When people talk about the crypto revolution, names like Coinbase, Binance, or Metamask dominate the conversation. But Stripe blockchain payments are quietly building the foundation for real-world crypto adoption.

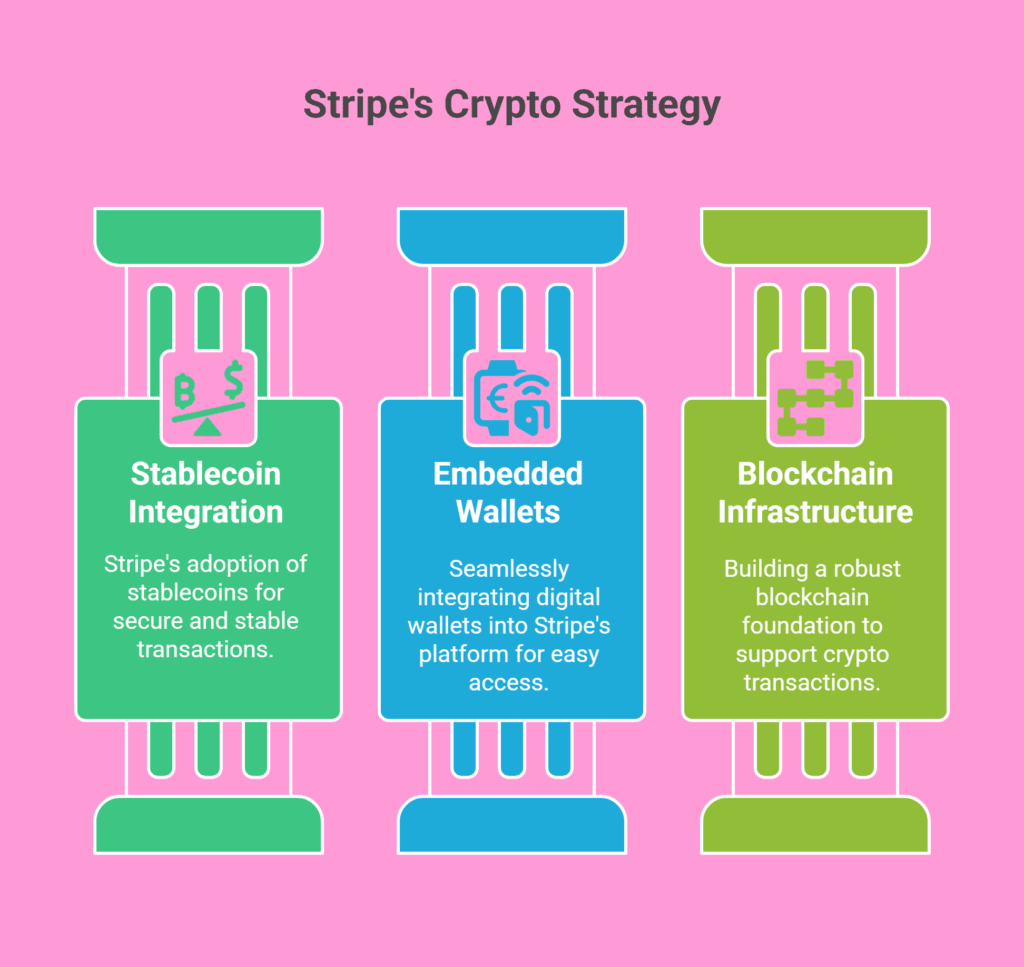

Best known for powering SaaS and eCommerce giants, Stripe is now enabling businesses to securely integrate crypto using stablecoins, embedded wallets, and blockchain infrastructure.

While the crypto market has seen its share of volatility and skepticism, Stripe is betting on a long-term vision: making crypto usable, safe, and invisible for mainstream businesses.

Stripe Blockchain Payments: A New Era of Digital Transactions

Over the last few years, Stripe has been investing heavily in redefining how businesses accept and manage money in a multi-currency, digital-first world. Unlike many crypto-native tools that require specialist teams and complex compliance layers, Stripe’s approach is refreshingly simple, secure, and developer-friendly.

