In 2025, the way we move money is changing—fast.

With the rise of stablecoins and embedded crypto infrastructure, the boundaries of what’s possible in global payments are expanding rapidly. At the center of this momentum is Stripe, making bold moves that signal stablecoins are no longer a fringe innovation—they’re becoming the financial rails of the future.

As businesses worldwide push for faster, more affordable, and borderless payment systems, Stripe’s evolving crypto roadmap is becoming a blueprint for how to stay competitive in the digital economy.

🔍 Stripe’s Strategic Crypto Moves in Stablecoins and Global Payments

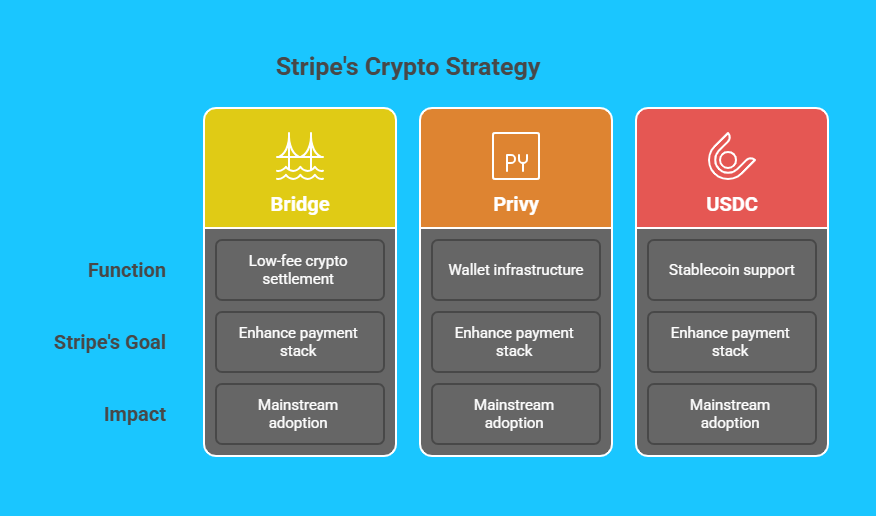

Stripe isn’t experimenting—it’s executing.

After acquiring Bridge (a low-fee crypto settlement platform) and Privy (a wallet infrastructure startup), and reintroducing support for USDC, Stripe is building a comprehensive crypto-powered payments stack. This isn’t just about Web3—this is about mainstream adoption.

Recent data from Bitwise and Coin Metrics shows that stablecoins processed over $27.6 trillion in Q1 2025—outpacing Visa’s entire 2023 transaction volume. That’s not a trend. That’s a transformation.

And Stripe’s moves validate the belief that digital dollars and on-chain settlements could be the future standard for B2B, B2C, and peer-to-peer transactions alike.

