In a pivotal move for the global payments industry, Fiserv and Wells Fargo are officially ending their 30-year joint venture (JV) in merchant acquiring, effective April 2025.

This long-standing partnership enabled thousands of merchants to process payments using a shared infrastructure. Now, both companies are shifting to operate independently—marking the end of one era and the beginning of a more competitive, customizable one.

What Was the JV—and Why It Mattered

Launched in the early 1990s, this JV combined Wells Fargo’s banking power with Fiserv’s technical infrastructure to offer streamlined card payment processing. For many merchants, it meant one trusted source for onboarding, terminals, support, and more.But times have changed. Today, fintech innovation is outpacing traditional models. Merchants are seeking flexible, real-time, API-first experiences—not legacy platforms with rigid systems.

What This Means for Merchants

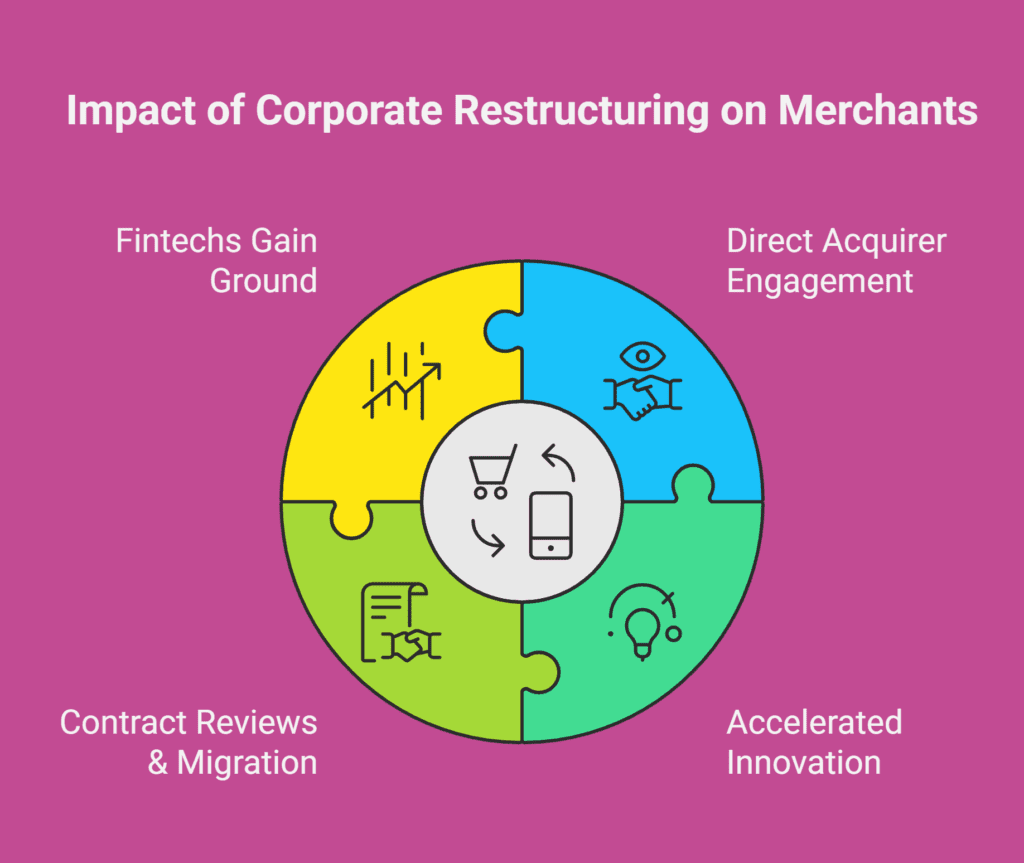

This transition is not just a corporate restructuring. It has real implications for how merchants engage with acquiring partners.

✅ 1. Direct Acquirer Engagement

Merchants will now work directly with Wells Fargo or Fiserv, each offering their own service models, tools, and support structures.

✅ 2. Accelerated Innovation

Freed from shared governance, both firms are expected to introduce new pricing models, reporting tools, and fraud protection features to win loyalty.

✅ 3. Contract Reviews & Migration

Existing JV customers will likely need to review and renegotiate contracts, assess pricing, or migrate systems—possibly on short timelines.

✅ 4. Fintechs Gain Ground

The breakup opens the door for fintech challengers like Stripe, Adyen, and custom solution providers to step in with faster, smarter offerings.

The Bigger Picture: Payment Acquiring Is Evolving

This JV dissolution reflects a global shift: payment acquiring is moving from static partnerships to dynamic, customizable platforms.

