The future of payments isn’t coming—it’s already here.

As digital ecosystems evolve, payment gateways are no longer just transaction bridges—they’re business accelerators. From enabling instant checkout experiences to unlocking global subscriptions, they’re reshaping how modern businesses earn, grow, and scale.

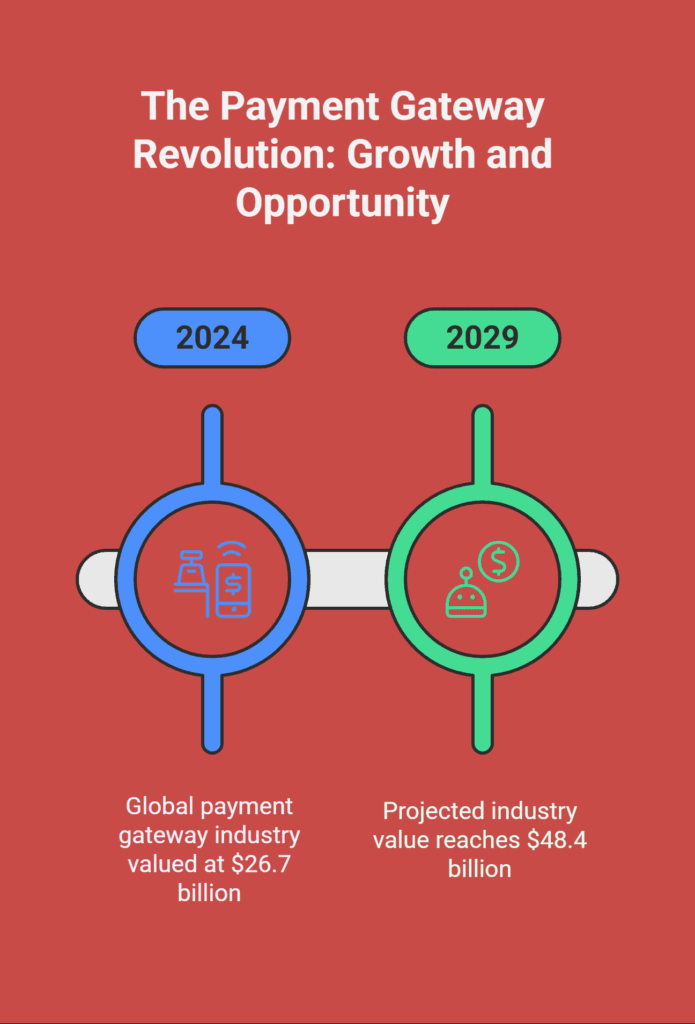

📈 According to MarketsandMarkets, the global payment gateway industry is projected to leap from $26.7 billion in 2024 to $48.4 billion by 2029—a staggering 12.6% CAGR. This is more than growth—it’s a paradigm shift in how companies monetize digitally.

For founders, product teams, and digital-first companies, this marks a now-or-never opportunity: either adapt and ride the wave—or fall behind the curve.

⚡ Want a quick deep dive? Check out our full LinkedIn article breaking down the $48B+ opportunity

Why Scalable Payment Gateways Spark a Global Payment Revolution

Behind the numbers lies a powerful truth: your payment stack is your silent growth engine. And right now, it’s time to upgrade from just “processing” to “performing.”

🔄 The Subscription Boom Is Rewriting Revenue Models

Monthly memberships. Auto-renewing services. On-demand access.

Subscription-based businesses are becoming the norm—not the niche. And they demand more than static billing. They require dynamic systems with smart proration, retry logic, churn prevention, and actionable analytics.

A seamless recurring experience builds trust—and trust drives retention. The more intelligently your payment gateway handles these touchpoints, the higher your LTV (lifetime value).

Use Case:

A fitness app offering flexible monthly/yearly billing uses smart dunning flows to recover failed payments—reducing churn by 18% without lifting a finger.

📱 Mobile & Hosted Gateways Are the New Checkout Standard

Clunky payment flows are dead.

Today’s users expect one-tap, branded, secure checkouts—especially on mobile. Hosted gateways (like Stripe Checkout, Razorpay Smart Collect, or Paystack Pop) deliver seamless UX while slashing dev time, security risks, and drop-offs.

