AI Has Moved From Buzzword to Payments Performance

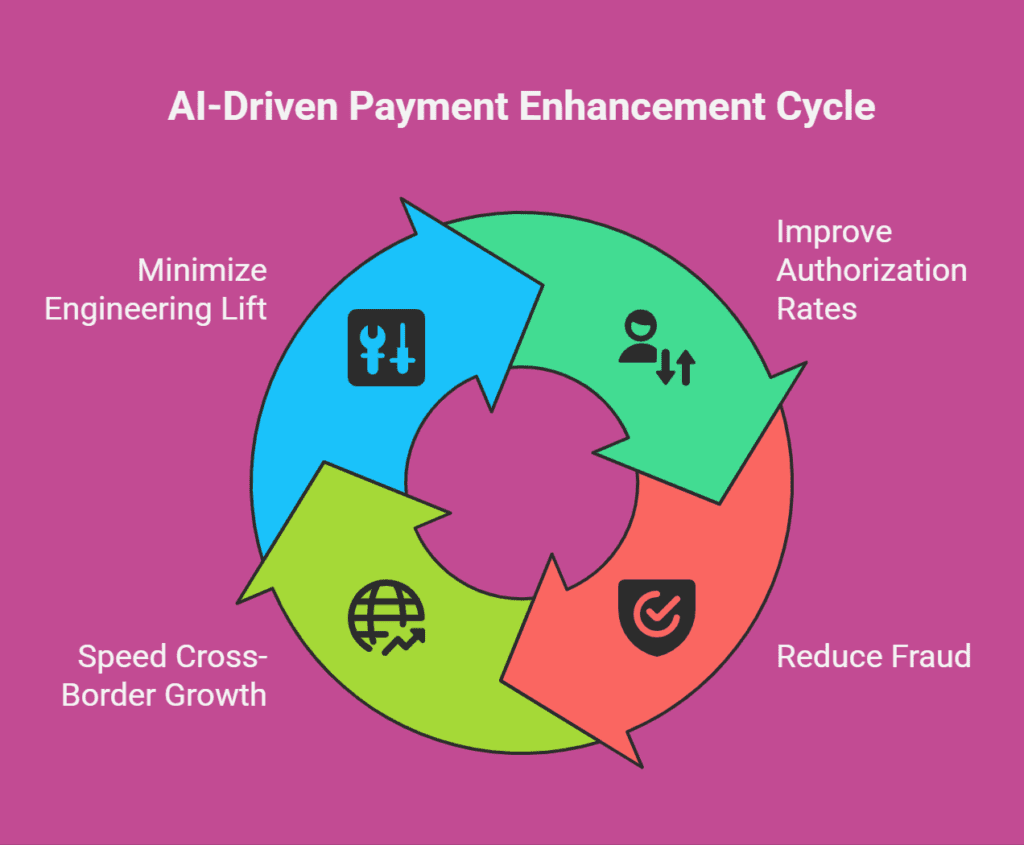

AI isn’t just writing emails anymore—it’s lifting authorization rates, reducing fraud, and speeding cross‑border growth for companies on Stripe. As FinTech Magazine notes, AI‑powered payments are now a growth lever, not a science project

💡 TL;DR: Stripe’s AI improves approvals, blocks more bad actors, and helps you expand globally—with minimal engineering lift

What the Latest Data Shows (Verified)