Here’s how Stripe is leading the charge:

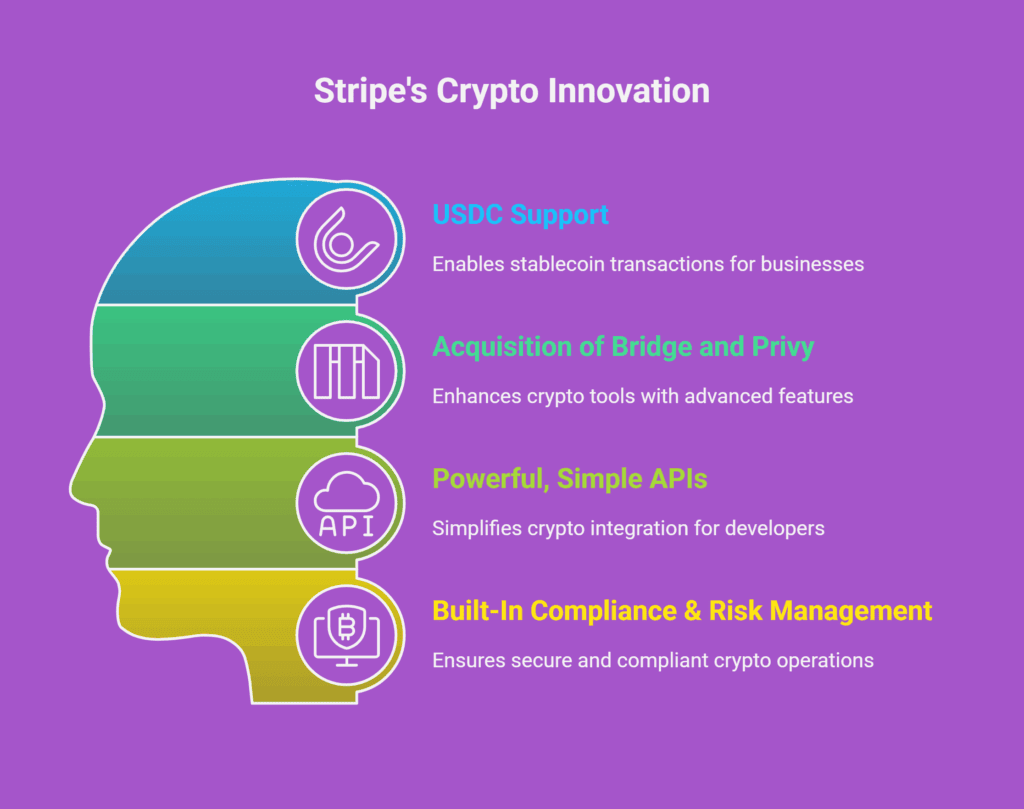

- USDC Support

Stripe now supports USD Coin (USDC), a regulated, fully-backed stablecoin pegged to the U.S. dollar. This enables businesses to accept and settle in crypto without exposing themselves to market volatility — ideal for international payments, payouts, and faster settlements. - Acquisition of Bridge and Privy

With the acquisition of Bridge, Stripe adds advanced stablecoin rails, and Privy brings embedded wallet functionality. Together, they represent Stripe’s commitment to offering crypto tools that are ready for production use, not just experimental environments. - Powerful, Simple APIs

True to its roots, Stripe has made integrating crypto into your product as easy as adding traditional card payments. Their API-first architecture makes it possible for any developer to launch stablecoin payments or embedded wallets with just a few lines of code.

Built-In Compliance & Risk Management

Crypto adoption often fails at the compliance level. Stripe handles KYC, AML, and fraud detection behind the scenes, allowing businesses to scale across borders without legal friction or security risks.

