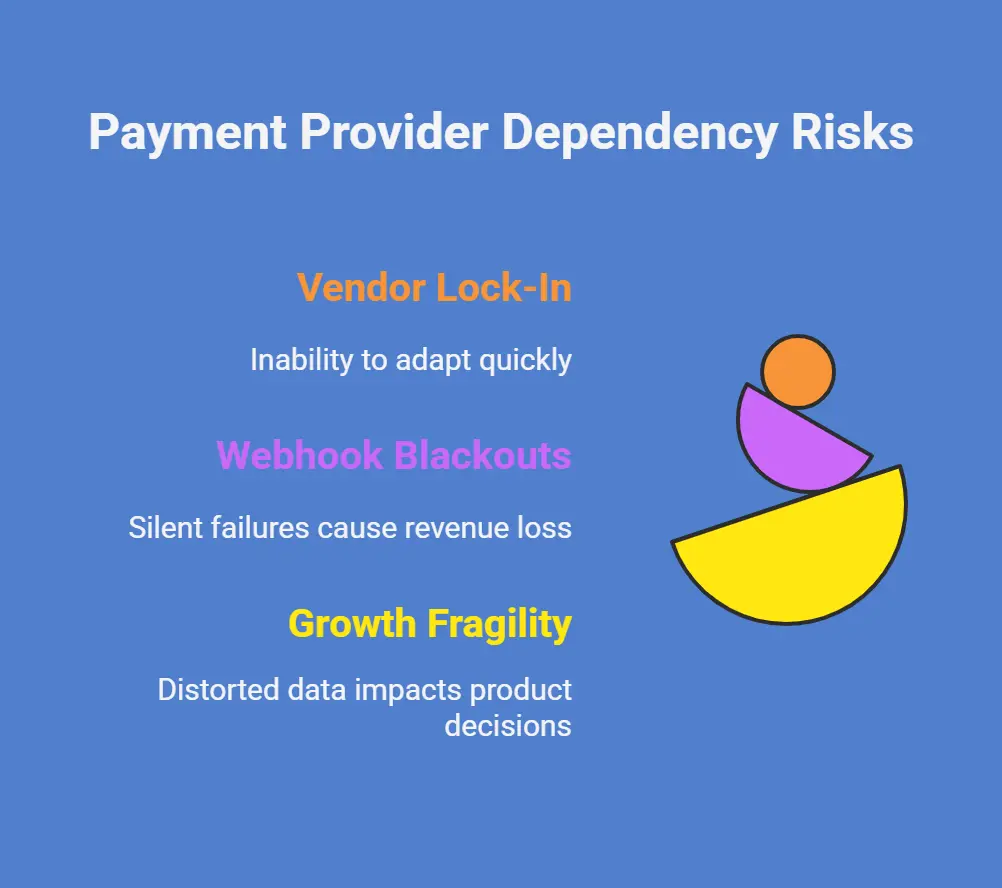

If 80% or more of your revenue flows through a single payment service provider (PSP), you’re exposed to their technical, legal, and reputational risks.

Here’s what the Fiserv situation highlights:

- Vendor Lock-In → Inability to pivot when things break

- Webhook Blackouts → Silent failures, broken entitlements, and missed revenue

- Growth Fragility → Forced migration metrics can distort product performance data