Speed, familiarity, and trust are the trifecta for high-converting checkouts—and hosted solutions nail all three.

Stat Boost:

Businesses using branded hosted checkouts see up to 35% higher mobile conversions than those using generic or iframe-based flows.

APAC Is Leading the Global Payment Charge

While Western markets mature, Asia-Pacific is exploding with digital wallet adoption, UPI growth, and mobile-first commerce.

From India’s Paytm to Indonesia’s GoPay and China’s WeChat Pay, regional solutions are winning trust and market share. Businesses that integrate localized payment rails can scale faster and penetrate untapped customer bases with ease.

Pro Tip:

Adding country-specific methods like UPI (India) or FPS (Hong Kong) isn’t just a feature—it’s a trust signal for users who prefer native solutions.

What This Means for Your Business Right Now

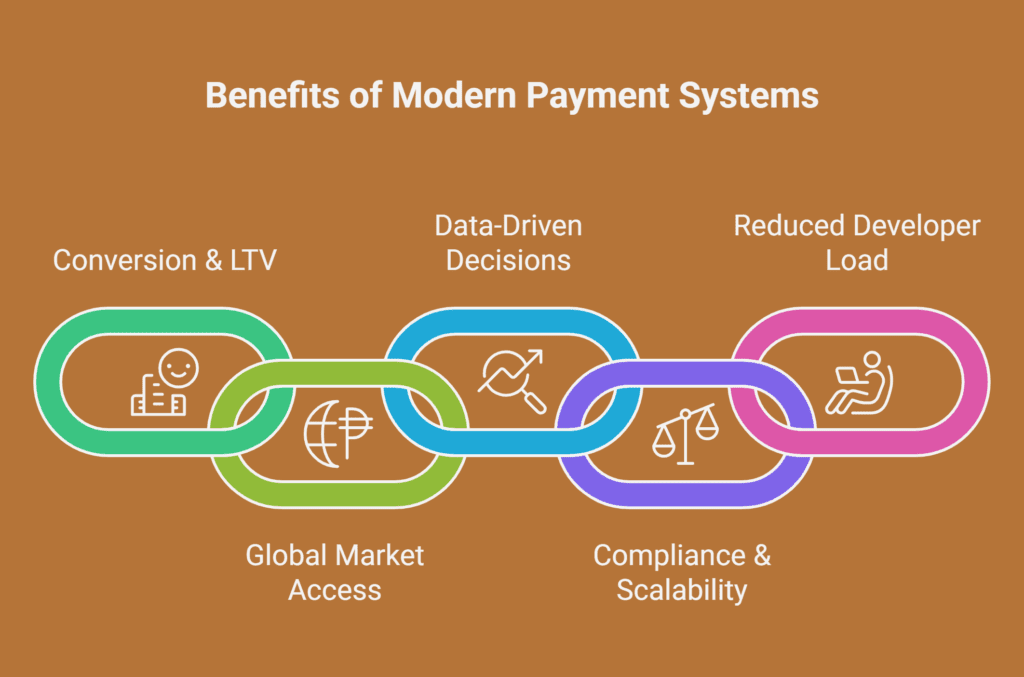

Here’s the reality: outdated payment systems cost you conversions, cash flow, and customer trust. But smart payment stacks do the opposite. Businesses that adopt scalable payment gateways see better retention, faster global scaling, and fewer drop-offs across mobile and web platforms.

With the right gateway, you can:

✅ Boost conversions & LTV with one-click checkouts, subscriptions, and wallet options

✅ Break into global markets by supporting local currencies, banks, and mobile payments

✅ Make smarter decisions with analytics that reveal churn patterns, drop-off points, and upsell windows

✅ Stay compliant and scalable with turnkey hosted flows and API flexibility

✅ Reduce developer load by using prebuilt UIs, secure tokenization, and ready-made integrations

In other words: if your payment gateway isn’t evolving, neither is your business.

