India’s eCommerce industry is evolving at an unprecedented pace. From hyperlocal shopping apps to massive online marketplaces, the digital shift is no longer optional—it’s the norm. But while we often celebrate rising smartphone usage, affordable data, and a growing digital-savvy population, one foundational pillar is often overlooked: payment gateways.These invisible engines do more than just process transactions. They’re the bridge between a user’s intent and your business’s revenue. Behind every “Pay Now” click lies a highly optimized infrastructure that ensures speed, security, and satisfaction. And in 2025, when digital trust is everything, your choice of payment gateway can make or break your app’s success. As the industry surges forward, payment gateways in India are silently powering this digital revolution.

Why Payment Gateways in India Are Core to Modern eCommerce

It’s easy to think of payment gateways as a technical add-on, but that’s outdated thinking. In today’s hyper-competitive digital marketplace, payment flows are growth flows.

1. Multi-Payment Options = Maximum Reach

India is diverse, and so are its users. Urban Gen Zs may prefer UPI and digital wallets, while older audiences might still trust net banking or cards. A modern gateway gives you access to all:

- Unified Payment Interface (UPI)

- Debit/Credit cards

- Buy Now, Pay Later (BNPL) & EMI

- Net banking

- Wallets like PhonePe, Paytm, Mobikwik

By offering flexibility, you eliminate friction—and friction is the #1 killer of conversions.

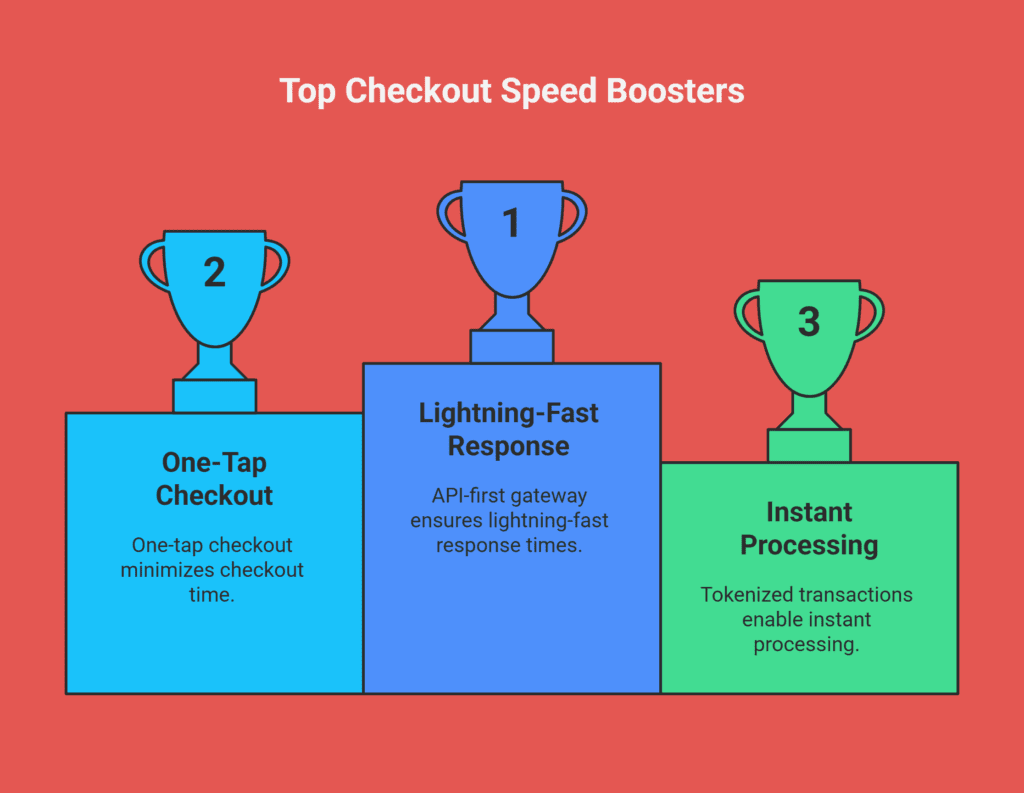

2. Speed = Conversions

Studies show that a 2-second delay in checkout leads to abandonment rates spiking by over 30%. A modern, API-first gateway ensures lightning-fast response times, no page reloads, and minimal redirections.

✅ Faster page loads

✅ One-tap checkout

✅ Auto-saved methods for repeat users

✅ Tokenized transactions = instant processing

Faster checkout is not a UX improvement—it’s a revenue strategy.

