Stripe’s Crypto Playbook: Subtle Yet Strategic

In an industry obsessed with hype, Stripe crypto payments are quietly redefining the landscape. Stripe has taken a subtler route to becoming one of the most influential players in crypto. While the headlines have focused on flashy coins and volatile markets, Stripe has been steadily laying down the infrastructure that connects traditional finance with blockchain-based systems.

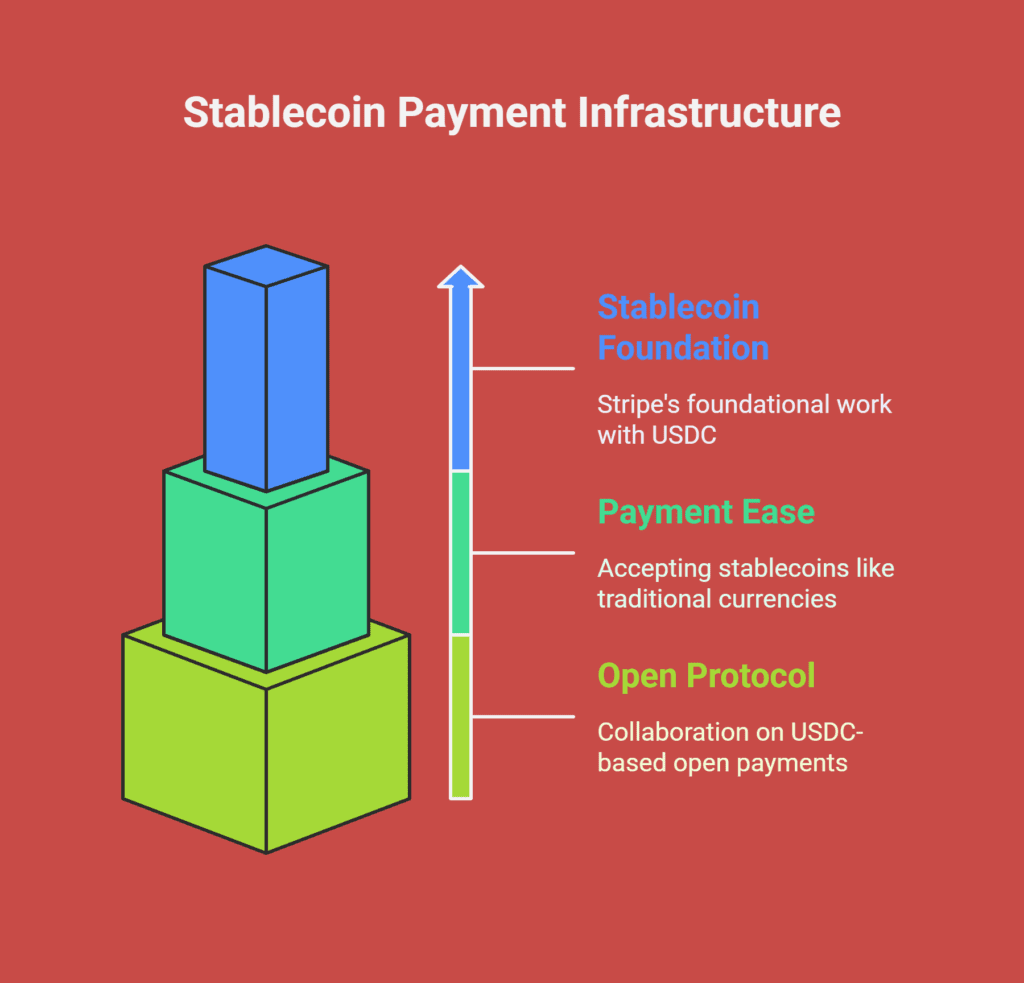

1. Laying the Infrastructure for Stablecoins

Stripe’s work with stablecoins like USDC isn’t just an add-on—it’s foundational. It’s enabling businesses to accept and settle payments in stablecoins with the same ease and reliability as traditional currencies. Their recent collaboration with Shopify and Coinbase on a new open payments protocol using USDC on Coinbase’s Base blockchain is a prime example.

