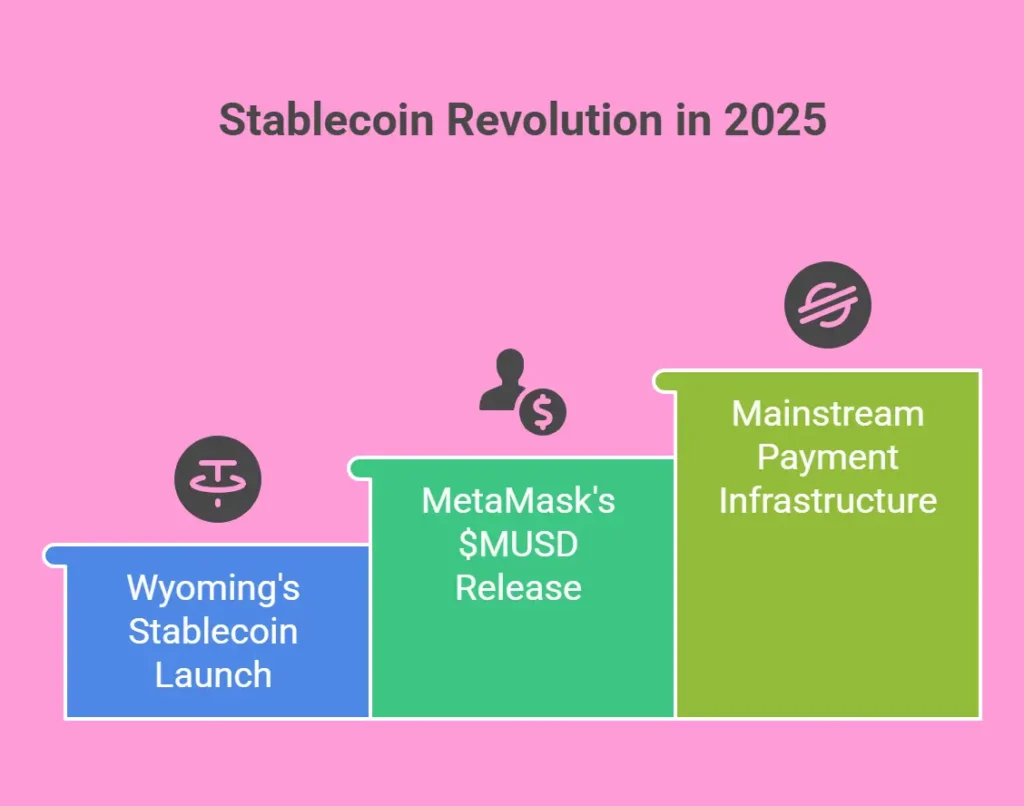

The 2025 stablecoin revolution isn’t just hype—it’s happening. And it’s changing how businesses move money globally.

In a year that’s already seen Wyoming launch the first state-backed stablecoin and MetaMask release $MUSD with Stripe’s support, stablecoins have evolved from crypto niche to mainstream payment infrastructure.

Whether you’re building B2B platforms, creator payout systems, or digital economies—stablecoins are now a serious tool in your fintech stack