🚀 Why Stablecoins in Global Payments Matter to Developers and Product Teams

✅ Stablecoins in Global Payments Are Now Core Financial Infrastructure

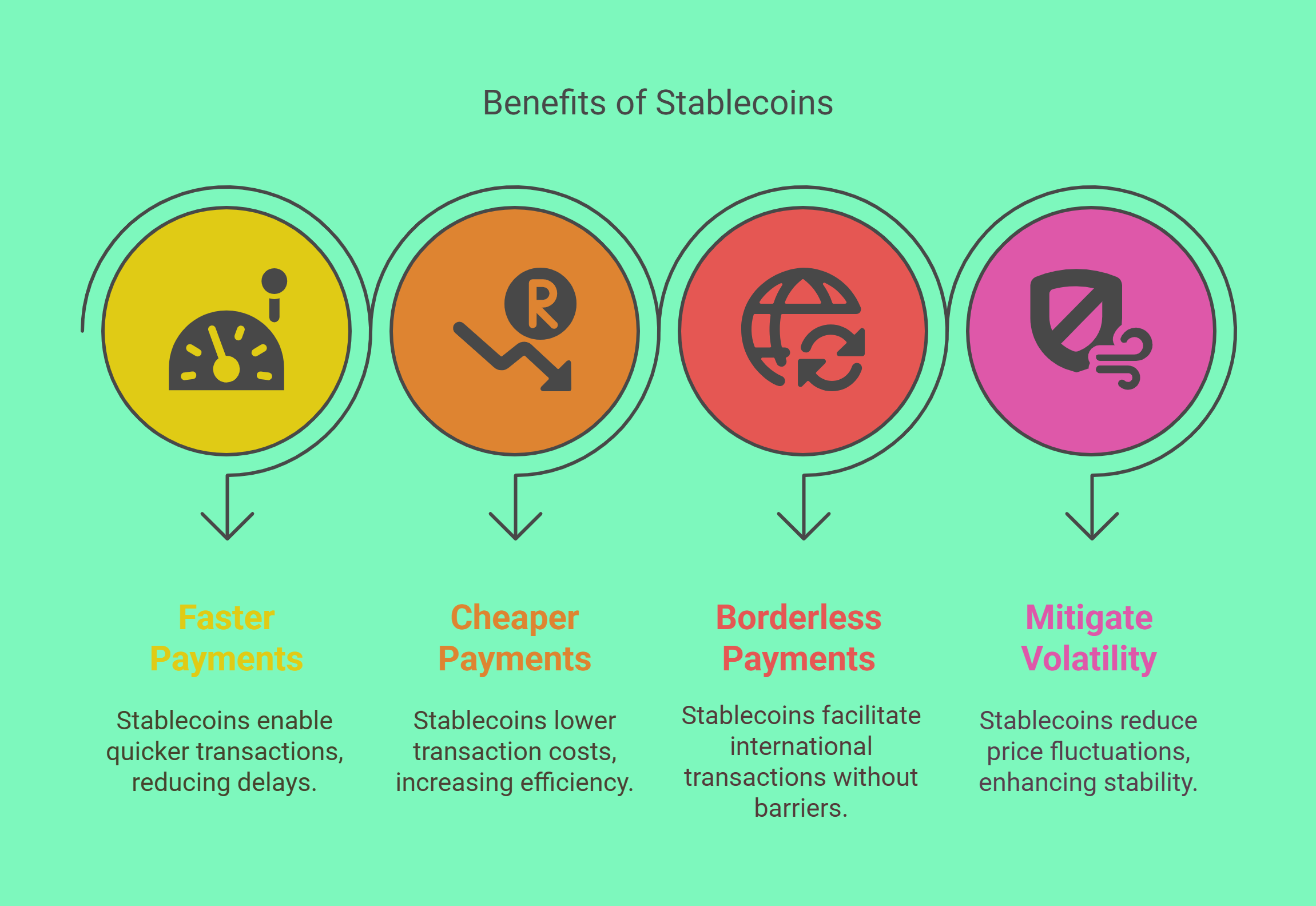

Stripe’s adoption of USDC is a strong indicator that stablecoins are now integral to serious, scalable payment systems—not just crypto-native platforms.

From eCommerce platforms to SaaS tools, stablecoins can now power faster, cheaper, and borderless payments with seamless integration.

They also mitigate volatility concerns often associated with traditional cryptocurrencies, making them business-friendly and user-trustworthy.