📌 Want the full industry context? Check out our breakdown on LinkedIn

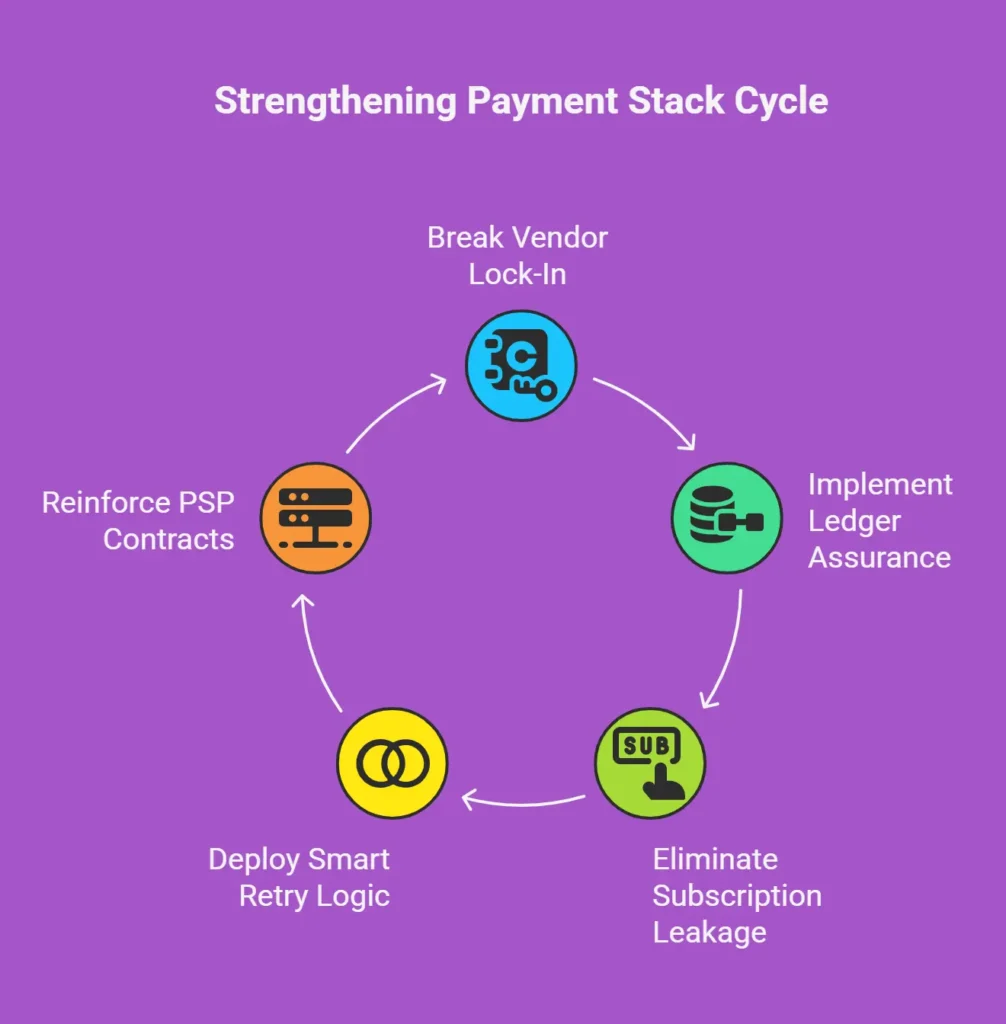

7-Day Action Plan: Strengthen Your Payment Stack

Here’s a tactical, engineering-first checklist you can start implementing this week:

1. Break Vendor Lock-In

- Implement a Stripe fallback lane behind feature flags

- Start routing 5–10% of transactions for performance benchmarking

2. Implement Ledger Assurance

- Add idempotent webhook handlers and DLQ (dead-letter queue) replay logic

- Create a reconciled subledger for renewals and refunds

3. Eliminate Subscription Leakage

- Sync Stripe Billing ↔ RevenueCat

- Unify entitlements across web, iOS, and Android

4. Deploy Smart Retry Logic

- Use issuer/BIN-aware retry windows

- Configure Stripe Radar rules to optimize decline recovery

5. Reinforce PSP Contracts

- Negotiate data portability clauses

Include SLA breach penalties and uptime guarantees

What’s Already Working for Forward-Thinking Teams

Leading SaaS and fintech teams are already taking control with:

- Stripe Billing + Radar for intelligent retries and dunning workflows

- RevenueCat + Stripe sync to keep access consistent during PSP disruptions

Feature-flagged PSP lanes to reduce migration risk and test new flows safely

How SubcoDevs Helps You Build PSP Resilience

At SubcoDevs, we help founders and CTOs de-risk their payment systems in weeks—not quarters. Our PSP resilience services include:

Free Vendor Risk Audit (30 minutes)

- Map out your payment stack

- Identify 2+ high-ROI improvements

Stripe Fallback Sprint (10 Days)

- Deploy a parallel Stripe lane (Billing or Payment Intents)

- Zero UX disruption

Built-in rollback and failover logic

Webhook Armor Package

- Guaranteed event delivery with:

- Idempotency

- DLQs

- Subledger reconciliation

- Idempotency

- Audit-ready reporting for finance and legal

👉Book your Payment Resilience Session

Or DM us for our “Fiserv Response Playbook”—a one-pager designed for legal, finance, and engineering teams.

Final Thought: Don’t Let a PSP Outage Become a Business Outage

Whether Fiserv’s lawsuits succeed or not, the damage has already been done—stock hits, lost merchants, and credibility risk.

If your revenue slows when your provider stumbles, now is the time to act.

Let SubcoDevs help you turn risk into resilience—fast, securely, and without disrupting your users.

🔒 Disclaimer:

This article is for informational purposes only and does not constitute legal advice. Fiserv, Clover, Stripe, and other names are trademarks of their respective companies. Sources include PR Newswire and AInvest.