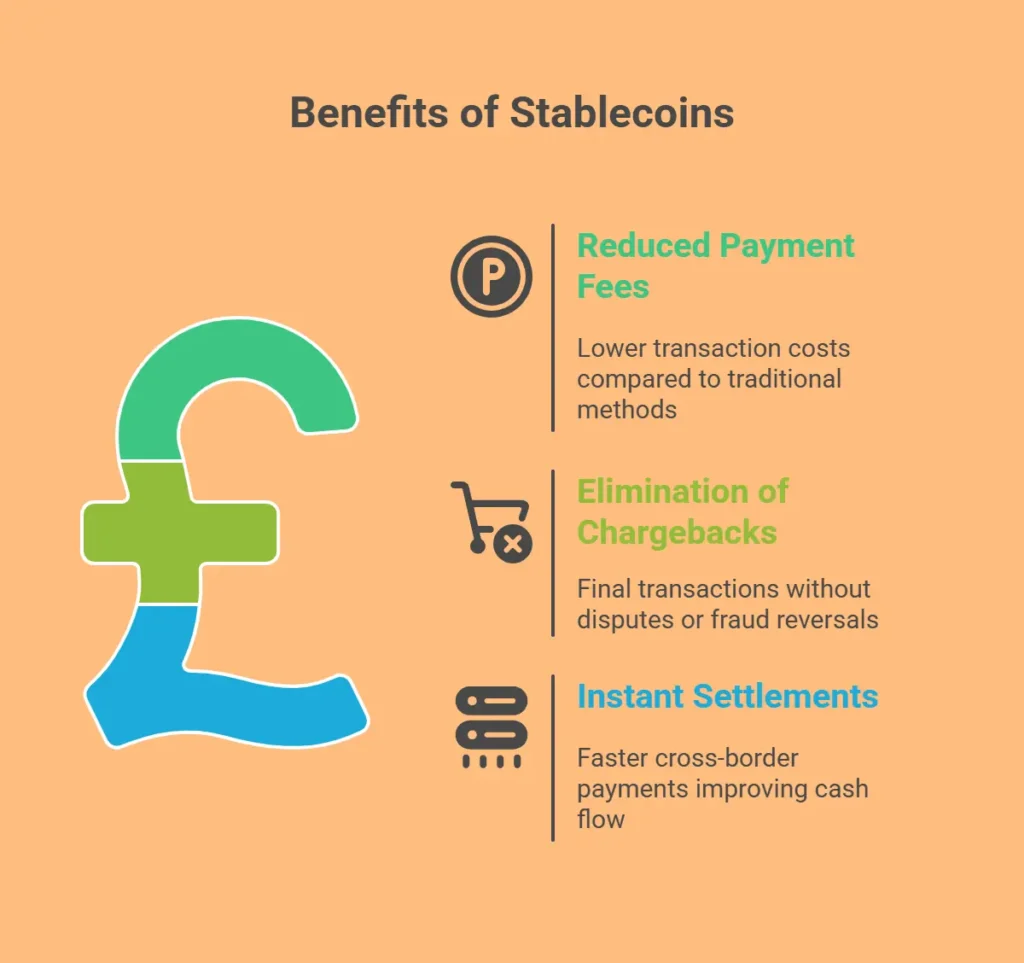

Why Should You Care?

Stablecoins aren’t just a trend—they’re a practical upgrade for modern payments.

Slash Payment Fees

Process transactions at just 0.5% – 1%, compared to 3%+ for credit card networks.

Eliminate Chargebacks

On-chain = final. No disputes. No fraud reversals. No chargeback nightmares.

Settle Instantly

Cross-border payments now complete in minutes, not days—improving cash flow across your business.