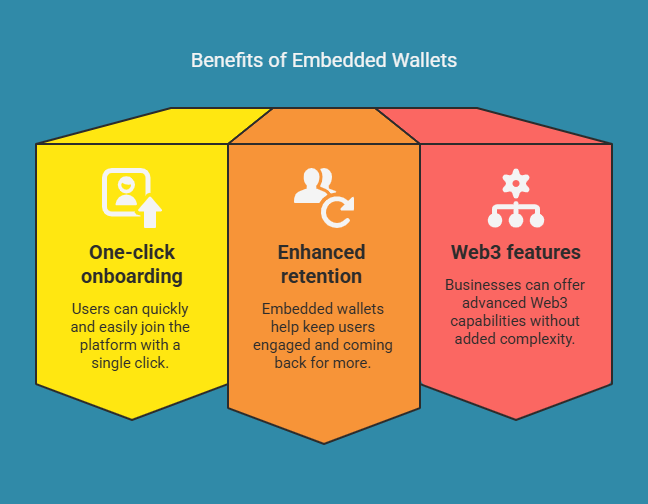

✅ Embedded Wallets for Frictionless User Journeys

Thanks to Privy, Stripe is enabling businesses to embed crypto wallets directly into their platforms, allowing users to sign in, authenticate, and transact—without ever leaving the app.

This kind of integration opens doors for:

- One-click onboarding

- Enhanced retention

- Web3 features without complexity

It’s a win-win for businesses that want to offer a modern experience without sacrificing user trust or ease of use.

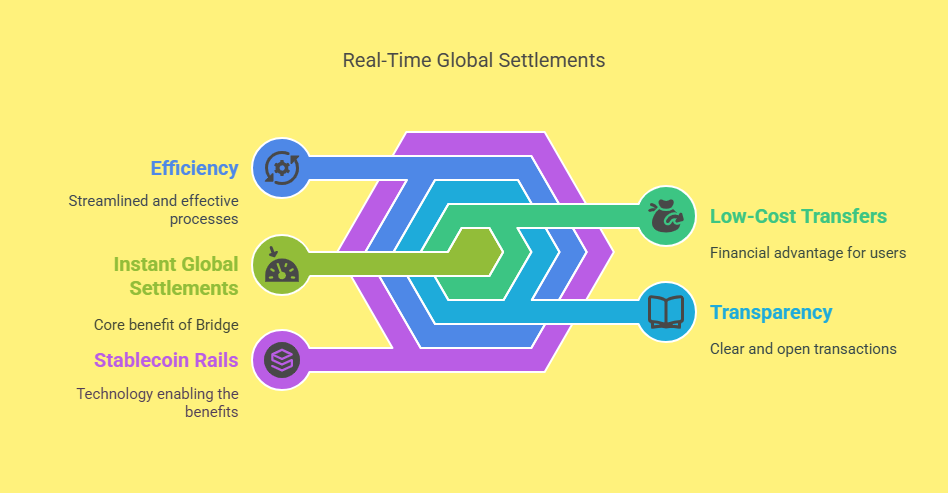

✅ Real-Time Global Settlements

Bridge enables instant, low-cost cross-border transfers, perfect for businesses expanding internationally or serving remote teams and customers.

Compared to legacy systems with settlement times spanning days and riddled with hidden fees, stablecoin rails offer transparency, speed, and efficiency—especially valuable in emerging markets and high-volume ecosystems.