Why This Matters for Forward-Thinking Businesses

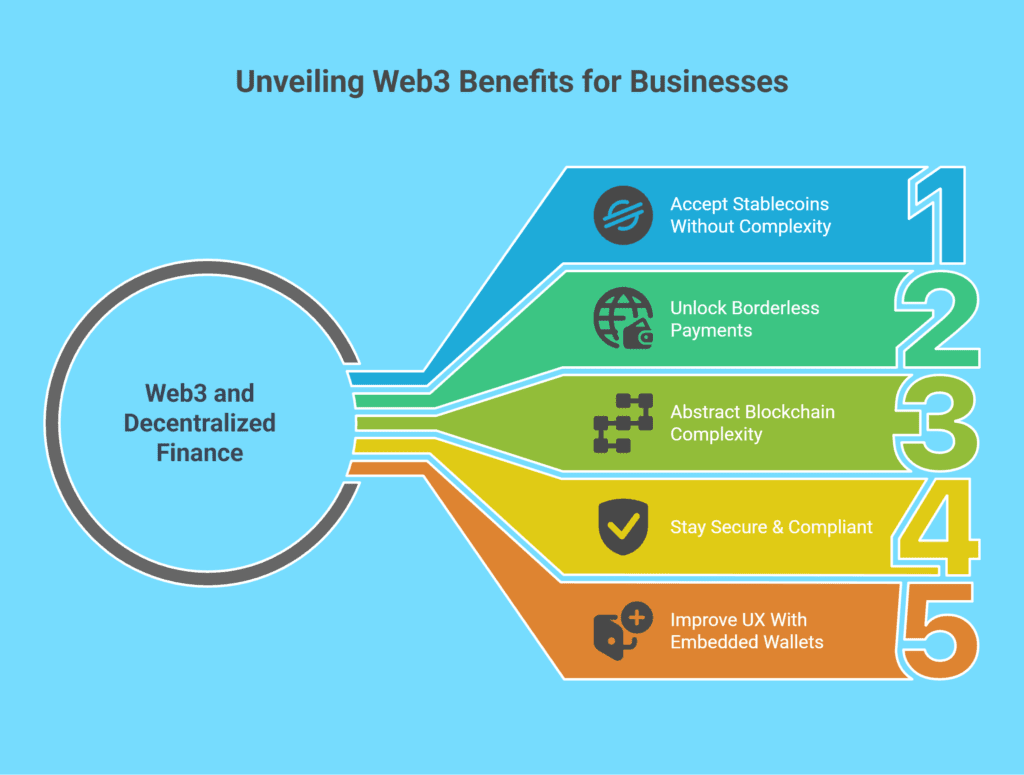

The rise of Web3 and decentralized finance isn’t just about speculation — it’s about transforming how money moves. Stripe is unlocking this potential for businesses that want real-world functionality without crypto complexity.

What This Means for Modern Businesses:

– Accept Stablecoins Without Complexity

Use USDC and other stablecoins to settle faster, eliminate bank delays, and improve liquidity.

– Unlock Borderless Payments

Serve international markets without relying on costly wire transfers, payment delays, or currency conversions.

– Abstract Blockchain Complexity

No need to hire a blockchain team or build infrastructure from scratch — Stripe handles the heavy lifting.

– Stay Secure & Compliant

Stripe ensures that your business remains compliant with evolving financial regulations worldwide, all while protecting users from fraud and risk.

– Improve UX With Embedded Wallets

Integrate Privy-powered wallets into your app or platform to offer smooth, secure, self-custody experiences — ideal for Web3 and fintech applications.

🔗 Go Deeper: Stripe’s Crypto Strategy in Action

We covered this topic in depth in our recent thought leadership post.

👉 Read the article: Stripe — The Unsung Hero Powering Crypto’s Next Chapter

This piece breaks down Stripe’s moves and what they really mean for businesses, developers, and the future of digital commerce.

🤝 SubcoDevs: Bringing Stripe’s Crypto Capabilities to Your Business

At SubcoDevs, we specialize in building Stripe-powered systems for SaaS companies, marketplaces, fintech platforms, and high-growth startups.