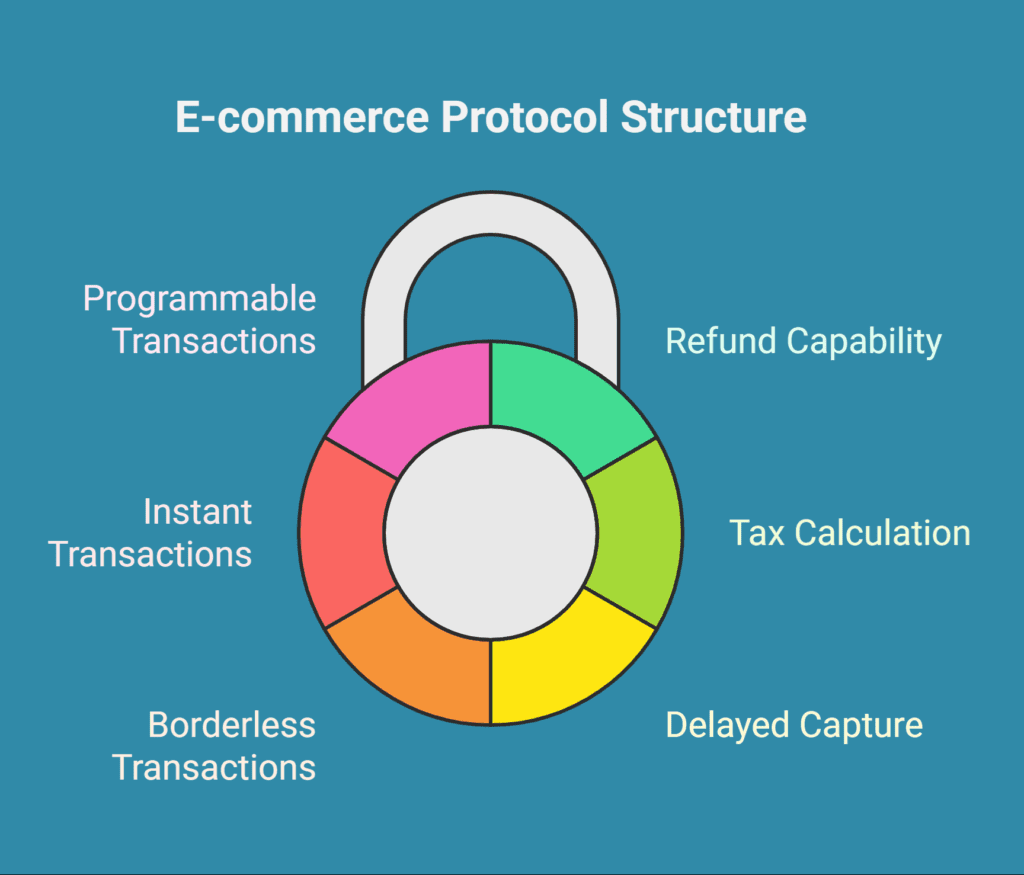

2. The Protocol That Could Change E-commerce

This open protocol isn’t your average blockchain integration. It offers features typically reserved for credit cards—such as refunds, tax calculation, and delayed capture—but in a borderless, instant, and programmable format. Stripe is handling the payouts, Shopify is powering the e-commerce engine, and Coinbase’s Base provides the L2 settlement layer.

