Stripe AI fraud detection just got a massive upgrade. Stripe has achieved one of the most significant breakthroughs in AI-powered fraud prevention. If you’re running an eCommerce platform, marketplace, or SaaS product—this could impact your revenue directly.

At SubcoDevs, we specialize in Stripe infrastructure. And Stripe’s recent leap in fraud detection—from 59% to 97% on specific attacks overnight—marks a turning point in the role AI plays in safeguarding revenue

How Stripe AI Fraud Detection Works: A Deep Dive

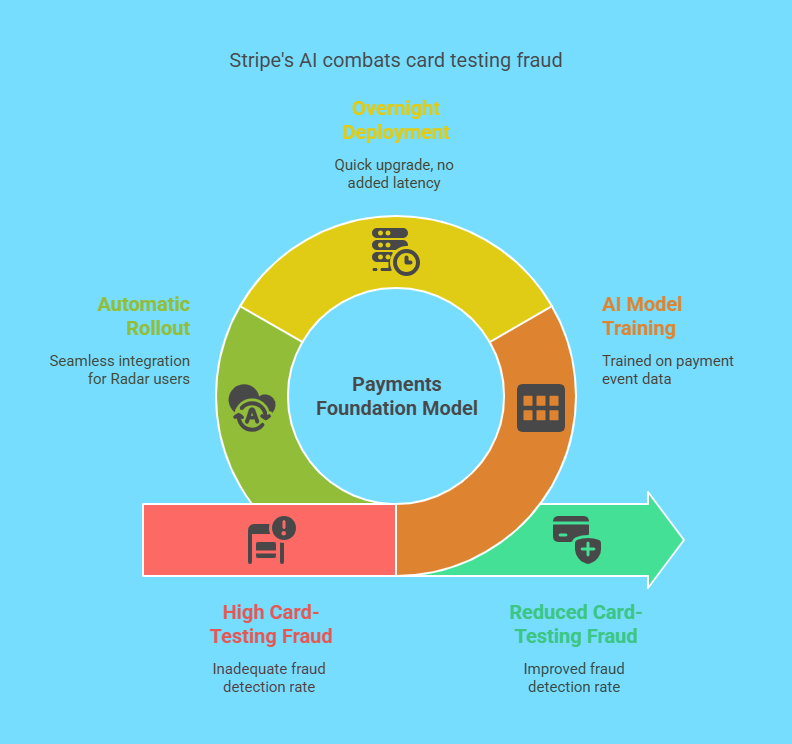

According to a recent article by Analytics India Magazine, Stripe deployed a new Payments Foundation Model—a proprietary AI system trained on tens of billions of real-world payment events.

This model enabled Stripe to:

- 🚀 Improve fraud detection for card-testing attacks on large-volume users from 59% to 97%

- ⏱ Deploy the upgrade overnight, with no added latency

- 🔐 Roll it out automatically for Stripe Radar users, requiring no additional integration or setup

Important clarification: This 97% accuracy boost is specific to card-testing fraud—a high-risk attack vector for high-volume platforms.

For general users and broader fraud types, Stripe reports an average 38% improvement in detection with its AI models.

Why Stripe AI Fraud Detection Matters for Businesses

If your business processes thousands of transactions per day—or operates in a subscription, DTC, or multi-vendor environment—then you are a likely target for automated card-testing attacks.

These attacks often go unnoticed by traditional rule-based systems, until it’s too late.

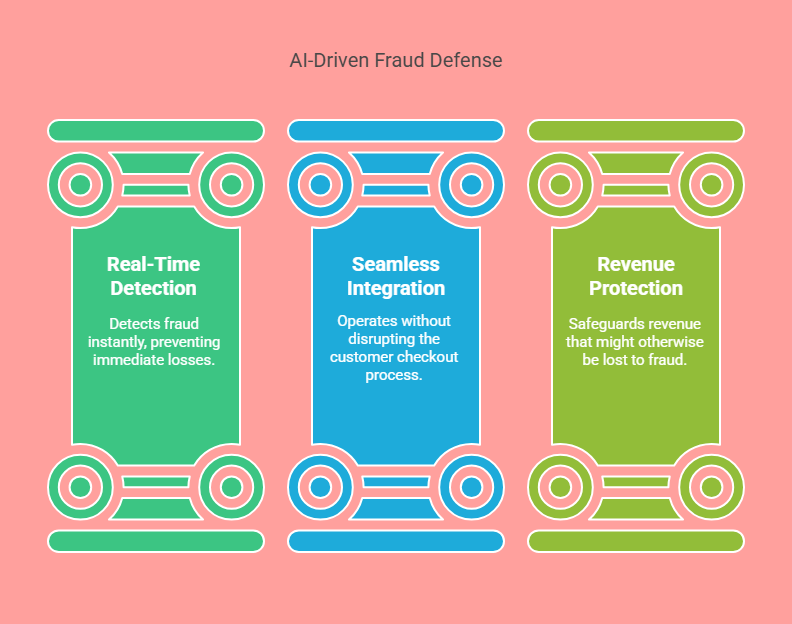

Stripe’s new model not only detects these faster, but it does so:

- In real-time

- Without interrupting your checkout flow

- While protecting revenue you didn’t know you were losing

AI-based fraud detection is no longer an optional feature. It’s infrastructure.

