In today’s fast-evolving financial technology space, consistency is a sign of trust and resilience. Fiserv has achieved exactly that by securing the No. 1 spot in the 2025 IDC FinTech Top 100 Rankings for the third year in a row.

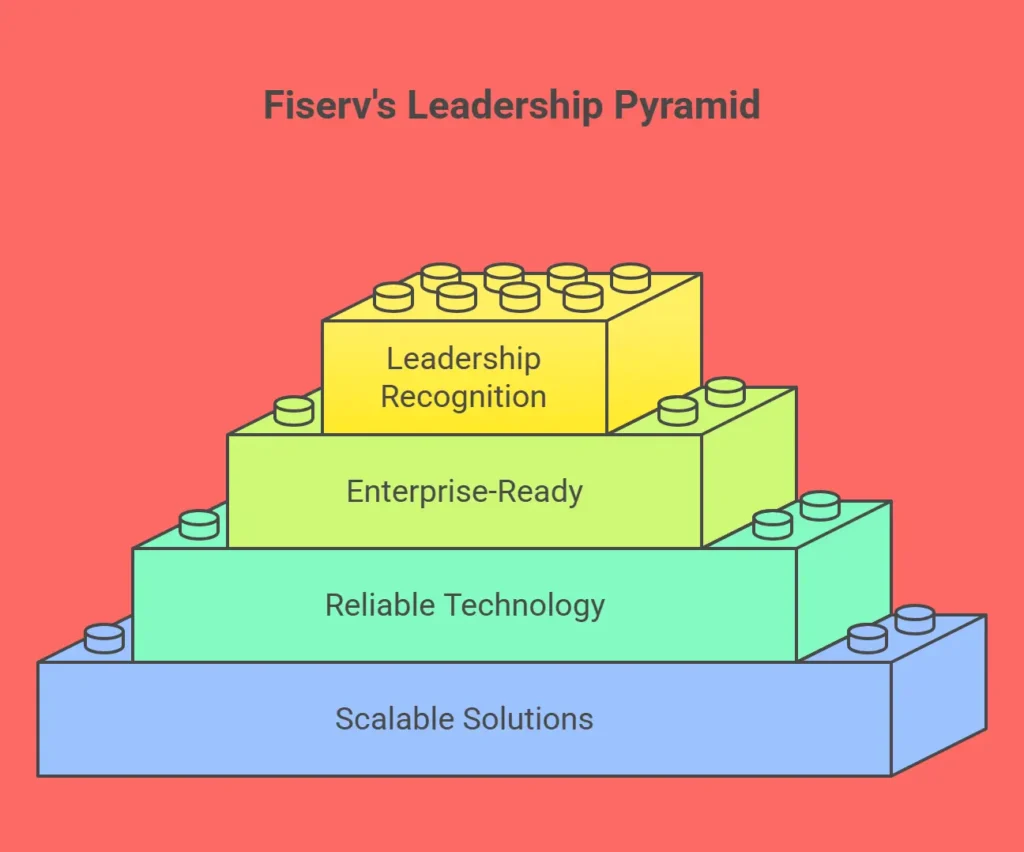

This recognition highlights Fiserv’s leadership in providing scalable, reliable, and enterprise-ready financial technology solutions. The IDC ranking evaluates global providers based on the revenue they generate from financial institutions across hardware, software, and services.

What Can FinTech Leaders Learn from Fiserv’s Continued Success?

With nearly 10,000 financial institutions and 6 million business locations relying on its technology, Fiserv’s influence reaches almost every U.S. household.