3. Security Builds Trust—and Brand

Digital payments are rising, but so is fraud. Today’s users are more privacy-conscious than ever. Your payment experience must feel safe, reliable, and verified.

Top gateways offer:

- PCI DSS compliance

- End-to-end encryption

- Tokenization

- Fraud scoring and behavior tracking

- Real-time alerts on suspicious activity

When users trust your payment flow, they’re more likely to return—and recommend.

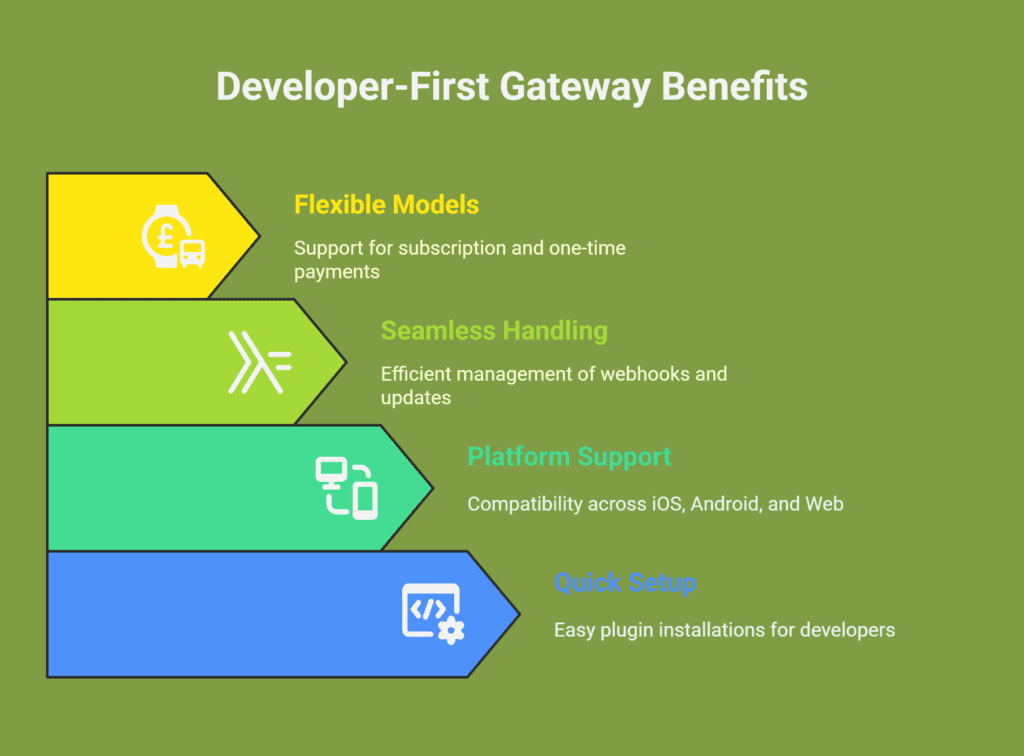

4. Developer-First Gateways Fuel Scalability

For founders and CTOs, integration ease matters. Developer-ready payment gateways like Razorpay, PayU, and Cashfree offer powerful SDKs, sandbox testing, and rapid deployment—saving precious dev hours.

With the right partner, you get:

- Quick plugin setups

- Support across platforms (iOS, Android, Web)