How SubcoDevs Helps You Leverage Stripe’s AI Power

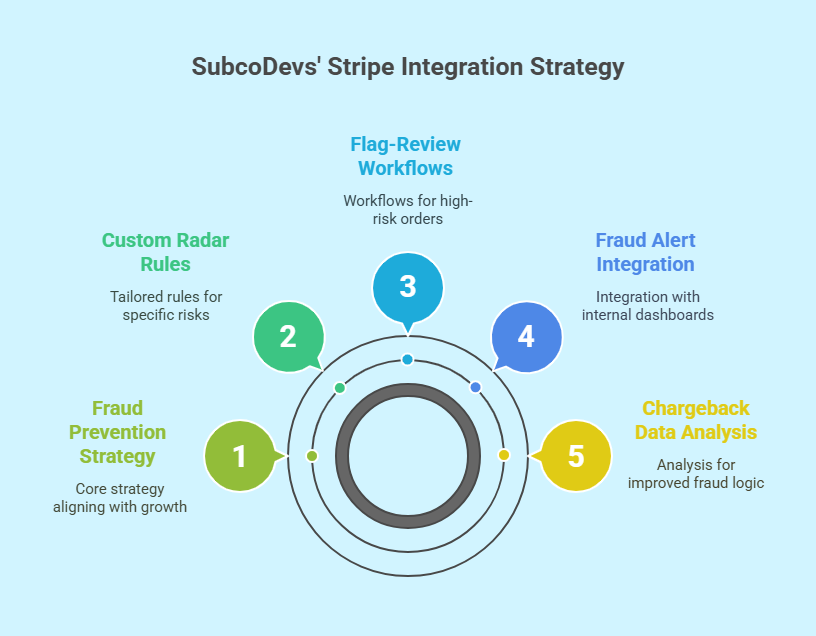

While Stripe’s Radar gives you access to powerful default protections, most businesses don’t know how to customize it for their specific risk scenarios.

That’s where SubcoDevs steps in.

We work with eCommerce founders, CTOs, and product teams to:

✅ Configure custom Radar rules and testing environments

✅ Build flag-review workflows for high-ticket or risky orders

✅ Integrate fraud alerts into internal dashboards (Salesforce, Slack, HubSpot, etc.)

✅ Analyze chargeback and decline data to train better fraud logic

✅ Align fraud prevention strategy with growth, not against it

And because we work almost exclusively on Stripe architecture, our strategies are tested across high-volume platforms globally.

💡 What You Might Be Missing

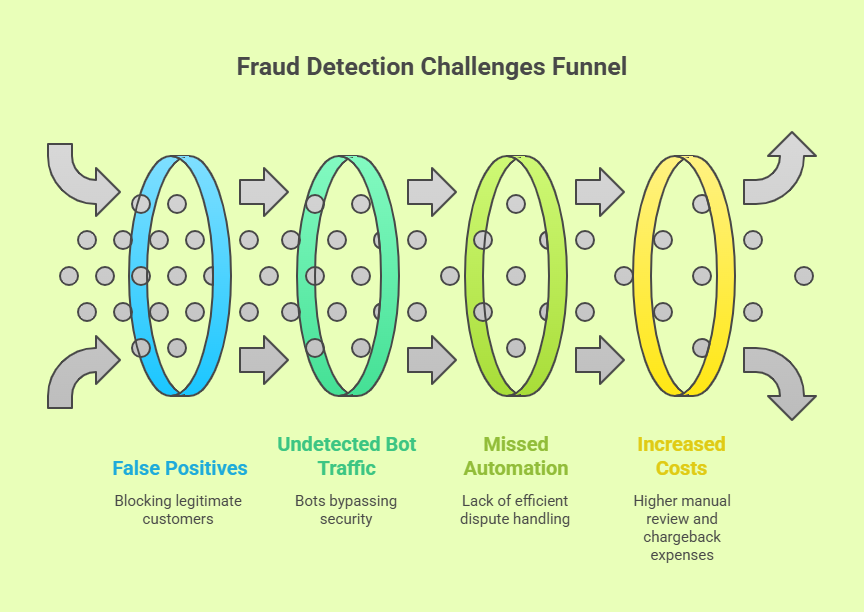

If you’re relying only on Stripe’s default settings or legacy fraud tools, you’re likely:

- Blocking good customers by mistake (false positives)

- Letting in sophisticated bot traffic undetected

- Missing revenue-saving automation in your dispute handling

- Paying increasing costs in manual fraud review time or chargeback losses

The most dangerous fraud is the one you never notice—until it’s already cost you.

📞 What Should You Do Next?

At SubcoDevs, we’re offering a free Stripe fraud audit for qualified businesses. In one 30-minute call, we’ll:

- Review your current Radar setup

- Identify gaps in your detection logic

- Benchmark your system against industry best practices

- Recommend quick wins and long-term safeguards

👉 Book your free session here »

🔗 Additional Reading

📘 Original article: How Stripe Used AI to Boost Fraud Detection

🔒 Learn about Stripe Radar

📈 Explore our payment gateway solutions

Final Words

Fraud prevention is no longer a back-office function.

It’s a growth-enabler—or a silent revenue killer, depending on how you approach it.

Stripe has raised the bar with AI. At SubcoDevs, we help you clear it.

👉 Let’s protect your revenue. Book a strategy session now.