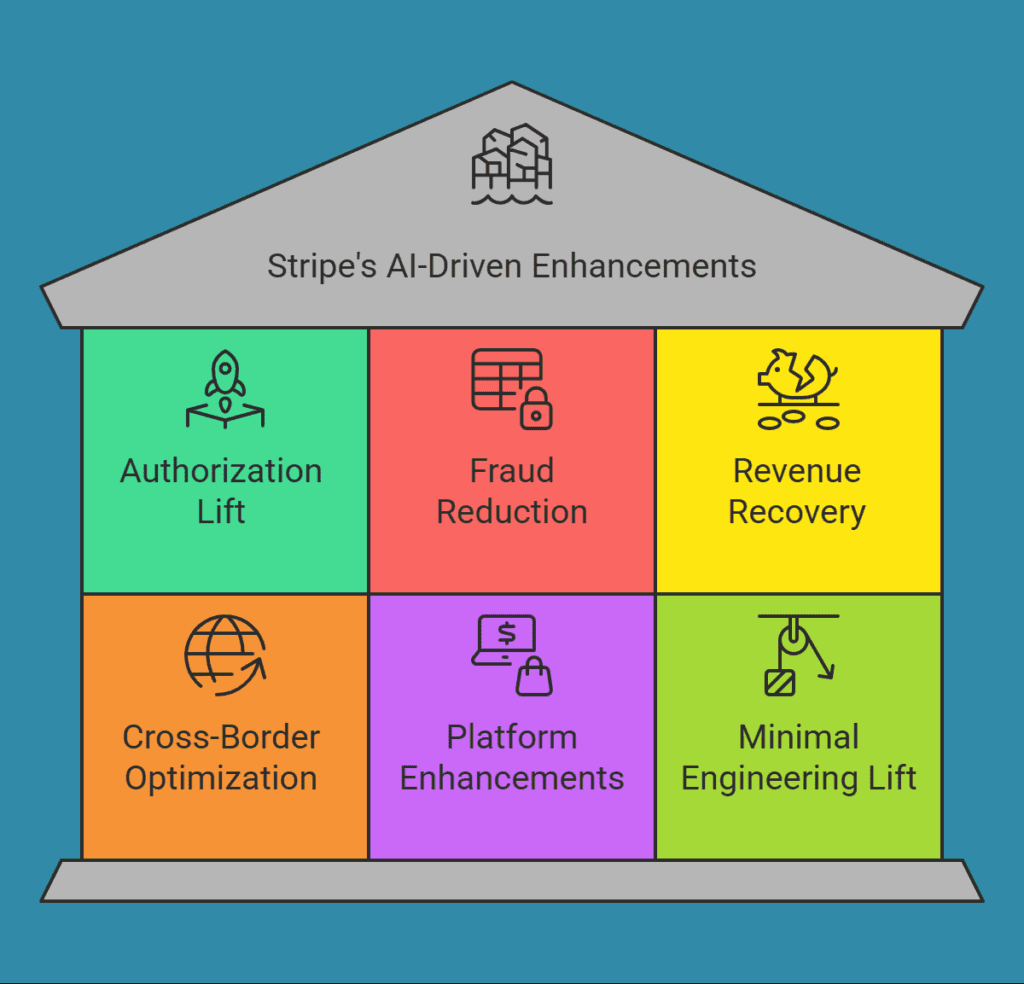

- Authorization Lift

Stripe’s Adaptive Acceptance increases authorization rates by ~2.2% on average, with some enterprises (e.g., Hertz) seeing ~4% uplift. - Fraud Reduction

Stripe Radar blocks 95%+ of card‑testing attacks in real time. Over BFCM 2024, Stripe reported blocking 20.9M fraudulent attempts worth $917M. Their AI models reduce fraud by ~38% on average. - Revenue Recovery

Smart Retries recover ~57% of failed recurring payments. Adaptive Acceptance reclaimed $6B in false declines in 2024 (~60% YoY increase). - Cross‑Border Optimization

Now active in ~50 countries, Stripe’s AI improves routing, SCA exemptions, currency handling, and local method fit—boosting international approval rates. - Platform Enhancements

Radar for Platforms gives account‑level fraud controls for marketplaces and SaaS platforms.

Minimal Engineering Lift

Most upgrades (like Radar, Adaptive Acceptance) require no additional integration for existing Stripe users

Context & Caveats (Read This)

- Dispute Reduction Metrics

Stripe offers Smart Disputes and partners like Chargeflow for auto-responses. However, global dispute-rate data isn’t consistently published—treat public % claims cautiously. - Regional Reality Check

While AI reduces friction, risk varies. For example, LATAM has higher reported fraud rates than North America. Pair AI tools with local payment methods and fraud rules per region.