We understand the nuances of payments, security, compliance, and scale. Our team works with clients across industries to simplify complex payment systems, making them crypto-ready and future-proof.

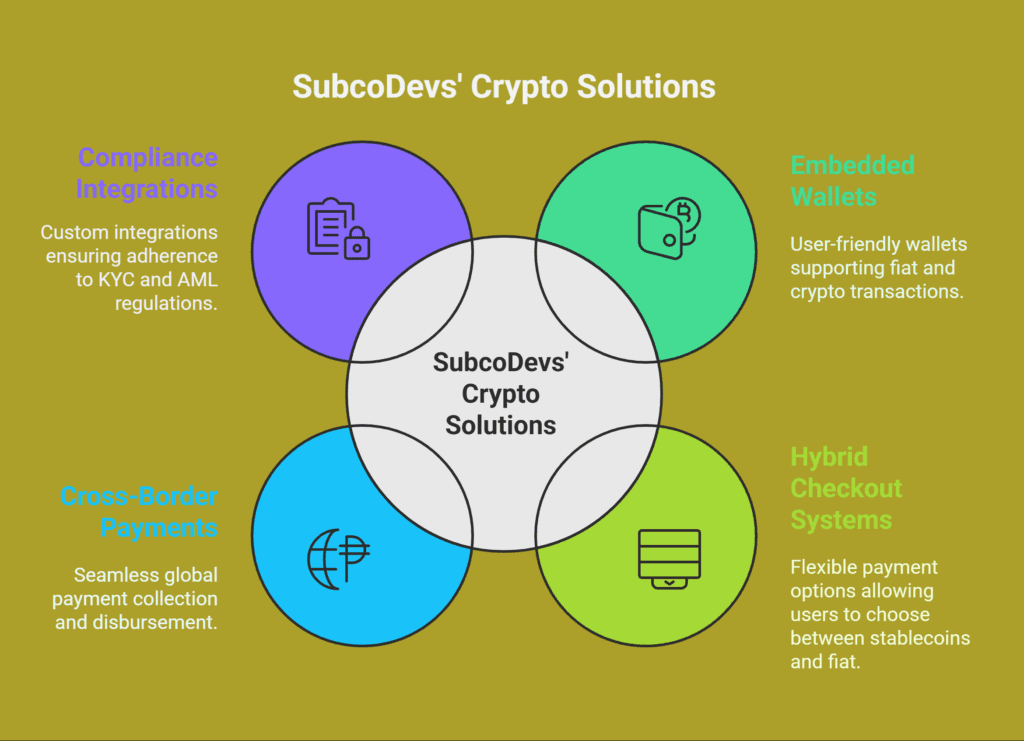

Here’s What We Can Help You Build:

- Embedded Wallets

Add user-friendly wallets to your platform, powered by Stripe + Privy, with support for both fiat and crypto. - Hybrid Checkout Systems

Let users choose between stablecoins and fiat currency during checkout — perfect for global, high-conversion commerce. - Cross-Border Payment Infrastructure

Seamlessly collect and disburse payments worldwide using Stripe’s crypto and traditional rails.

Custom Integrations with KYC & AML Logic

Stay compliant with global regulations while offering cutting-edge payment features.

We remove the guesswork and give you the power to launch, iterate, and scale with confidence.

📩 Let’s build something extraordinary.

DM us on LinkedIn or contact us directly to discuss how we can support your product with next-gen payments.

📣 Final Thought: Crypto Isn’t the Future — It’s the Now

The future of money is evolving — fast. And it’s not about crypto replacing traditional finance. It’s about convergence.

Fiat + Stablecoins. Cards + Wallets. Speed + Security.

Stripe understands this shift and is already building for it. If you want to stay ahead of the curve, you need partners who know how to build on top of Stripe’s evolving stack.

The crypto shift is real. Stripe has the rails. SubcoDevs brings the engine.

Let’s redefine what your business can do with payments — together.