The in-app economy is no longer just a side stream—it’s now the main revenue engine for modern digital products. According to a recent report, the global in-app purchase (IAP) market is projected to reach $505.68 billion by 2034, with a 23.5% compound annual growth rate (CAGR).

As a result, this isn’t a niche opportunity—it marks a global shift in how consumers interact with apps.

From productivity tools and wellness apps to gaming platforms and neobanks, monetization success is now directly tied to how smart, scalable, and seamless your in-app payment system is.

Why the In-App Purchase Boom Is Just Getting Started

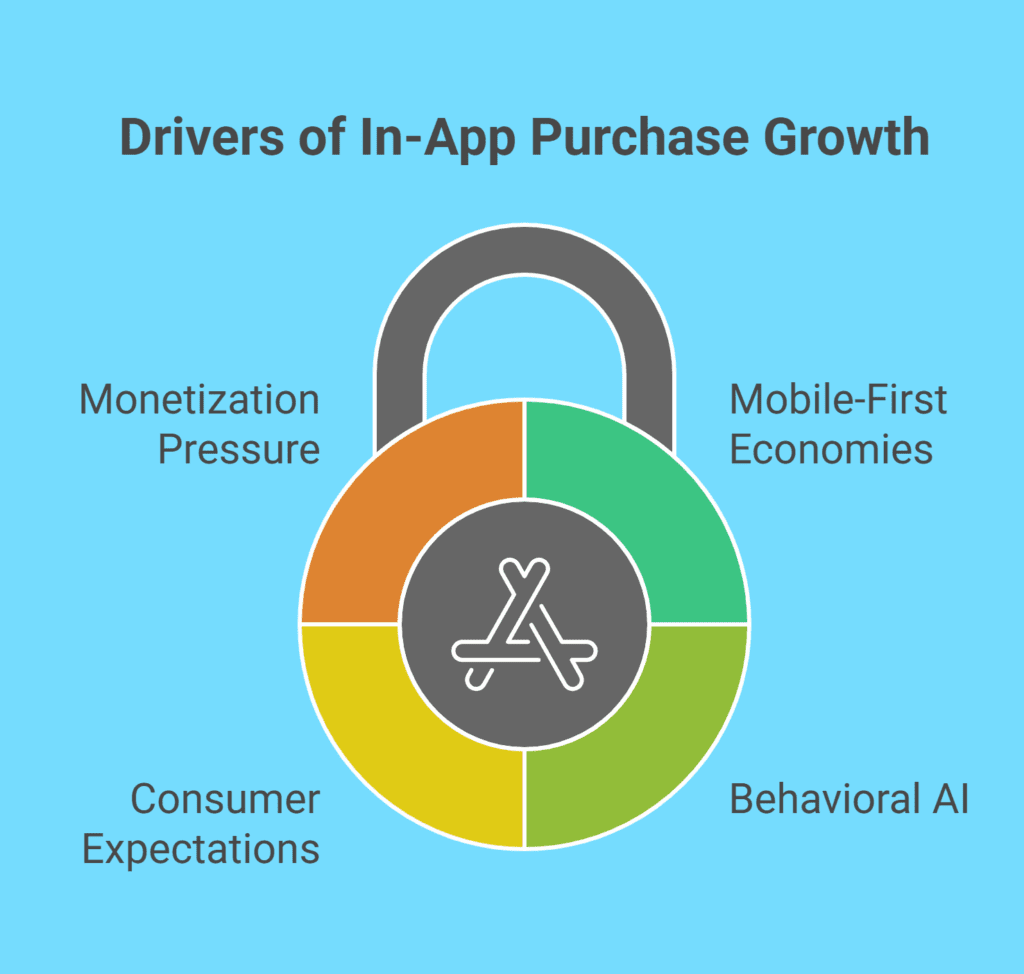

The rise of digital-native users, mobile-first ecosystems, and AI-driven personalization is completely transforming how app monetization works. A few key drivers include:

- Mobile-first economies: Countries across Asia, Africa, and Latin America are seeing explosive mobile adoption. This opens massive new markets for IAP-based apps.

- Behavioral AI: Machine learning models now predict user intent and push targeted in-app offers with near-perfect timing—maximizing conversion.

- Consumer expectations: Users today expect lightning-fast checkouts, saved payment preferences, instant currency conversion, and native-feeling UX.

- Monetization pressure: As acquisition costs rise, apps are doubling down on extracting more value from existing users through premium add-ons and microtransactions.

Yet, despite this opportunity, many app teams treat their payment infrastructure as an afterthought—and that’s where growth stalls.

