The financial world is undergoing a quiet revolution—one that’s impossible to ignore.

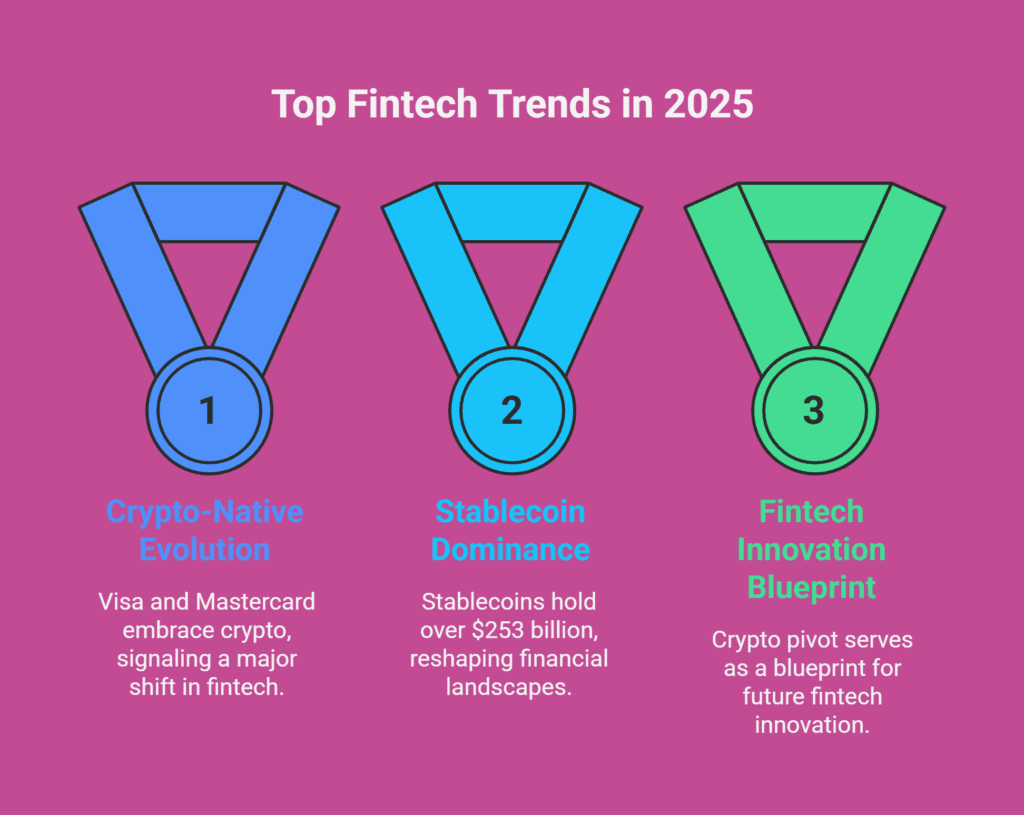

With over $253 billion now held in stablecoins, even the world’s most traditional payment giants—Visa and Mastercard—are rethinking their position in the digital economy. No longer treating crypto as a side quest, they’re making strategic moves to evolve into crypto-native value movers.

This shift is more than a headline—it’s a blueprint for the future of finance. And if you’re building or scaling a fintech product, this may be the most important trend to watch in 2025.

The Quiet Shift: From Card Rails to Real-Time Crypto Payments

Visa and Mastercard are actively embracing the crypto ecosystem in ways that were unthinkable just a few years ago. Here’s how:

- Pilot testing stablecoin settlements on real-world merchant transactions

- Deploying blockchain-backed clearing systems for faster cross-border payments

- Responding to margin pressures by eliminating intermediaries and reducing costs

What once took days now happens in seconds—with more speed, transparency, and lower fees.

This transformation is not driven by hype—it’s driven by UX demands and economic pressure. The shift is real, and it’s accelerating.

