Stripe has once again made a powerful move in the world of financial infrastructure by acquiring Orum, a US-based startup known for accelerating and optimizing real-time money transfers. This isn’t just a tactical acquisition—it’s a bold step toward transforming how businesses move money at scale.Let’s unpack what this means for the future of payments, and how SubcoDevs can help you take advantage of these evolving capabilities.

🚀 Why Did Stripe Acquire Orum?

Orum built its reputation on predictive intelligence and real-time money movement via ACH, FedNow, and other U.S. payment rails. Its technology enabled companies to:

- Eliminate delays in fund transfers

- Reduce payment failure rates

- Gain better control over financial operations

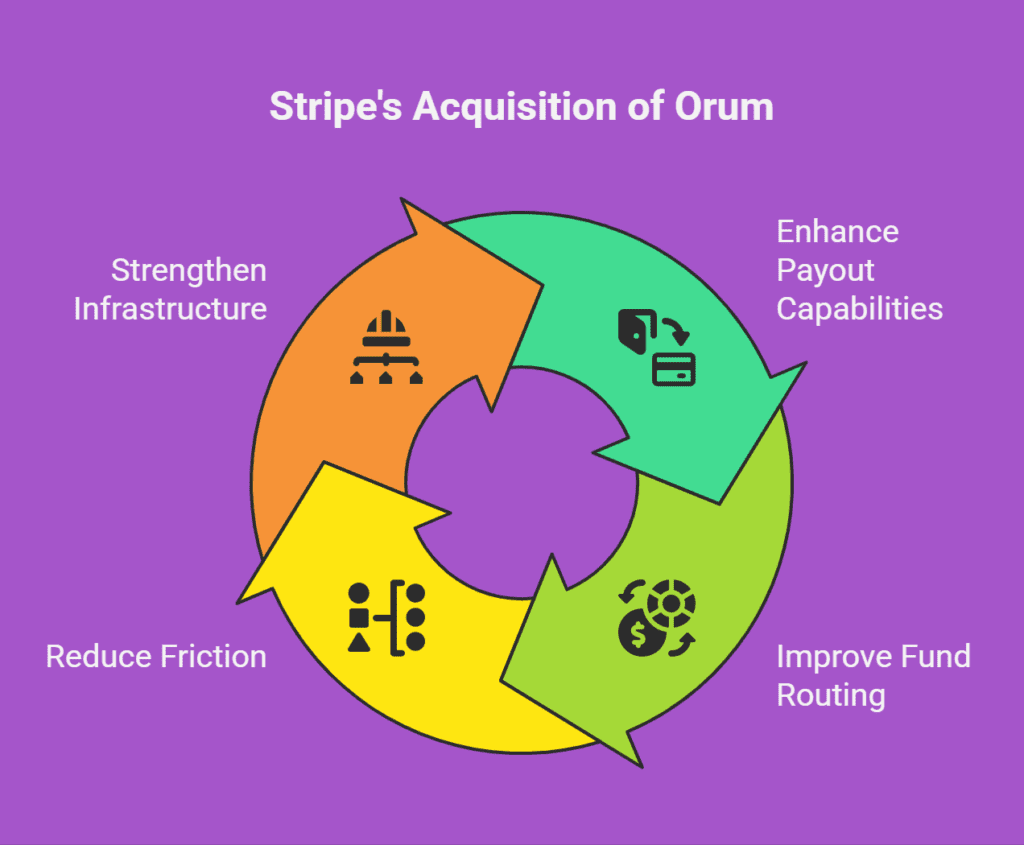

By acquiring Orum, Stripe is:

- Enhancing its payout capabilities

- Improving fund routing and reliability

- Reducing friction in embedded finance and treasury workflows

- Strengthening real-time infrastructure for marketplaces and platforms

This acquisition aligns with Stripe’s long-term vision to provide a full-stack money movement solution—far beyond just payment acceptance

