Stripe is powerful, but it’s not plug-and-play. Even advanced e-commerce setups leak 5-12% of potential holiday revenue if left untuned. Here are the top 10 hidden leaks we see and how to fix them before peak season.

1. False Declines From Issuers

Issuers often decline legitimate payments because their risk models are outdated. These “false declines” cost merchants billions each year.

What to do: Turn on Stripe Adaptive Acceptance, which retries soft declines in real time with smarter routing. This typically delivers a 2-6% lift in approvals, a margin-changer during Black Friday and holiday traffic surges.

2. Poor Mobile Conversion

Holiday traffic is overwhelmingly mobile. Yet too many checkouts bury wallet options. Shoppers drop when friction is high.

What to do: Place Apple Pay, Google Pay, and Link at the top of checkout. Merchants who optimize mobile wallets consistently see 7-10% higher conversion on mobile devices.

3. Smart Retries Not Configured

Subscription renewals and saved-card checkouts silently fail when declines aren’t retried intelligently. For high-volume D2C brands, this becomes a massive recurring revenue leak.

What to do: Enable Smart Retries with issuer-aware scheduling. Stripe data shows this can recover 40-60% of lost recurring payments.

4. Card Testing Attacks Driving Noise

Fraud bots flood your checkout with stolen card numbers, inflating decline ratios and damaging your standing with issuers. Even when blocked, these attacks distort your payment data.

What to do: Tune Stripe Radar with velocity checks, BIN-based rules, and geolocation filters. Done right, you can cut 95%+ of testing attacks.

5. One-Size-Fits-All Routing

Sending all transactions through the same path ignores differences in authorization rates, costs, and issuer preferences. This “lazy routing” costs margin and approvals

What to do: Implement policy-based routing across cards, pay by Bank, and wallets. Measure by auth rate and blended cost, not just convenience.

6. Local Payment Methods Missing

Entering new markets without local methods is like opening a store with the wrong currency. EU shoppers expect iDEAL or Klarna, Brazilians want Pix, Indians prefer UPI.

What to do: Add local methods pre-holiday. Merchants who localize payments often see double-digit conversion lifts in new markets.

7. Weak Dunning Strategy That Kills LTV

If your dunning emails say only “your card failed, please update,” most customers won’t act. This silently destroys LTV.

What to do: Use Stripe Billing’s dunning flows, but layer SMS nudges and retry logic around payday cycles. This simple change lifts recovery and customer lifetime value.

8. No Cost Awareness in Payment Mix

Credit cards cost 2-3x more than bank rails. Many merchants don’t optimize for cost, especially on high-ticket holiday orders

What to do: Incentivize ACH and Pay by Bank. For orders above a set threshold, this can save 30-70 basis points in processing costs.

9. Ignoring Soft Decline Codes

Treating all declines the same wastes recoverable revenue. “Insufficient funds” should be retried differently than “do not honor.”

What to do: Use Stripe’s API to read decline codes and design retries accordingly. Merchants who decode soft vs. hard declines recover significantly more revenue.

10. Checkout Latency and Tokenization Failures

Every extra 300ms of checkout latency reduces conversion. Tokenization errors, where a card fails before even reaching the issuer, create invisible revenue loss.

What to do: Audit checkout performance and error logs. Consider Stripe’s hosted Checkout for PCI/SCA compliance and faster load times

Case Study: The $3M Black Friday Leak

One e-commerce brand came to us last year with three big problems:

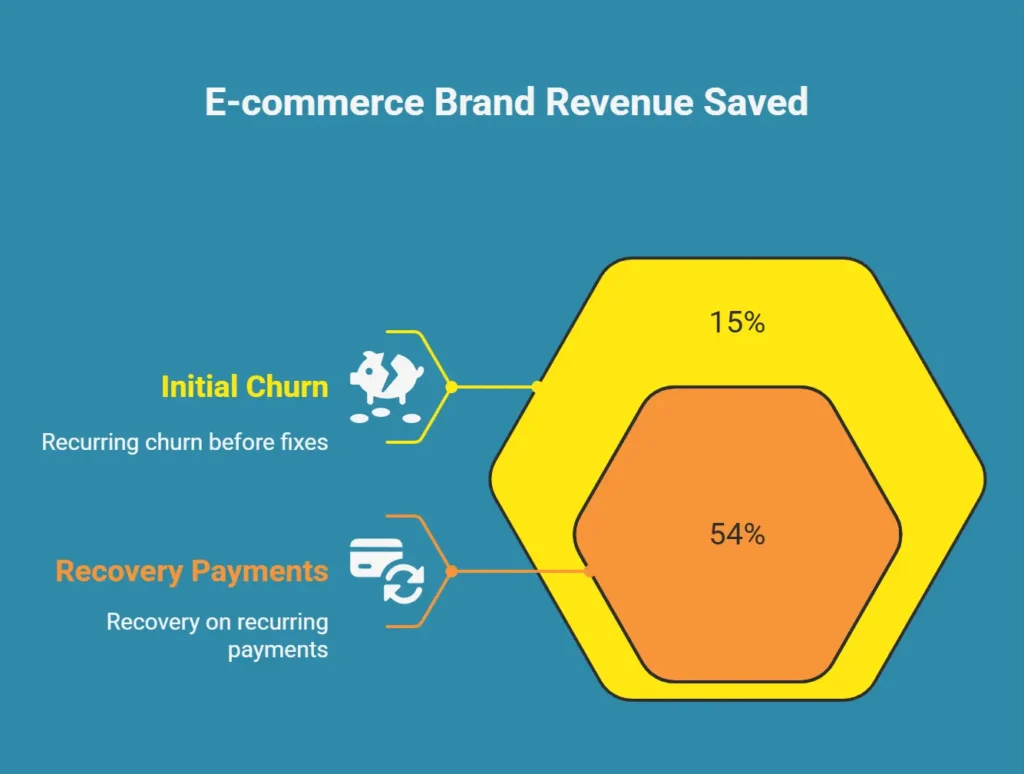

- Symptoms: 9% false declines, 15% recurring churn, and poor EU conversion.

- Fixes: We enabled Adaptive Acceptance and Smart Retries, rebuilt Radar rules, added iDEAL + Klarna, and deployed cost-based routing.

- Results (in 60 days): +5.1% authorization lift, 54% recovery on recurring payments, +12% EU conversion, and >95% cut in card testing attacks.

- Impact: $3M in annualized revenue saved, just in time for Black Friday.

The Bottom Line

Stripe’s stack is one of the most advanced in the industry. But without optimization, it silently leaks millions, especially during the holiday season when volume is highest.

SubcoDevs specializes in Stripe-first payment optimization for e-commerce, SaaS, and marketplaces. We help you fix today’s leaks while preparing your stack for tomorrow’s multi-rail future.

👉 Book your 20-minute Stripe audit before the holidays and walk into Q4 knowing your checkout isn’t leaving money on the table.