Introduction: Stablecoin Infrastructure Goes Mainstream

Fiserv and PayPal have launched a stablecoin interoperability rail that connects FIUSD and PYUSD, enabling businesses and consumers to move money faster, cheaper, and more intelligently than ever before.

⚠️ Regulatory Note: As of June 23, 2025, FIUSD is still pending final approval from the New York Department of Financial Services (NYDFS). However, the foundation is in place and real-world integration is already underway.

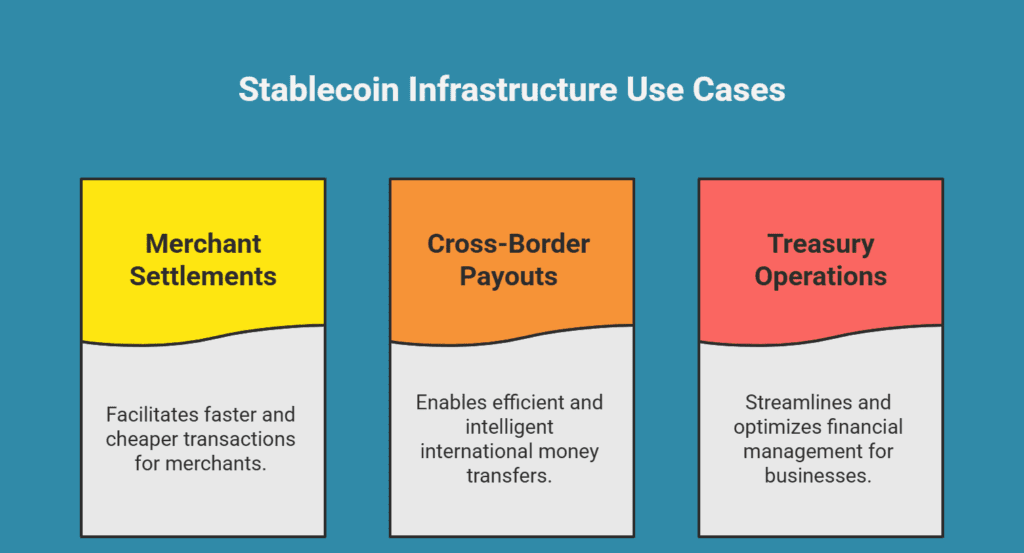

This stablecoin infrastructure supports high-impact use cases including:

- Merchant settlements

- Cross-border payouts

- Treasury operations

It signals a powerful shift in how money moves across digital and global ecosystems.