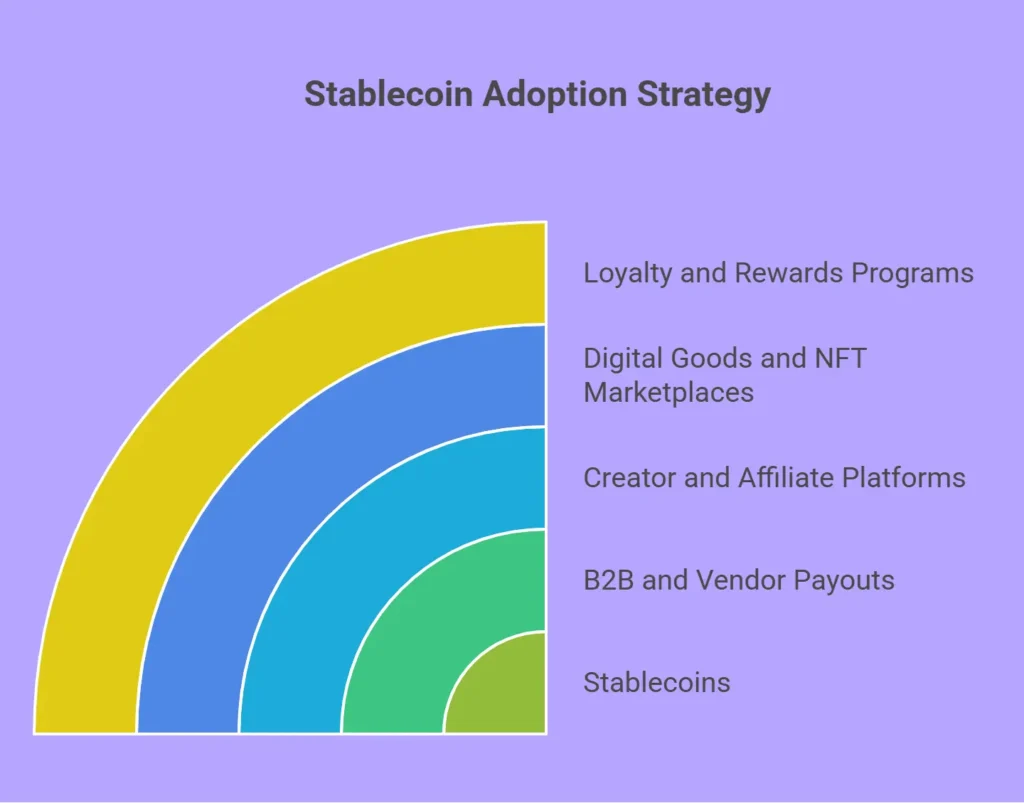

Who Should Use Stablecoins?

Stablecoins are ideal for teams building or scaling:

- B2B and vendor payouts

- Creator / affiliate platforms

- Digital goods, gaming, and NFT marketplaces

- Loyalty and rewards programs

And if you’re looking for:

- Lower operating costs

- Global payout capabilities

- Final, dispute-free settlement

Stablecoins are no longer optional—they’re strategic.

📌 Want the original perspective that inspired this blog? Read our founder’s full breakdown on LinkedIn.

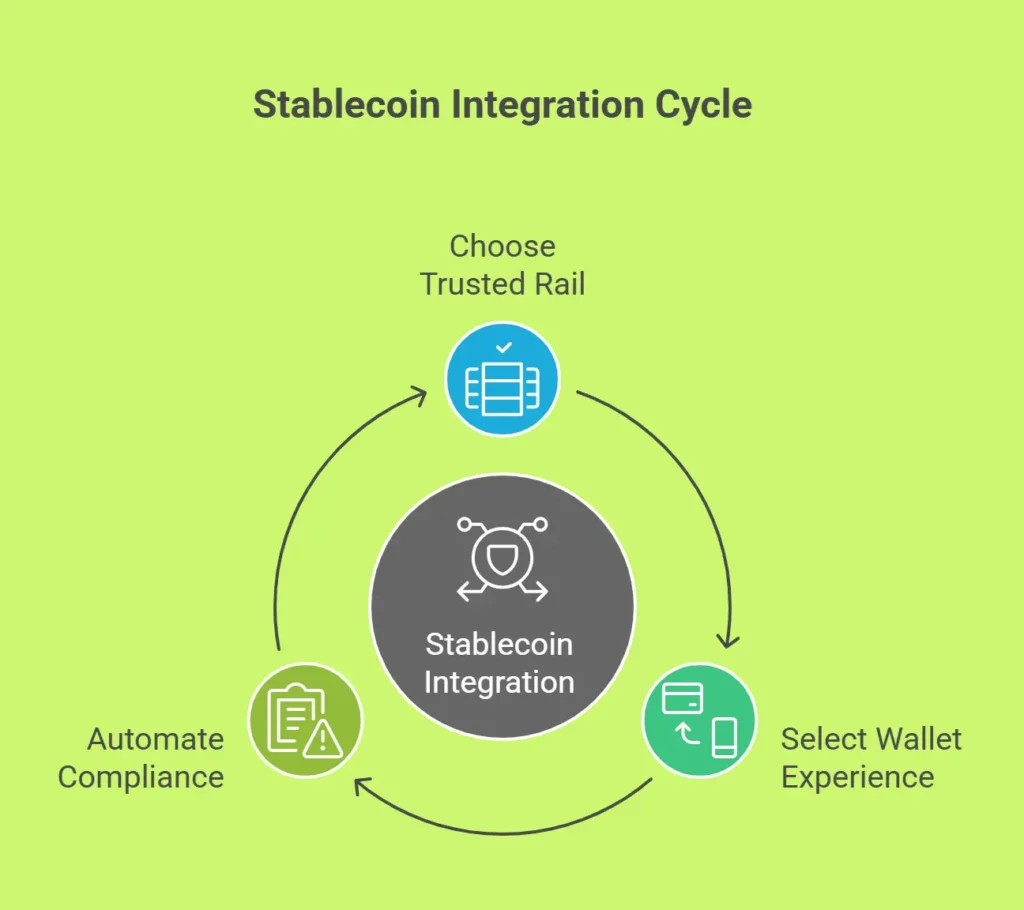

How to Integrate Stablecoins (Without Getting Rekt)

Stablecoin integration doesn’t have to be risky or disruptive—if done right. Here’s how to start:

1. Choose the Right Rail

Use trusted, enterprise-grade platforms such as:

- Stripe Bridge

- Lightspark

These tools help manage compliance, reporting, and stablecoin flow infrastructure.