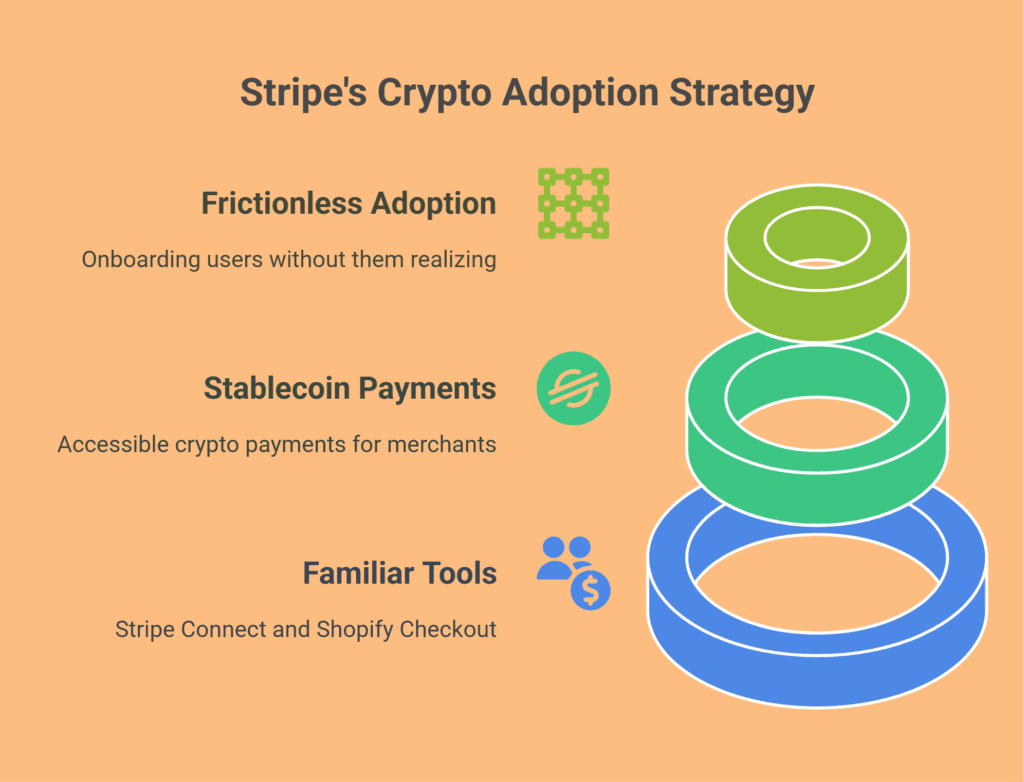

3. Why Stripe’s Role Is Bigger Than You Think

Stripe’s significance isn’t just technical. By making stablecoin payments accessible through familiar tools like Stripe Connect and Shopify Checkout, they are onboarding merchants and users into crypto—without them even realizing it. It’s frictionless adoption disguised as convenience.

4. Stripe Radar: AI for Smarter, Safer Crypto Transactions

Earlier this year, Stripe upgraded its fraud detection with an AI foundation model trained on billions of transactions. For large platforms, it boosted fraud detection from 59% to 97%—overnight. With fraud being a key concern in crypto, Stripe’s AI-first approach is helping de-risk adoption.

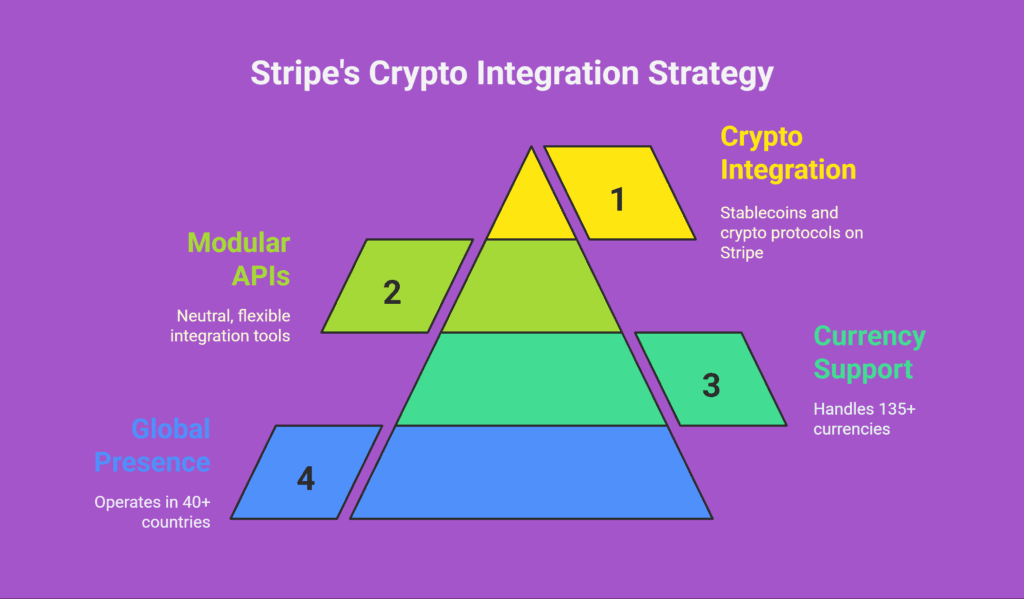

5. Stripe’s Global Payment Network: A Trojan Horse for Crypto

With a presence in over 40 countries and support for 135+ currencies, Stripe already owns a huge chunk of global payments plumbing. Now imagine stablecoins and crypto protocols riding on top of this infrastructure. Stripe’s neutral, modular APIs make this future not just possible—but likely.

Final Thoughts for Founders & CTOs

Stripe’s approach offers a lesson: true disruption often comes in quiet waves, not loud crashes. For any founder building in fintech, SaaS, or e-commerce, Stripe’s playbook is worth studying. Their ability to bridge traditional finance and decentralized rails—without friction—is setting a new standard.

What This Means for You

At SubcoDevs, we specialize in integrating platforms with Stripe and building custom payment solutions tailored to your needs. Whether you’re exploring stablecoin payments, recurring billing models, or marketplace architecture, we help you navigate Stripe’s growing ecosystem.

Let’s talk.

👉 Book a free consultation with SubcoDevs today to future-proof your payments.

References: Forbes Article: How Stripe Quietly Became One of Crypto’s Most Important Companies