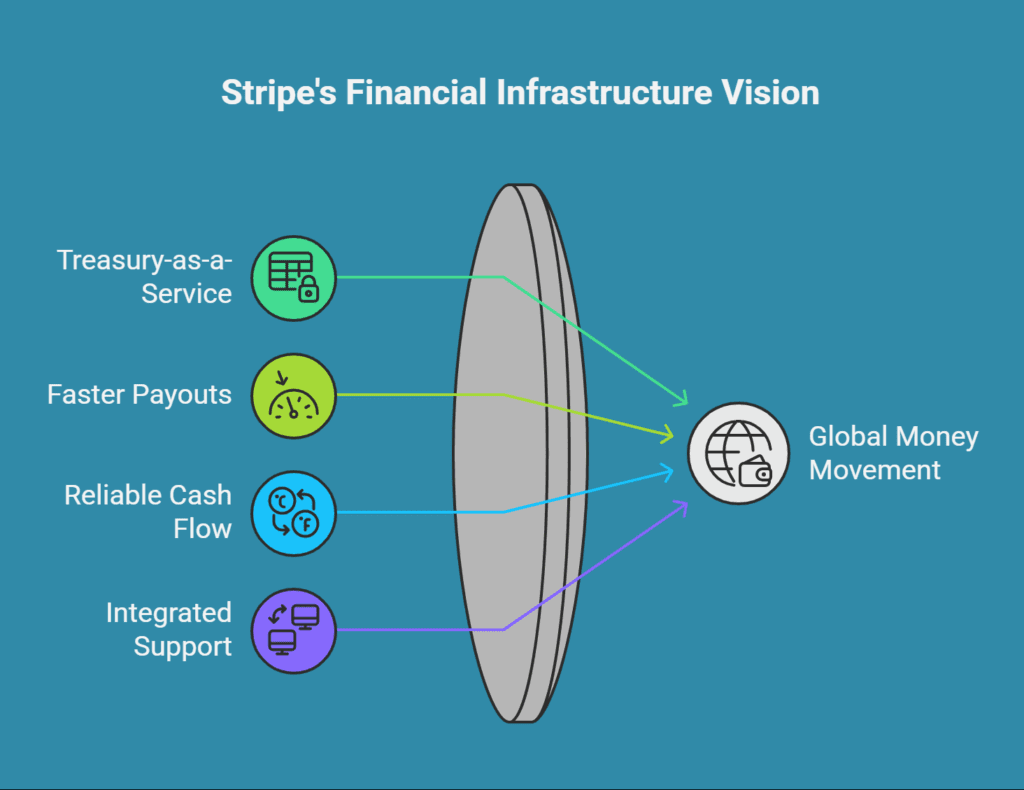

🌐 Stripe’s Broader Vision: Beyond Payment Acceptance

Stripe is quietly evolving into the underlying infrastructure for global money movement. With Orum now integrated, Stripe can supercharge:

- Treasury-as-a-service for platforms

- Faster, smarter payouts for workers, sellers, and users

- Reliable cash flow tools for SaaS and fintech startups

- Full support for FedNow and faster ACH integrations

By combining Orum’s predictive models with Stripe’s APIs, we’re looking at a new standard in how money flows through:

- Payroll systems

- Financial services

- Vertical SaaS

E-commerce platforms

💡 Why Founders and CTOs Should Care

In today’s digital economy, time is money. Faster access to funds directly translates into:

- Improved user experience

- Reduced churn

- Better liquidity management

If your platform still relies on outdated payout systems or slow ACH transfers, you’re already falling behind.

Stripe + Orum unlocks a future where:

- Funds are disbursed in seconds, not days

- Risk and fraud are managed intelligently in real-time

Your finance operations become programmable and scalable

🛠️ How SubcoDevs Can Help

At SubcoDevs, we are Stripe-first experts in building smart, scalable, and efficient payment systems. Whether you’re looking to:

- Integrate real-time payouts

- Modernize your treasury stack

- Launch an embedded finance product

- Or simply reduce your payment ops overhead