2. Select the Best Wallet Experience

- PSP-Hosted Wallets → Easier for users, smoother onboarding

- Self-Custody Wallets → More decentralized, ideal for crypto-native users

Pick the wallet type that matches your users and product roadmap.

3. Automate Compliance

Use tools like Ledgible to:

- Track crypto taxes and gain/loss reporting

- Tag wallet activity by geography

- Ensure audit-ready reporting from day one

Risks to Watch For

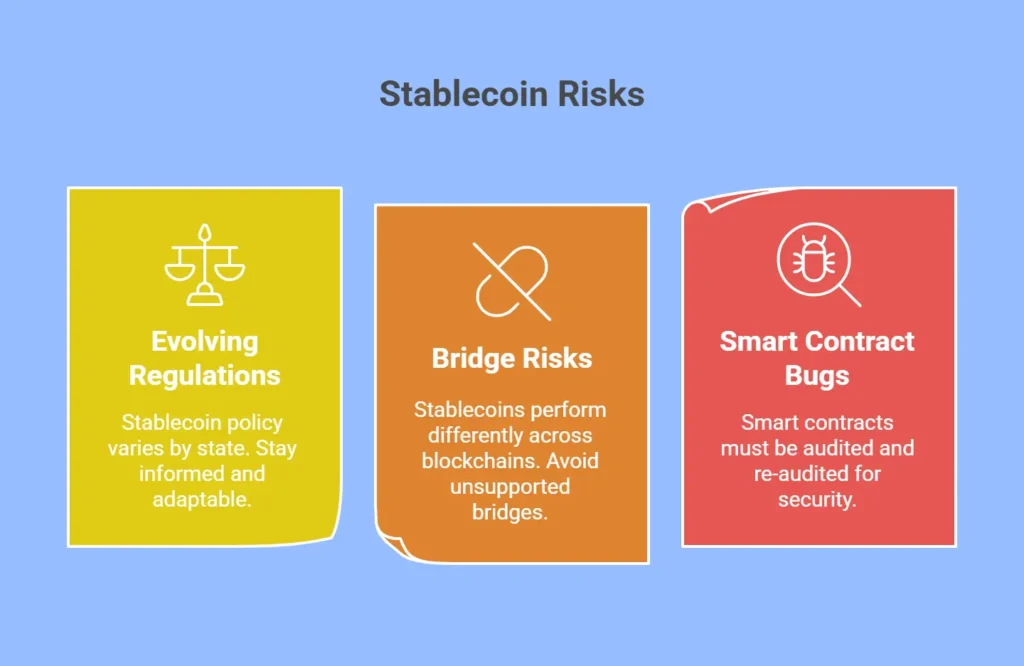

Before going live, make sure your team understands and prepares for:

- Evolving Regulations

Stablecoin policy still varies state by state. Stay informed and adaptable. - Bridge Risks

Not all stablecoins perform equally across blockchains. Avoid unsupported or low-liquidity bridges.

Smart Contract Bugs

Smart contracts must be audited—then re-audited. Security isn’t optional when funds are on-chain

🤝 How SubcoDevs Helps You Launch Safely

At SubcoDevs, we help fintech and SaaS platforms launch stablecoin payment flows that are:

- Secure

- Compliant

- Built for global scale

- Fully integrated with Stripe, MetaMask, and modern treasury systems

Whether you’re running pilots for US→EU vendor payouts or embedding stablecoin wallets into your platform, we’ll help you ship fast—without disruption.

🚀 Ready to Future-Proof Your Payments?

Stablecoins are no longer experimental. They’re faster, cheaper, programmable, and already here.

👉 Book your Stablecoin Architecture Session Or contact us for a free checklist to plan your zero-risk pilot, complete with tech stack guidance and compliance frameworks.

2025 is the year real-time programmable payments go mainstream. Let’s help you lead it.

🔒 Disclaimer

This blog is for informational purposes only and does not constitute legal or financial advice. Consult a qualified advisor before implementing stablecoin technologies. Sources: Wyoming State Treasury, MetaMask, Stripe, IRS.