Why This Matters for Businesses and Platforms

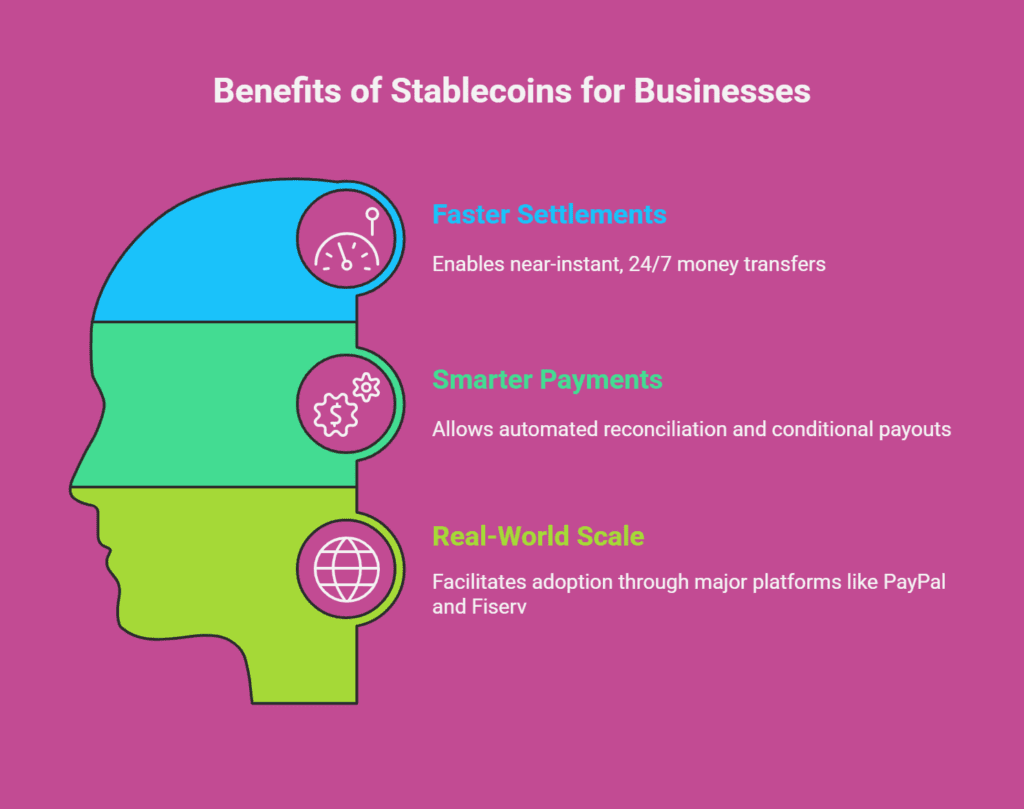

Faster, Always-On Settlements

Stablecoins offer near-instant, 24/7 money transfers, eliminating banking-hour delays and significantly cutting FX fees. This leads to:

- Better cash flow

- Faster access to working capital

- Higher operational efficiency

Smarter, Programmable Payments

The ability to program money means businesses can:

- Automate reconciliation

- Enforce conditional payouts

- Maintain real-time audit trails

These are essential features for modern finance teams and payment systems.

Real-World Scale

This isn’t a pilot—it’s production-grade infrastructure with massive reach:

- PayPal: Over 435 million global users

- Fiserv: Infrastructure partner to 10,000+ financial institutions

Together, they enable stablecoin adoption at scale, across consumer and enterprise touchpoints

Why This Matters for Businesses and Platforms

Faster, Always-On Settlements

Stablecoins offer near-instant, 24/7 money transfers, eliminating banking-hour delays and significantly cutting FX fees. This leads to:

- Better cash flow

- Faster access to working capital

- Higher operational efficiency

Smarter, Programmable Payments

The ability to program money means businesses can:

- Automate reconciliation

- Enforce conditional payouts

- Maintain real-time audit trails

These are essential features for modern finance teams and payment systems.

Real-World Scale

This isn’t a pilot—it’s production-grade infrastructure with massive reach:

- PayPal: Over 435 million global users

- Fiserv: Infrastructure partner to 10,000+ financial institutions

Together, they enable stablecoin adoption at scale, across consumer and enterprise touchpoints

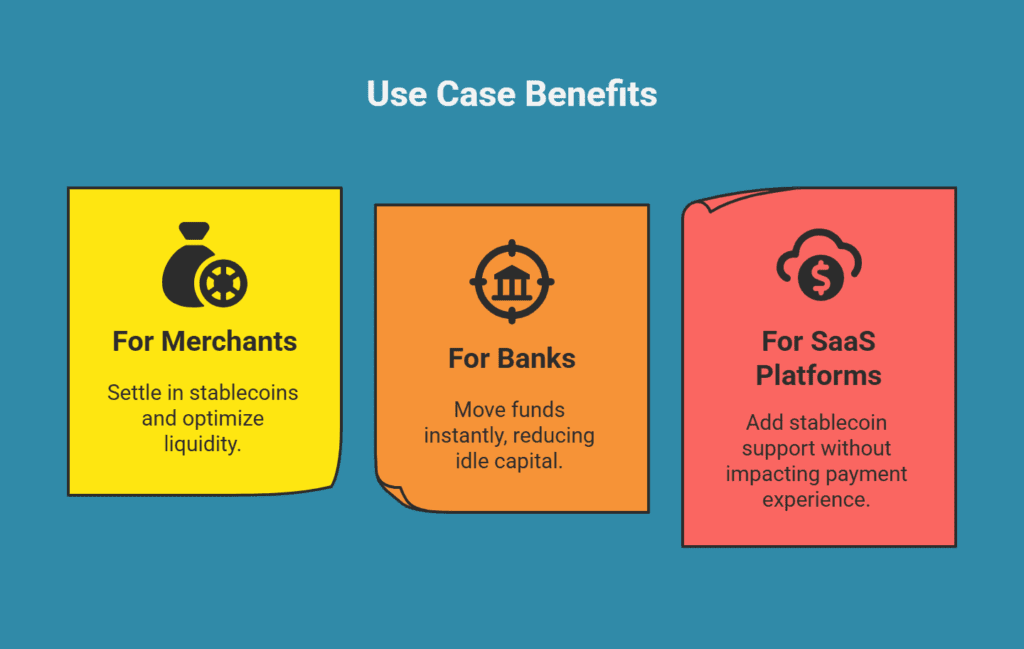

Use Case Benefits by Sector

For Merchants

Receive fiat from customers, settle in stablecoins, and optimize liquidity without affecting frontend UX.