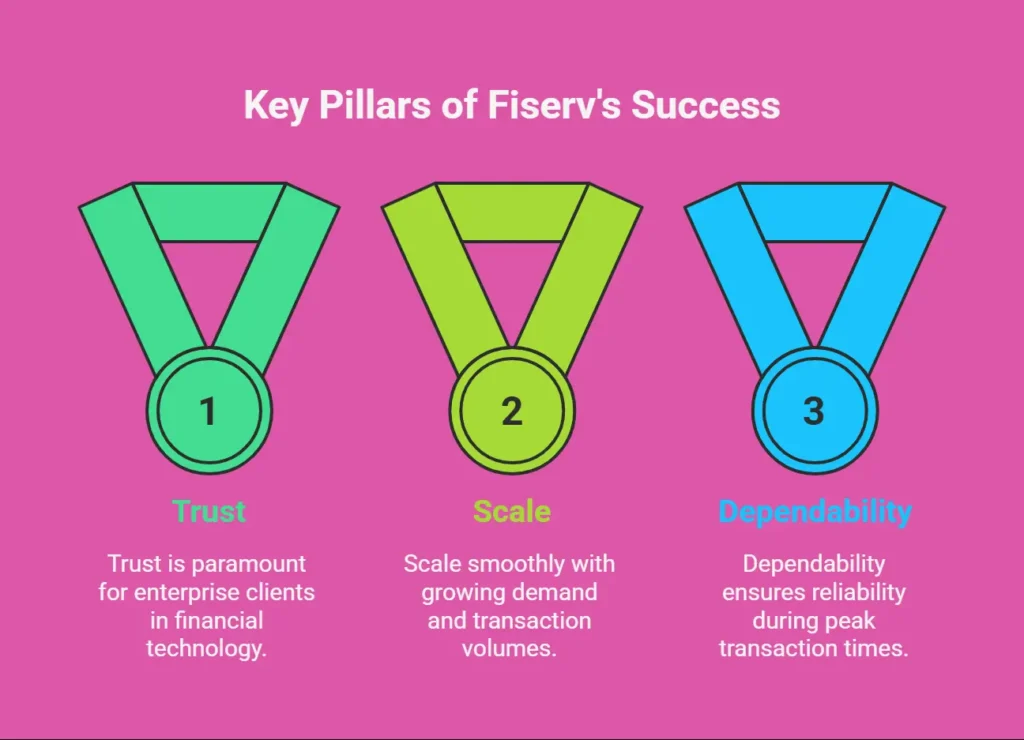

For FinTech founders, product leaders, and payments teams, the message is clear: enterprise clients value more than features. They value trust, scale, and dependability.

Your payments stack must do more than handle edge cases. It must:

- Scale smoothly with growing demand

- Meet compliance expectations from regulators

- Deliver reliability during peak transaction times

Setting the Benchmark in Payments Infrastructure

Fiserv’s strengths in core account processing, digital banking, issuer services, and account-to-account transfers demonstrate what dependable infrastructure looks like. These capabilities set the standard for providers aiming to serve at an enterprise level.

👉 Want a closer look? You can read the original LinkedIn article here for additional insights.

A 7-Day Action Plan for FinTech Teams

If you are building or scaling a payments ecosystem, here is a framework you can use to move closer to enterprise-grade standards:

- Audit your stack and identify outages, sync issues, or compliance gaps.

- Benchmark against leaders to spot missing capabilities.

- Increase reliability with fallback systems, strong SLAs, and stress testing.

- Adopt modular design so you can add new features without starting from scratch.

- Track trust metrics such as latency, authorization rates, and customer complaints.

- Enhance fraud detection with real-time and adaptive solutions.

Plan for scale by ensuring infrastructure can grow with your customer base

Building Future-Ready Payment Ecosystems

At SubcoDevs, we help businesses create resilient, scalable, and high-performance payment stacks. By integrating Stripe, in-app purchases, and banking APIs into one ecosystem, we deliver:

- Real-time reconciliation for accurate reporting

- Adaptive fraud detection to safeguard revenue

- High uptime supported by fallback pathways

- Infrastructure that grows seamlessly with your users

Final Thoughts

Fiserv’s continued success in the IDC FinTech Top 100 proves that trust and reliability define the future of digital payments. For FinTech innovators, the challenge is to build systems that not only meet current demands but also scale confidently into the future.

🚀 Ready to make your payments stack enterprise grade? Let’s review your flows, fix weak spots, and prepare your platform for long-term growth.