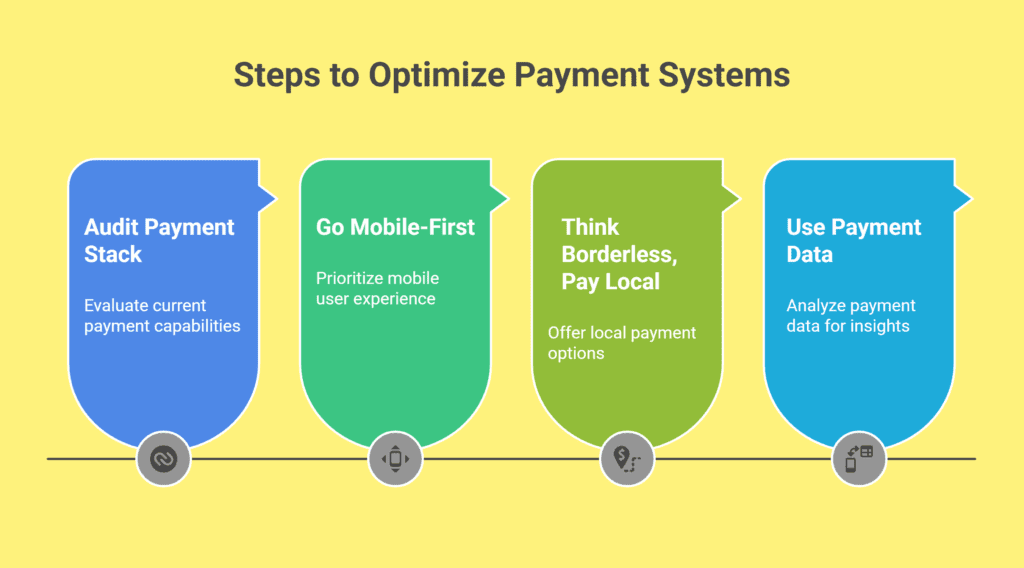

Your Next Steps: What to Fix Before You Scale

Modern payments aren’t just about “working”—they’re about working smarter, faster, and more globally.

1. Audit Your Payment Stack

Are you equipped to support subscriptions? Crypto? Wallets? Local payment rails? If you’re unsure, you’re likely behind.

Even top-tier apps lose millions from simple oversights—like not supporting retry logic for failed cards or missing regional options.

2. Go Mobile-First—Now

Over 70% of eCommerce happens on mobile, yet many checkout experiences still prioritize desktop. Prioritize UX that feels native, loads lightning fast, and supports local wallets and quick-pay options.

3. Think Borderless, Pay Local

Going global? Think local. Accept payments in the currency, method, and language your customers prefer. This lowers bounce rates and increases purchase confidence—especially in emerging markets.

4. Use Your Payment Data Like a Product Team

Why are users dropping off during payment? What subscription plan has the highest retention? When do most downgrades happen?

These answers aren’t found in Google Analytics—they’re in your payment system.

Integrate dashboards or third-party tools to make this intelligence part of your decision-making workflow.

🤝How SubcoDevs Builds Scalable Payment Gateways That Drive Growth

At SubcoDevs, we don’t just integrate gateways—we build high-performance payment ecosystems tailored to your scale-up journey.

Here’s how we help you win:

🔹 Recurring Billing Engines: From freemium upgrades to annual renewals, we handle subscription logic that drives retention.

🔹 Hosted & API Gateways: Custom-designed checkout flows that are fast, frictionless, and fully branded.

🔹 Global Payment Rails: Accept payments in any currency, via local wallets, cards, or even crypto.

🔹 Real-Time Analytics: Get dashboards that tell you more than “money in”—they reveal user behavior, drop-offs, and ARPU growth.

🔹 Custom Payment Architecture: Whether you’re bootstrapping or enterprise-ready, we build stacks that flex with your roadmap.

🔹 Compliance & Security: We ensure PCI-DSS and GDPR compliance with built-in security at every layer.

Curious where your current setup is leaking revenue? Let us audit your gateway—on the house.

The Time to Upgrade Is Now

The global payment landscape is evolving at lightspeed. Businesses that win are those who treat payments like a product, not just a backend process.

Your payment system is where conversion happens. Where trust is built. Where retention begins.

If you’re still stuck with legacy flows, limited methods, or underused analytics—you’re not just missing payments. You’re missing opportunity.

📩 SubcoDevs helps companies implement scalable payment gateways that grow with their user base. Let’s talk about building your next-gen payment stack

👉 Or read our full breakdown on LinkedIn to explore this transformation in greater depth.

💳 $48.4B and rising—your growth depends on how you charge for it. Let’s build smarter, scale faster, and monetize better.