For Banks

Move funds instantly between wallets and core systems, reducing idle capital and improving treasury operations.

For SaaS & Stripe-Based Platforms

Add stablecoin support to existing payout or treasury flows without impacting your core payment experience

Explore the Full Technical Breakdown

For an extended technical overview and deployment strategy, read our full article on LinkedIn:

👉 Fiserv × PayPal Stablecoin Rail: Deep Dive & Pilot Blueprint

How SubcoDevs Helps You Succeed

At SubcoDevs, we design and deploy next-generation payment ecosystems—with a focus on stablecoin readiness, Stripe-powered infrastructure, and regulatory-safe architecture.

Our fintech engineering team delivers:

- End-to-end reconciliation systems

- Clean rollback paths with observability

- Sandbox-tested pilots launched in under two sprints

- Support for PYUSD, FIUSD, and fiat-stablecoin hybrids

Get a Free Stablecoin Readiness Call

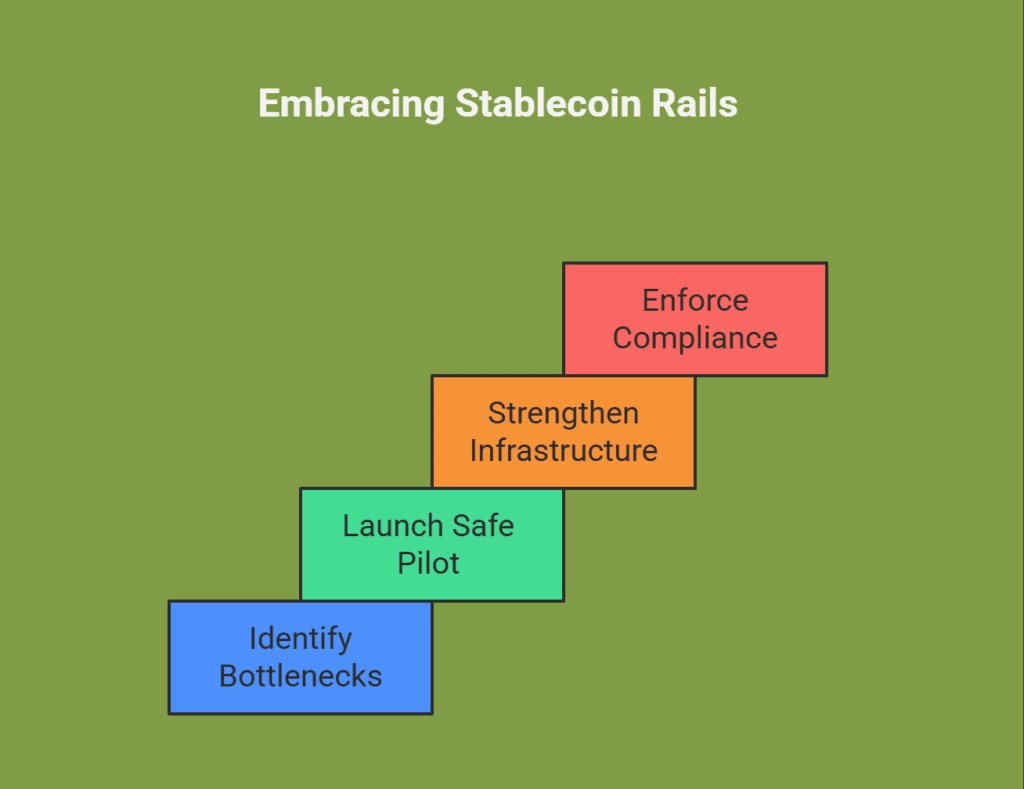

We’re offering a complimentary 30-minute strategy session to help your team:

- Identify your best-fit stablecoin use case

- Map a compliant, secure rollout

- Access a plug-and-play pilot blueprint

📩 Contact us today to get started and stay ahead of the curve in the evolving world of digital payments.