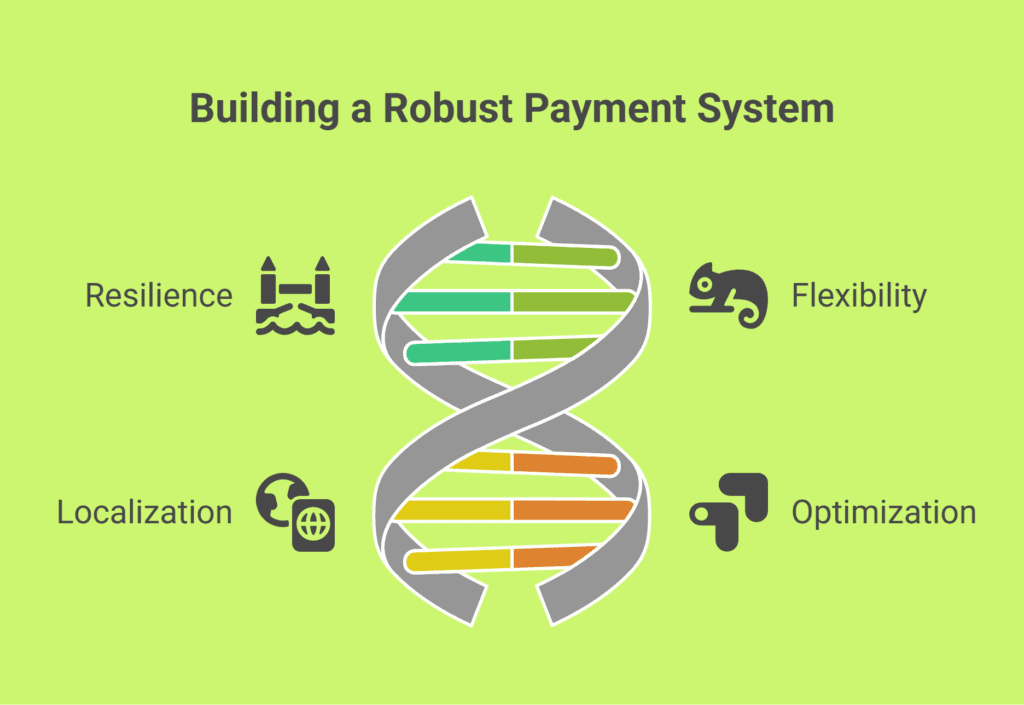

Why a Smart Payment Stack Is a Growth Multiplier

A strong app will only get you so far. To scale revenue and compete globally, your payment system needs to be:

- Resilient – Fail-safes for transaction declines, fraud detection, and payout issues.

- Flexible – Able to support multiple billing models: one-time purchases, trials, tiered subscriptions, usage-based pricing.

- Localized – Tuned to the payment norms, language, and currency of each target market.

- Optimized – Designed to reduce drop-off during checkout and increase approval rates.

The key? Turning payments into a revenue strategy, not just a backend function.

SubcoDevs + Stripe: The Power Duo for App Monetization

At SubcoDevs, we help app-based businesses leverage Stripe’s world-class payment infrastructure with a strategic lens. Instead of just “hooking up Stripe,” we build intelligent, scalable, and conversion-focused payment flows.

Here’s what that looks like in practice:

✅ Global Coverage – Accept payments in over 135 currencies. You also get support for local methods like UPI (India), SEPA (EU), and iDEAL (Netherlands).

✅ Native In-App Checkout – Seamlessly integrate payments into your mobile or web platform using Apple Pay, Google Pay, and platform-specific APIs.

✅ Fraud Protection & Smart Routing – With Stripe Radar and Payment Element, false declines drop and payment success rates go up.

✅ Subscription and Usage Billing – Manage recurring revenue effortlessly through automated invoicing, usage tracking, and flexible trial options.

✅ Market-Specific UX – Customize your payment UI/UX to local cultures, which builds user trust and improves conversions across regions.

These are not just technical perks—they are growth levers that directly impact acquisition cost, LTV, and churn.

Why CTOs, Product Managers, and Founders Must Act Now

In today’s environment, being “good enough” is no longer enough.

Failed payments lead to lost users.

Delayed payouts can strain your cash flow.

Inflexible flows often cause friction as your app scales.

Moreover, apps aren’t just competing on features—they’re competing on speed, retention, and global reach. That’s why your payment strategy must connect innovation with real revenue growth.

🔗 Want a deeper look into how your payment setup could be holding your growth back?

Check out our full LinkedIn post for additional insights.

Let’s Build a Payment Stack That Scales with Your App

At SubcoDevs, we don’t just integrate Stripe—we engineer monetization systems designed to grow with you. Whether you’re just starting to charge users or optimizing for global scale, our team aligns your business goals with a seamless, secure, and scalable payment infrastructure.

📈 From ideation to optimization, we turn your payment system into a revenue catalyst.

👉 Book your free consultation today

Let’s build a smarter way to grow—one transaction at a time.