Discover how Aspire and Stripe are transforming payment systems for SMEs across the APAC region.

Business payments in Asia just got a speed upgrade.

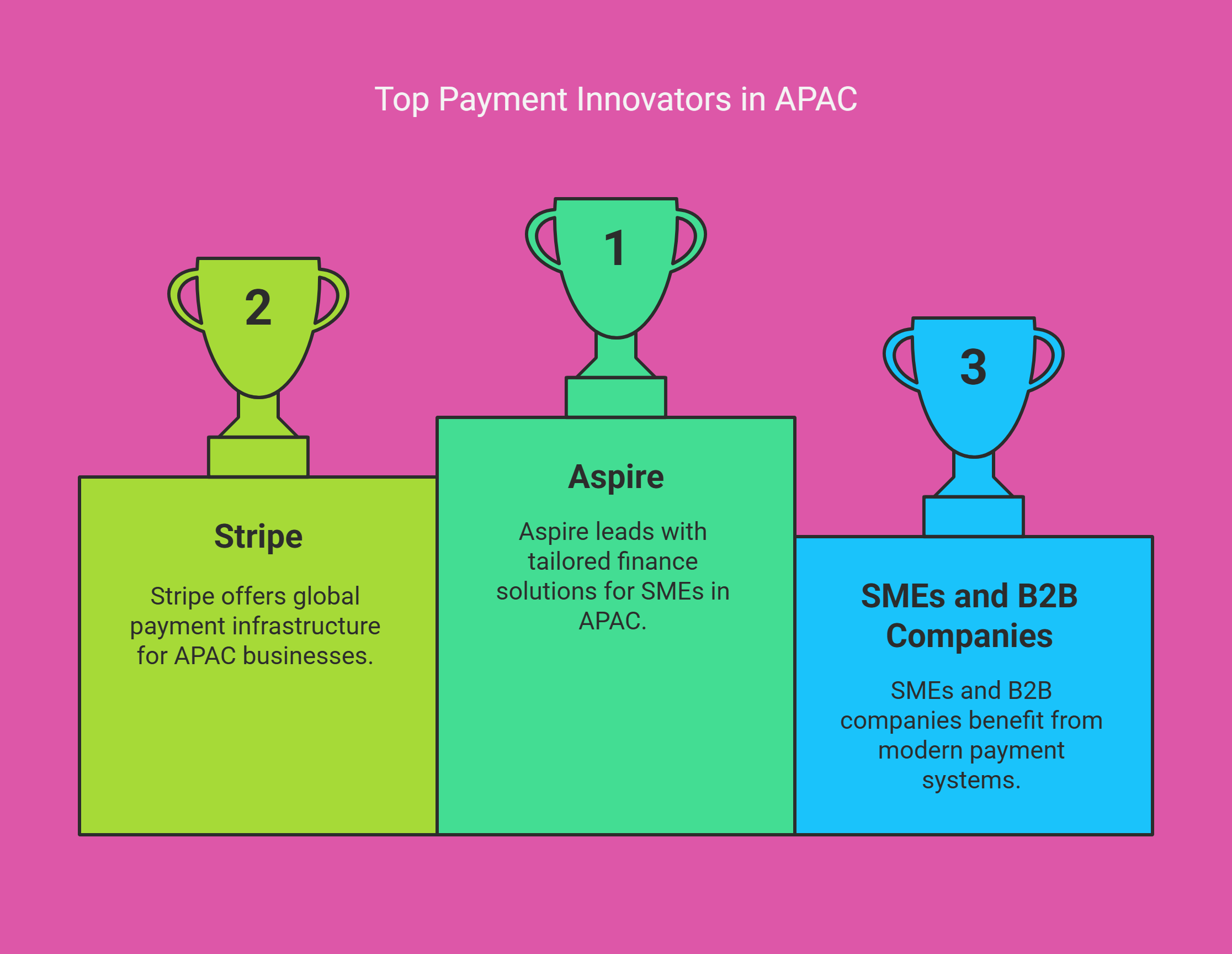

Thanks to a game-changing partnership between Aspire, a leading Singapore-based finance platform, and Stripe, global businesses across the APAC region can now access a faster, more flexible, and more modern payment infrastructure—tailored especially for SMEs and B2B companies.

This isn’t just a feature update. It’s a strategic evolution for businesses tired of outdated banking rails, slow settlements, and limited payment options.

