Introduction

Imagine this: a customer is ready to buy, cart full, intent clear — and then, the payment fails. They try again. Still no luck. Frustrated, they abandon the purchase. Now multiply that across hundreds or thousands of visitors a month. That’s lost revenue, lost trust, and lost opportunity.

At SubcoDevs, we’ve helped clients recover up to 30% of lost revenue by optimizing their payment flows. This guide explores the top 25 reasons credit card payments fail and what you can do to fix them, whether you’re using Stripe, Square, or another payment gateway.

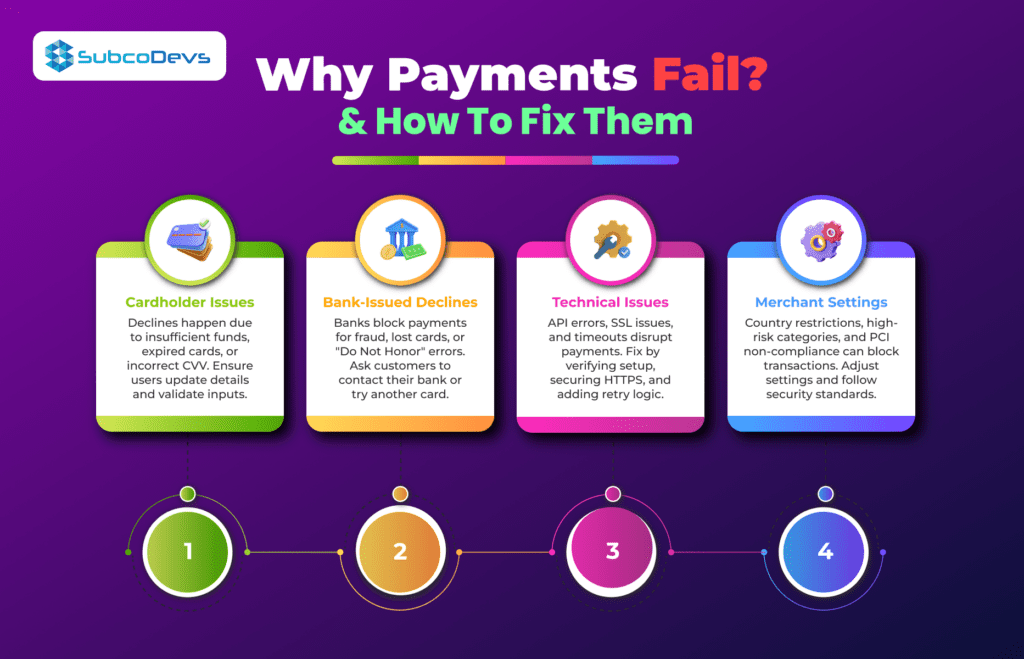

Cardholder-Related Issues

1. Insufficient Funds

Cause: The customer doesn’t have enough money in their account.

Fix: Suggest the user try again later or use a different payment method.

2. Card Expired

Cause: The card has passed its expiry date.

Fix: Prompt the customer to update their card details.

3. Incorrect Card Number

Cause: Typing errors while entering the card.

Fix: Use real-time validation to alert users as they type.

4. Wrong CVV or Expiration Date

Cause: Mistyped security code or expiry.

Fix: Highlight input errors clearly during the transaction.

5. Maxed Out Credit Limit

Cause: Customer has hit their credit card limit.

Fix: Suggest using another card or retrying after payment is made.

6. Blocked for Suspicious Activity

Cause: Card issuer flagged the transaction.

Fix: Ask customer to contact their bank and whitelist your site.

7. Card Not Supported for Online Use

Cause: Some debit cards can’t be used online.

Fix: Inform the customer and offer alternative payment options.

8. Card Restricted to Domestic Use

Cause: Card only works in the issuing country.

Fix: Recommend enabling international payments or using another method.

Issuer/Bank-Related Issues

1. Do Not Honor

Cause: Generic decline from bank.

Fix: Suggest contacting the bank to understand the issue.

2. Lost or Stolen Card

Cause: Bank has deactivated the card.

Fix: Inform user their card may be compromised.

3. Fraud Rules Triggered

Cause: Card issuer’s AI flagged it.

Fix: Recommend alternate card and inform the customer.

4. 3D Secure Authentication Failure

Cause: Customer failed authentication.

Fix: Allow retry and show step-by-step guidance.

5. Address Verification (AVS) Mismatch

Cause: Billing address doesn’t match card records.

Fix: Ask customer to double-check their billing details.

Technical/Integration Issues

1. Payment Gateway Timeout

Cause: Server or API timeout.

Fix: Use retry logic and monitor logs.

2. Incorrect API Keys

Cause: Misconfiguration in payment gateway setup.

Fix: Ensure API keys and environment (test/live) are correctly set.

3. SSL Certificate Error

Cause: Insecure site connection.

Fix: Ensure all payment pages are HTTPS secured.

4. Incorrect Currency Format

Cause: Currency mismatch or incorrect decimal placement.

Fix: Validate and format amounts correctly.

5. JavaScript Errors on Payment Page

Cause: Broken scripts preventing token generation.

Fix: Debug the frontend and ensure Stripe.js loads correctly.

Merchant-Side Settings

1. Restricted Countries in Stripe Settings

Cause: Some countries might be blocked.

Fix: Review Stripe dashboard country settings.

2. Minimum/Maximum Payment Amounts Set

Cause: Configured limits on transaction values.