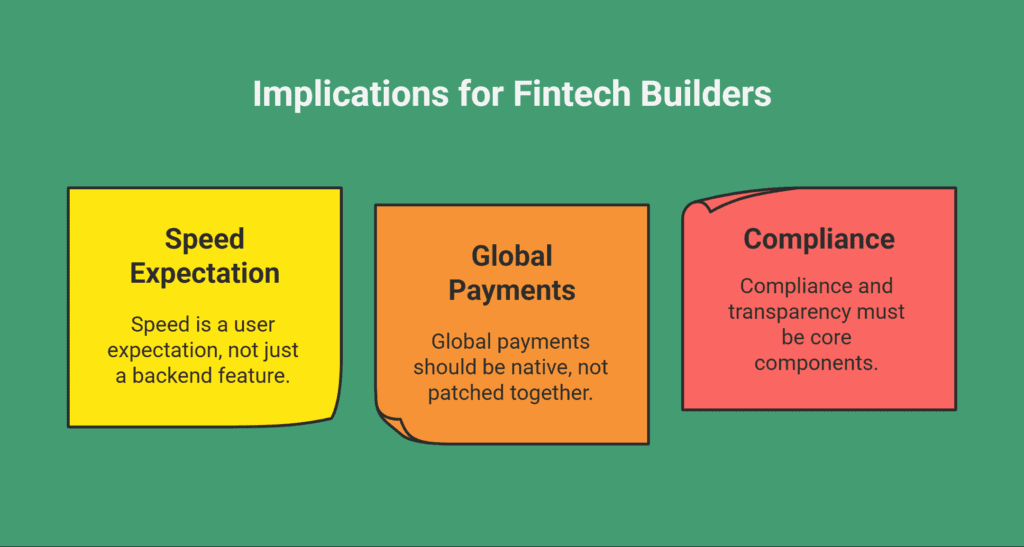

What This Means for Product Owners, CTOs, and Fintech Builders

If you’re building a SaaS platform, embedded finance product, or payment infrastructure, this trend has serious implications:

- Speed isn’t a backend feature—it’s a user expectation

- Global payments must be native, not patched together

- Compliance and transparency need to be core components of your architecture

Old rails weren’t built for digital-first ecosystems. Innovators who cling to outdated systems will soon hit scalability walls—while their competitors race ahead with faster, lighter, more compliant infrastructure.

Curious how these shifts are already reshaping the fintech landscape? Explore our original LinkedIn breakdown here.

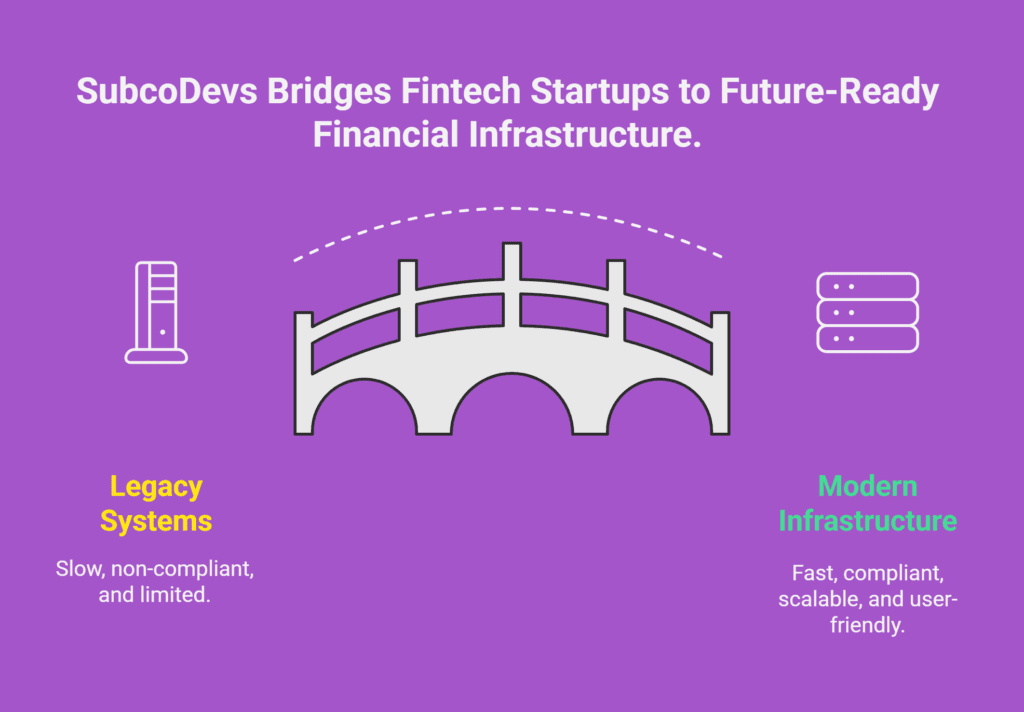

How SubcoDevs Builds Future-Ready Financial Infrastructure

At SubcoDevs, we help fintech startups and product teams translate these macro trends into high-performance platforms.

Our custom solutions are built for scale, speed, and compliance from day one:

✅ Seamless integration of modern payment APIs

✅ Full-stack development of multi-currency, multi-region flows

✅ Built-in regulatory readiness with real-time reconciliation

✅ Embedded finance systems: wallets, payouts, and remittances

Whether you’re launching your first fintech MVP or modernizing legacy systems, we turn complex payment architecture into simple, scalable, user-friendly systems.

What Visa & Mastercard Are Teaching Us

This is more than a pivot by two industry giants—it’s a signal. A playbook. A warning.

💡 Move before you’re forced to

💡 Design payments as a core part of your UX—not an afterthought

💡 Build for global scalability, automation, and regulatory resilience

The infrastructure of finance is changing—and those who adapt now will own the next decade of digital money movement.

Let’s Build Smarter Fintech Together

At SubcoDevs, we engineer Stripe-grade, Airwallex-style financial infrastructure that’s ready for the new digital economy.

👉 Book your free consultation now to future-proof your fintech stack.