- Seamless handling of webhooks and status updates

Subscription and one-time models in the same flow

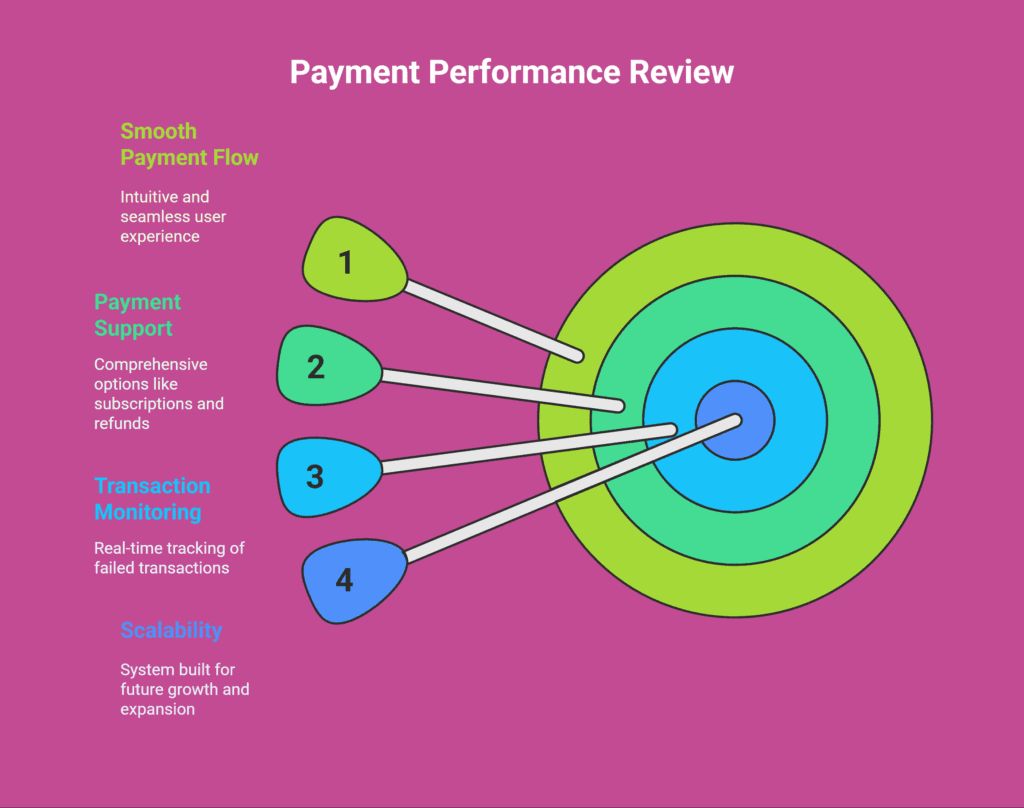

Founders & Product Teams—Ask Yourself:

Let’s get real. When was the last time you reviewed your payment performance?

- Are your users able to pay in one smooth, intuitive flow?

- Does your system support subscriptions, refunds, retries, wallets, and UPI EMI?

- Are you tracking failed transactions in real time, or reacting post-churn?

- Is your current setup built for scale, or is it a patchwork of quick fixes?

If you’re unsure or saying “not yet”—you’re likely losing revenue quietly, every single day.

How SubcoDevs Builds eCommerce Payment Systems for Business Growth

At SubcoDevs, we don’t just “integrate payment gateways”—we design robust, scalable, conversion-optimized payment ecosystems that serve your users, developers, and revenue goals.

Here’s how we do it:

✅ Full-stack integration with India’s top gateways (Razorpay, PayU, Cashfree, CCAvenue)

✅ Webhook & analytics setup for real-time monitoring of success/failure/refund events

✅ Multi-model billing support: subscriptions, freemium, trials, and one-time purchases

✅ Compliance-first architecture with fraud detection and encrypted flows

✅ UX-optimized checkout and onboarding journeys that reduce drop-offs and boost retention

Whether you’re launching your first mobile commerce platform or scaling a mature product, our team builds with speed, security, and scalability in mind.

“A smooth payment flow is not a feature—it’s your silent growth partner.” – SubcoDevs

India’s Digital Payment Infrastructure: A $100B eCommerce Opportunity

The numbers don’t lie. Here’s why now is the time to invest in your payment infrastructure:

- India processed over 14 billion UPI transactions in a month (2025)

- UPI holds over 60% market share in retail digital payments

- The payment gateway market in India is expected to double by 2033

- Apps with optimized payment experiences see 2x better conversion rates and 40% lower churn

👉 In short, if your app isn’t prioritizing seamless payment experiences—you’re falling behind.

🔗 Want More Insights Like These?

We break down real-world payment strategy, conversion tips, and fintech trends in our latest article on LinkedIn. 👉 Read the full article here and join the conversation with founders, developers, and growth leaders.

Ready to Build the Future of Your App’s Revenue?

If your current payment system feels clunky, fragile, or outdated—it’s not just a technical debt. It’s a growth blocker.

At SubcoDevs, we help founders, eCommerce leaders, and product teams turn payments into a strength—not a struggle.

Let’s help you build:

- A conversion-optimized checkout flow

- A fraud-resistant, compliance-ready backend

- A multi-model monetization engine that grows with your users

- A developer-friendly payment system that’s easy to manage and scale

Whether you’re selling subscriptions, one-time products, or bundled offers—we make your payments work smarter, faster, and safer.

📞 Let’s talk about building a better payment infrastructure today. Schedule your free consult at www.subcodevs.com