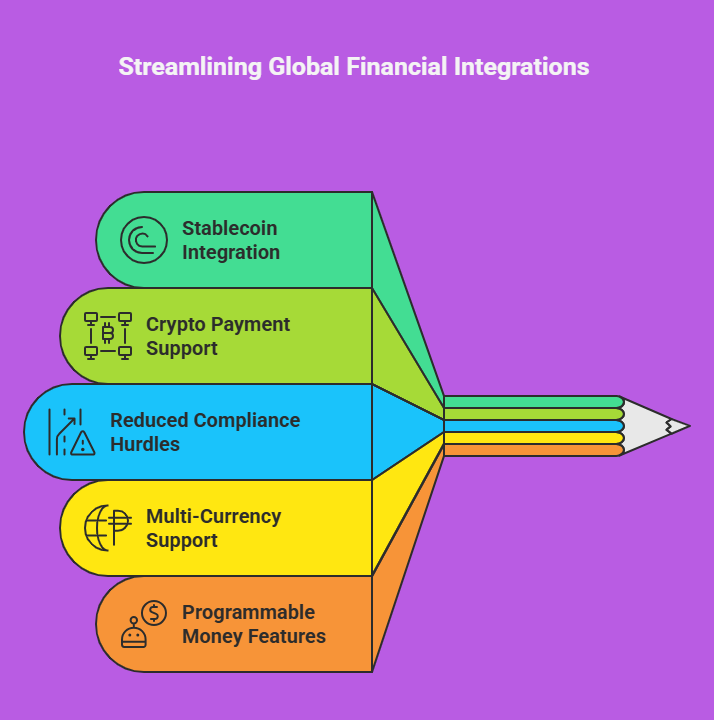

✅ Developer-Friendly APIs

Stripe’s powerful APIs now support stablecoin and crypto payment integrations, reducing time-to-market for any team wanting to go global—without traditional banking delays.

This makes it easier for developers to:

- Integrate digital payments with fewer compliance hurdles

- Offer multi-currency support (USD, USDC, and more)

Leverage programmable money features like smart contracts and automation

💡 Want a deeper dive into Stripe’s crypto momentum?

👉 Check out the original LinkedIn article here to see why the fintech industry sees this as a pivotal moment for digital payments.

🌎 Stablecoins Are Going Mainstream—Are You Ready?

Stripe isn’t alone. Visa, PayPal, and SWIFT are also rolling out native stablecoin features. Financial regulators are drafting stablecoin guidelines. And startups across the globe are building their stacks with stablecoin rails—not traditional banks.

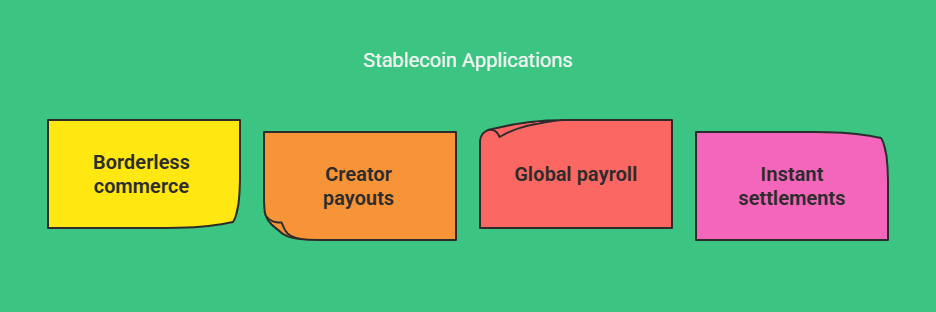

Stablecoins are rapidly becoming the financial language of the internet, especially for:

- Borderless digital commerce

- Creator and gig economy payouts

- Global team payroll systems

- Instant B2B settlements

For businesses targeting underbanked markets, digital-native customers, or real-time global transactions, this shift is a golden opportunity to get ahead.