What This Means for Founders & E‑Commerce Leaders

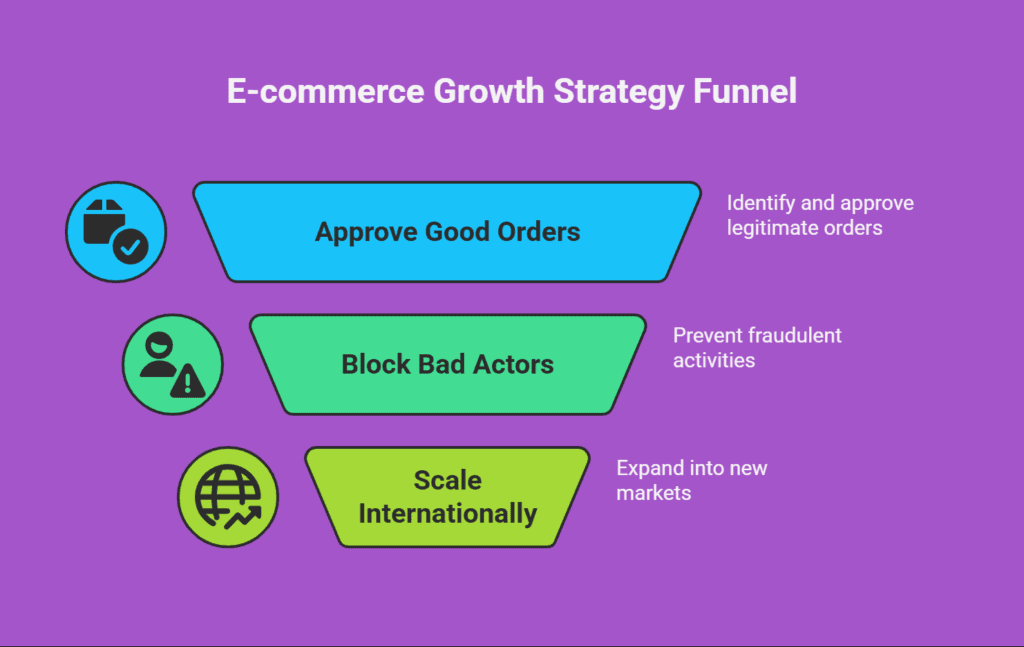

- Approve More Good Orders

Use Adaptive Acceptance to cut false declines—especially on mobile and paid traffic. - Block More Bad Actors

Radar’s card-testing defenses help preserve both your approval rate and your brand. - Scale Internationally with Confidence

Combine AI routing/risk tools with local wallets and acquirers for each target market.

Quick Wins We Implement for Clients (Stripe‑First)

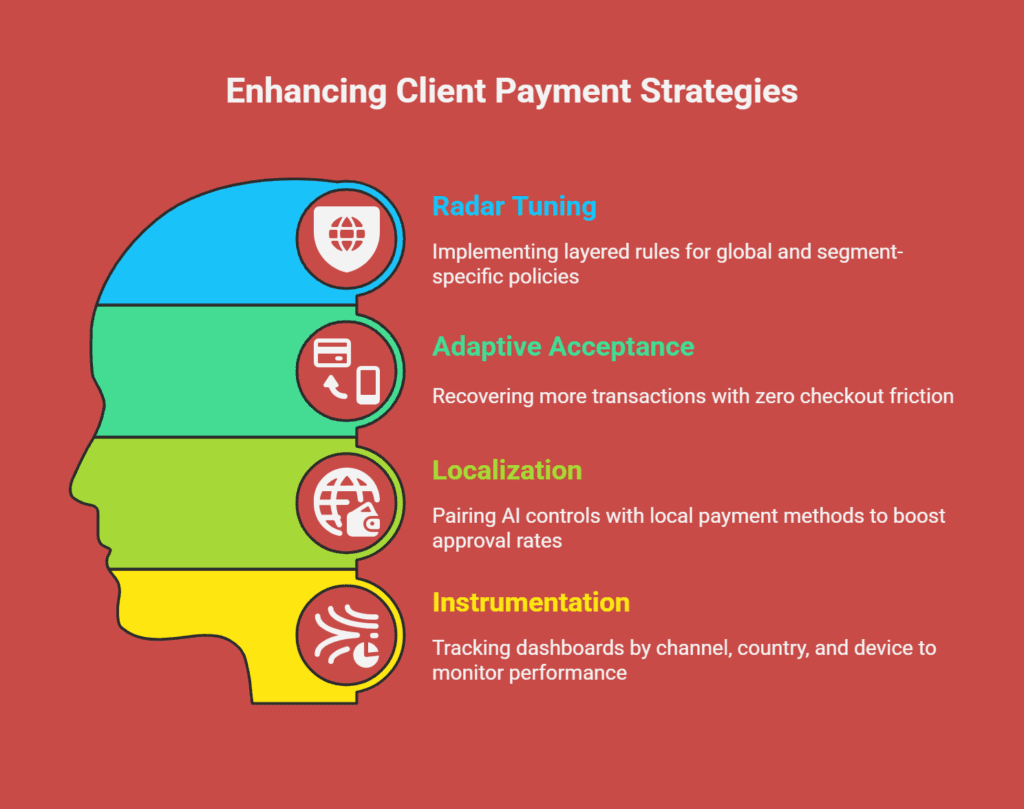

- Turn On & Tune Radar

Use layered rules for global + segment-specific policies (e.g., high-risk SKUs, new buyers). Add review queues and alerts. - Ship Adaptive Acceptance + Smart Retries

Recover more transactions with zero checkout friction. Track improvements by issuer, device, and region. - Localize Methods & Routing

Pair AI controls with local payment methods + SCA exemptions to boost approval rates.

Instrument the Loop

Track dashboards by channel, country, and device—covering auth lift, fraud rates, disputes, and recovery

Bottom Line

AI has officially crossed the chasm in payments.

Companies using Stripe’s Adaptive Acceptance, Radar, and Smart Retries are now seeing:

- Cleaner approvals

- Fewer fraudulent attempts

- Measurable revenue lift

—all with minimal engineering work.

Want to activate this in your stack next quarter (not next year)?

👉Book a 20‑minute Stripe audit with SubcoDevs. We’ll highlight the three highest‑ROI fixes for your checkout and payout