Fix: Adjust limits or inform the customer of restrictions.

3. Incorrect Webhook Configuration

Cause: Payment status not syncing.

Fix: Test and verify your webhook endpoint.

4. High-Risk Merchant Category Code (MCC)

Cause: Stripe may block high-risk industries.

Fix: Use specialized high-risk payment processors if needed.

Regulatory & Security Issues

1. PCI Compliance Not Met

Cause: Unsafe payment handling methods.

Fix: Use hosted fields or Stripe Elements to maintain compliance.

2. Repeated Declines Leading to Temporary Ban

Cause: Gateway blocks further attempts.

Fix: Implement a cool-off period before retries.

3. IP Address or Device Blacklisted

Cause: Security systems blocked the attempt.

Fix: Encourage the customer to try another network or device.

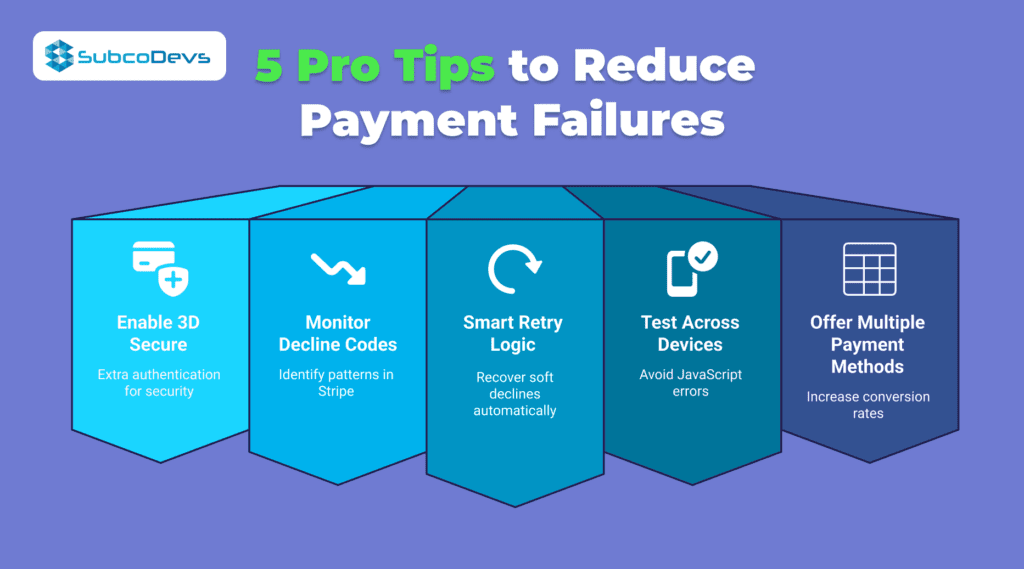

Pro Tips to Reduce Failures

- Enable 3D Secure for extra authentication.

- Implement real-time validation and form UX best practices.

- Offer multiple payment options: PayPal, wallets, BNPL.

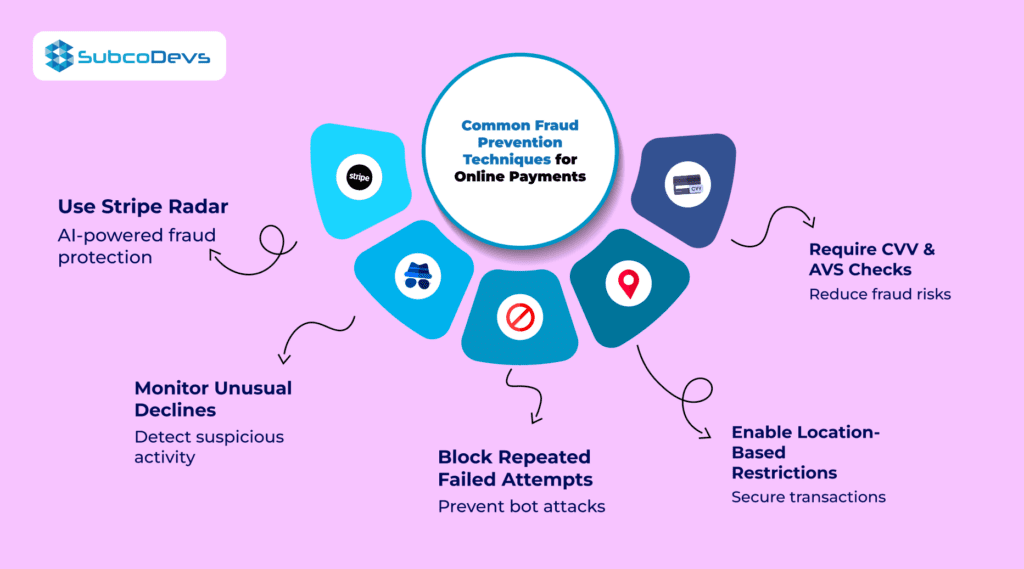

- Use Stripe Radar rules to manage fraud with precision.

- Monitor decline codes in your Stripe dashboard for insights.

- Add smart retry logic to recover soft declines.

- Test payment flows across browsers, devices, and countries.

Conclusion

Every failed payment is a missed opportunity. But with the right approach, you can turn payment failures into frictionless experiences. Want expert help optimizing your Stripe or payment gateway setup?

🔹 Book a free consultation with SubcoDevs today — let’s turn those declines into revenue.