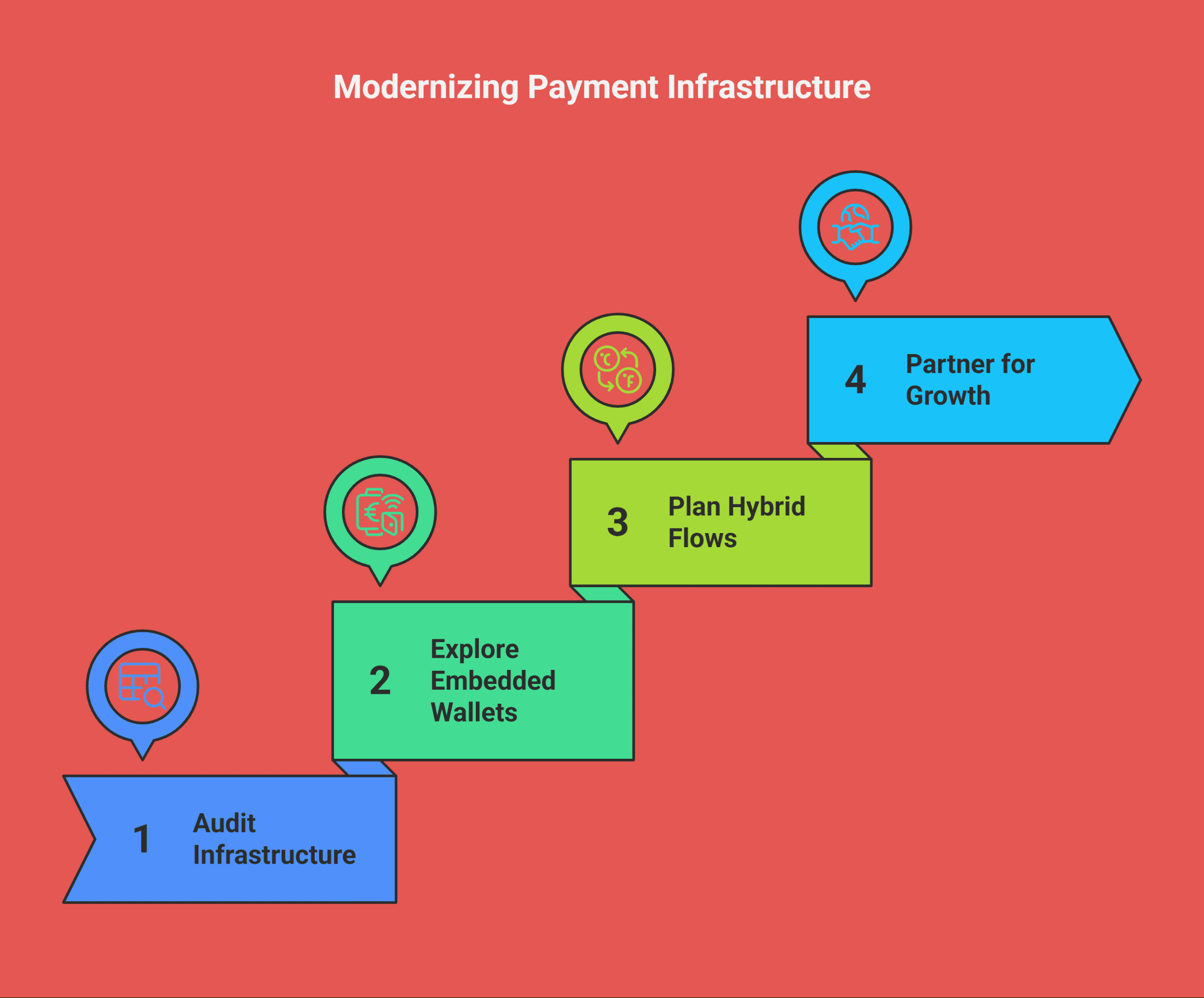

✅ What You Should Do Now

- Audit your current payment infrastructure—can it scale globally?

- Explore embedded wallets to improve conversion and retention.

- Plan for hybrid payment flows with both fiat and crypto options.

- Talk to a partner who can help you move fast and build smart.

Not modernizing your payment infrastructure in 2025 is like ignoring mobile in 2015—it’s a risk you can’t afford.

🤝 How SubcoDevs Can Help

At SubcoDevs, we help startups and enterprises modernize their payment systems with secure, scalable, crypto-ready solutions:

– Embedded wallets for seamless user experiences

– Stablecoin and fiat hybrid payment systems

– Stripe-compatible cross-border payment flows

We understand how to navigate the evolving crypto-fintech landscape—from compliance to user experience—so you can focus on scaling your business.

Whether you’re building from scratch or upgrading your legacy stack, we bring speed, security, and strategy to your fintech ambitions.

💬 Let’s Build the Future of Payments

Need help integrating stablecoins or embedded wallets into your platform?

👉 Talk to us today and start building the next generation of global payments.