Today’s merchants demand:

- Plug-and-play integrations

- Real-time visibility into payment performance

- Built-in fraud prevention

Transparent pricing with no lock-ins

They want a payments stack built for scale, control, and adaptability.

💬 Want a quick summary? Check out our original LinkedIn breakdown here

🤝 SubcoDevs: Helping You Navigate the Shift

At SubcoDevs, we help growing businesses transition to modern, future-proof payment ecosystems. Whether you’re managing a migration or building a new acquiring strategy from scratch—we’ve got you covered.

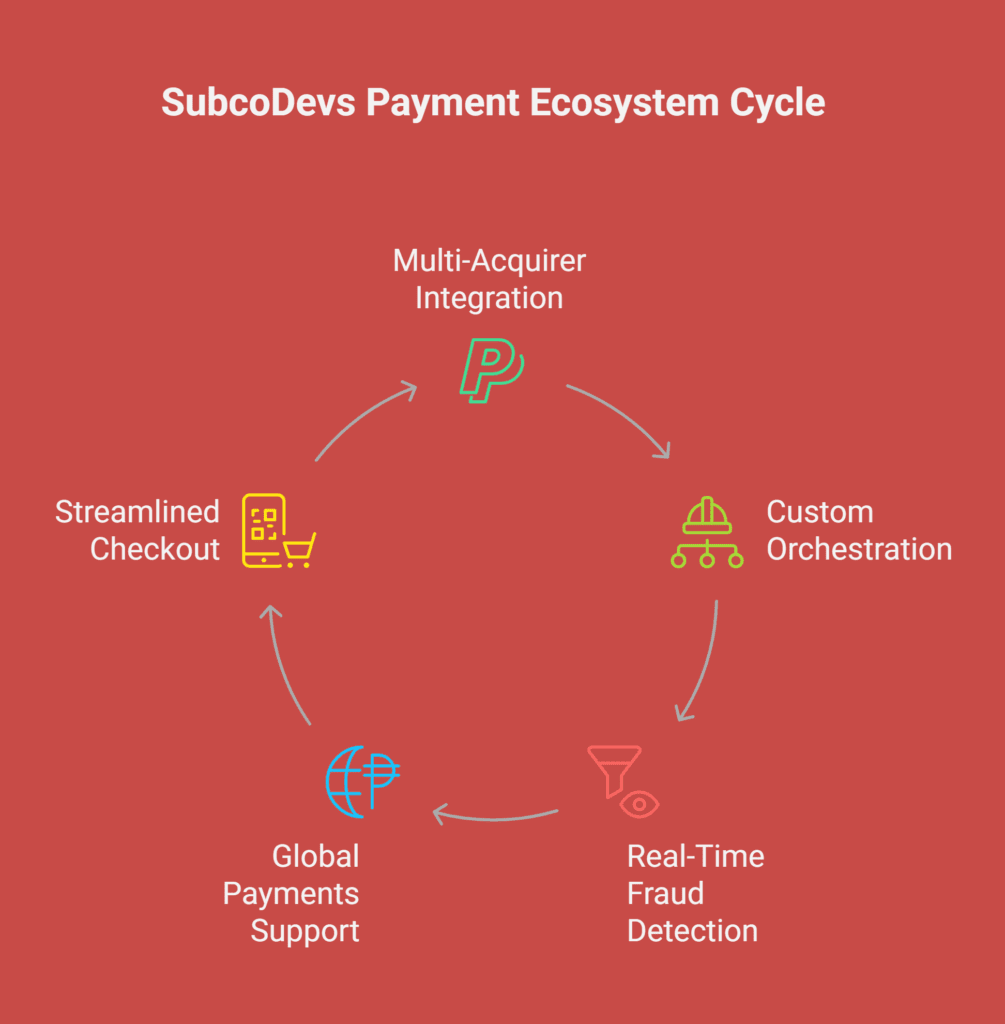

Our Capabilities Include:

- Multi-acquirer integrations (Stripe, PayPal, Adyen & more)

- Custom orchestration layers for smart routing and APIs

- Real-time fraud detection, analytics, and reporting

- Global payments and localization support

- Streamlined checkout for web and mobile platforms

We don’t just offer integrations—we deliver end-to-end payment architecture tailored to your business model.

Final Takeaway

The end of the Fiserv–Wells Fargo JV marks more than a transition—it’s an opportunity. It’s a chance to step back, audit your payment stack, and invest in technology that supports growth, security, and long-term success.

At SubcoDevs, we help you stay ahead—not just adapt.

📩 Let’s build your future-ready payment infrastructure. Contact us today