Why Aspire Stripe B2B Payments Are a Game-Changer for APAC Businesses

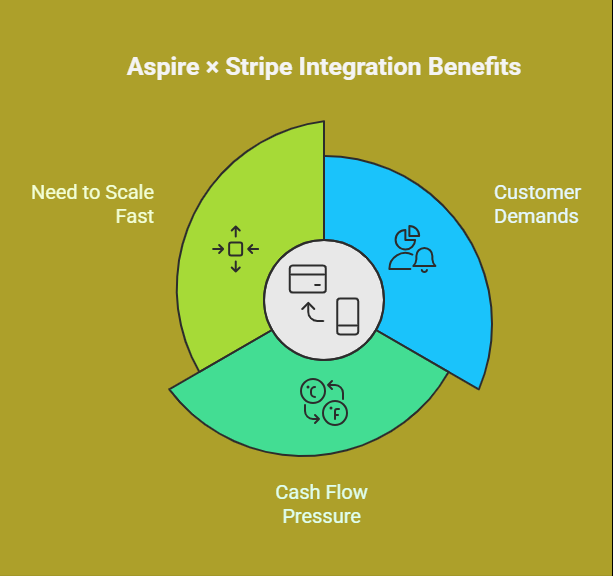

Aspire × Stripe is more than just tech—it’s an operational advantage. If you’re a finance lead, founder, or product manager in the APAC region, you’re likely juggling customer demands, cash flow pressure, and the need to scale fast.

This integration addresses all of that with four powerful benefits:

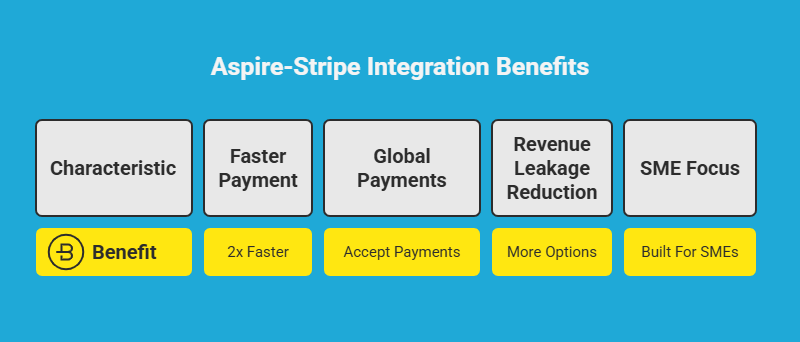

✅ Get Paid 2× Faster

With Stripe’s settlement speed, Aspire users can now receive funds in just 3 days instead of 7, giving you faster access to working capital and improving cash flow cycles dramatically.

(Source: aspireapp.com, crowdfundinsider.com)

✅ Accept Global Payments—No Website Needed

Whether you operate via WhatsApp, email, or just invoices, you can now send secure payment links and collect payments instantly from cards and regional wallets like Apple Pay, Google Pay, GrabPay, and WeChat Pay.

(Source: aspireapp.com, digitalcfoasia.com)

✅ Reduce Revenue Leakage with More Payment Options

Don’t accept cards? You could be losing up to 4.6% of potential revenue. This integration ensures your business meets customer expectations with modern, mobile-first payment choices.

(Source: aspireapp.com)

✅ Built for the 97% of APAC Businesses That Are SMEs

Most B2B platforms cater to enterprises—but this one doesn’t. Aspire and Stripe bring enterprise-grade fintech power to small and medium-sized businesses, without the enterprise complexity.

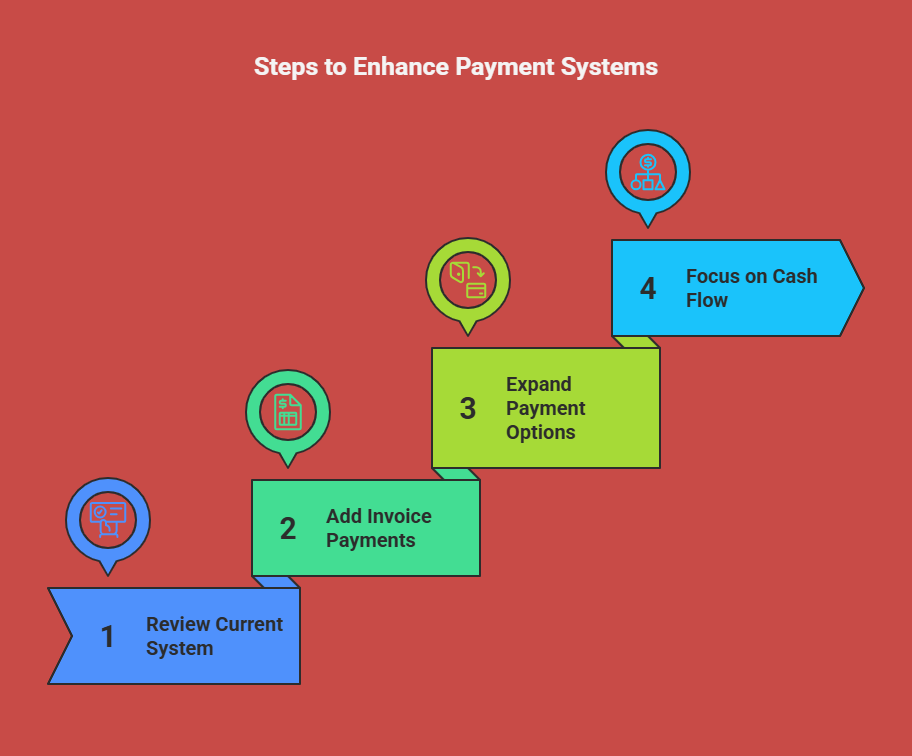

Next Steps to Leverage Aspire Stripe B2B Payments Effectively

Here’s a checklist for businesses that want to stay competitive:

- Review your current payment system – Are you stuck with long settlement cycles?

- Add invoice and link-based payments – This is now a baseline expectation.

- Expand payment options – Meet your customers where they are, with wallets they already use.

- Focus on cash flow – Faster payments mean faster reinvestment into growth and operations.

👉 Want deeper insights on how this integration is redefining B2B fintech in Asia?

Read our detailed breakdown on LinkedIn here.

How SubcoDevs Can Help You Stay Ahead

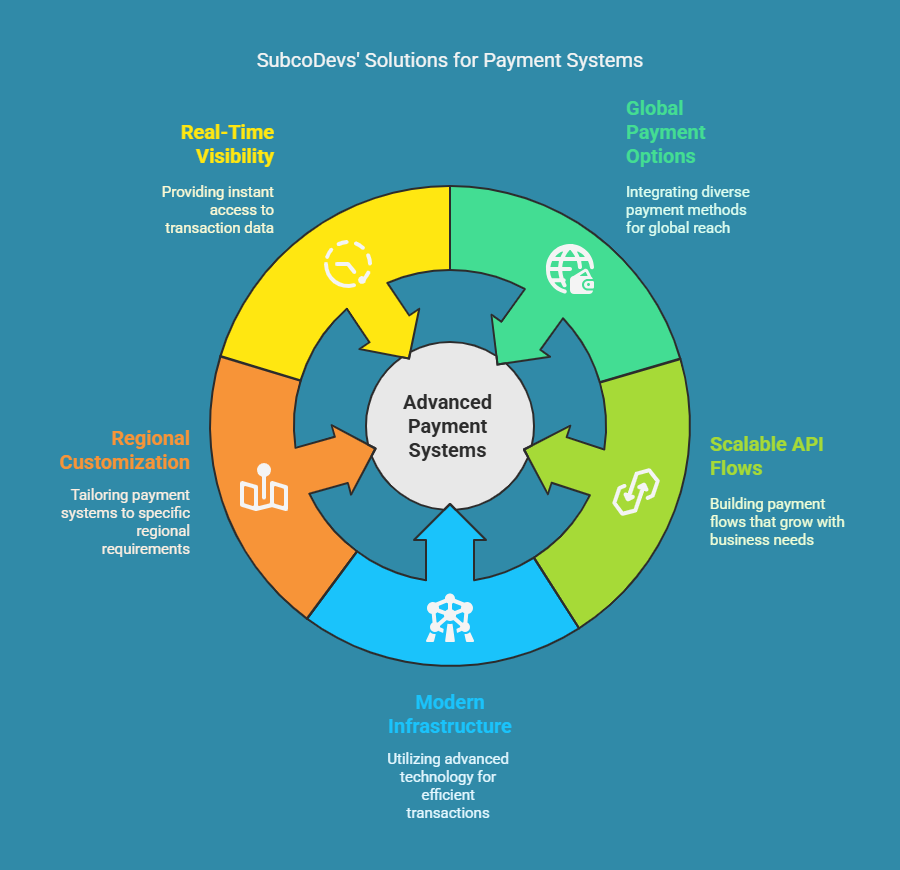

At SubcoDevs, we build smart, scalable, and localized payment systems that leverage industry leaders like Aspire and Stripe.

Whether you’re upgrading an old system or launching a new digital product, our engineering teams help you:

- Integrate global payment options (cards + wallets)

- Build API-based payment flows that scale

- Reduce settlement delays with modern infrastructure

- Customize checkout for specific regional needs

- Ensure real-time visibility and reporting

📩 Looking to modernize your payment stack?

Want to integrate multiple digital wallets in one flow?

Curious how Stripe + Aspire could fit your business?

Let’s talk.

Final Thought from Our CTO’s Desk

Fintech infrastructure is evolving—and fast.

The Aspire × Stripe integration is not a luxury add-on. It’s a competitive requirement for B2B companies operating in Asia today. If you’re still relying on manual invoicing and week-long settlements, you’re not just lagging—you’re leaking revenue and efficiency.

We’re here to help you catch up—and stay ahead.

👉 Book a free strategy session with SubcoDevs.